You've made it this far by making the right decisions.

Our tailored investment strategies can provide income generation, inflation protection, and growth to meet your lifestyle needs.

BATAIS: Gold Mining Alternative Strategy is a hybrid hedge fund and separately managed account (SMA) for qualified investors seeking generational wealth through gold mining investments.

Income Growth Advisors, LLC believes that we have entered an inflationary cycle where abnormally high returns in gold and gold mining are possible. Top hedge fund managers and strategists are predicting gold can trade to $5000/ounce by 2028, and in the longer term, we believe gold could rise toward $10,000/ounce over the next ten years.

Our strategy focuses on gold resource companies which are transitioning to gold mining companies like Blue Lagoon Resources, Inc. and long term call option contracts on larger market capitalization companies like Agnico Eagle Gold Corporation (AEM), New Gold inc. (NGD) and gold ETFs like VanEck Junior Gold Miners ETF (GDXJ).

Click here for the BATAIS: Gold Mining Alternative Strategy PDF.

BATAIS, which stands for Bespoke Alternative Tax Advantaged Investment Strategy, will invest in high risk investments like options and microcaps like Blue Lagoon Resources, Inc. For this reason, this strategy is like a hedge fund and seeks qualified investors. On the other hand, we believe there is an opportunity for returns of 10x in three years for both Blue Lagoon and select LEAPs on certain gold miners and believe this is a clever way to generate noncorrelated alpha while participating in the precious metals market.

Once BATAIS achieves its return objective and exits the capital growth phase, we will reinvest those proceeds in tax advantaged income assets like Master Limited Partnerships (MLPs) which can provide nearly tax free returns of capital to the investors at yields between 7% to 10%.

The strategy is designed for qualified investors because the investments strategy is a high-risk high-return portfolio. Investors should have at least $1,000,000 in liquid assets (not real estate) and an annual income of $200,000 a year. Minimum investments are $100,000 and up to $5,000,000 per account.

BATAIS: Gold Mining Alternative Strategy

Bespoke Portfolios for Where You Are,

and Where You're Going.

What Separates IGA?

Experience and tailored investment strategies are what separate IGA from its competition. Since 1984, Halsey has worked on Wall Street and has distinguished himself repeatedly. Halsey worked on the floor of the New York Futures Exchange and in brokerage at Merrill Lynch, Alex. Brown, and Deutsche Bank. He won the USA Today CNBC National Investment Challenge in 1992 and was conferred the CFA designation in 1993. Halsey founded two investment advisories and three hedge funds.

Halsey’s trading, equity analysis, and portfolio management experience form the backbone of IGA and keep him connected with network of renowned and talented investment professionals with whom he confers.

Halsey has been cited in Barron’s and the Wall Street Journal. Halsey publishes regularly on Seeking Alpha, twice selected as SA’s Editor’s Choice, appears on South Carolina Public Radio, CNBC and posts on social media.

Why Commodities Now?

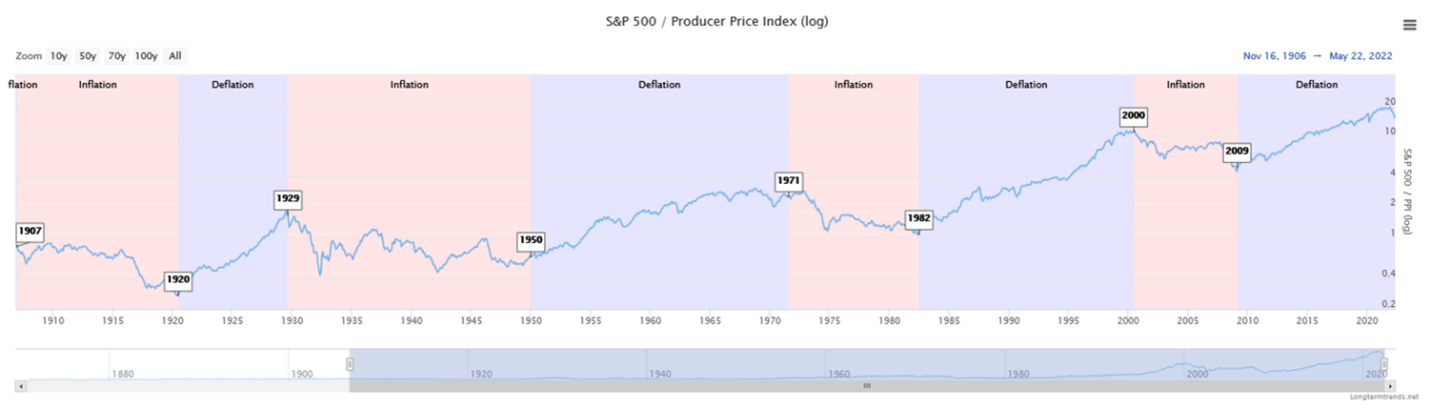

Markets go through cycles. Today’s investment environment has radically shifted to an inflationary commodity super cycle. Inflation is now matching 40-year high levels and interest rates are rising. Forty years of declining interest rates have now reversed, and this environment is threatening bubbles in stocks, bonds, and real estate. Many of the stocks and strategies which have worked so well for investors for the last 40 and or 10 years won’t offer the same high returns they have grown to expect.

Consequently, IGA is investing in securities with portfolio strategies that should perform well in this new market environment.

There is no simple formula to investing; however, our current client portfolios emphasize commodities, precious metals, energy, Master Limited Partnerships, and inflation-beneficiaries. Since the COVID-19 market bottom, our client portfolios are up nicely and outperforming while most major stock indices and bonds are having historically terrible performance. We attribute our recent success to recognizing the fundamental and economic factor changes of today’s inflationary commodity super cycle. See the inflationary deflationary cycle chart below:

Account Types

Income Growth Advisors, LLC offers two principal ways to invest. We can manage your investment account, 401-K, 529, or retirement account at your existing custodian. Without having to move your account, Income Growth Advisors, LLC can select mutual funds and securities that institution offers to easily manage your portfolio. Through Pontera, formerly Fee-X, we can invest your account on your current platform on a fee basis.

We also manage discretionary accounts and non-discretionary accounts through Interactive Brokers LLC. Those accounts can be individual accounts, retirement accounts, or college savings accounts including IRA Rollovers, SEPs, 401Ks, 529s, Inherited IRAs, Roth IRAs, and traditional IRAs. In every situation, we discuss with you what your investment objectives are and craft a program to meet your goals and objectives.

Interactive Brokers is an American multinational brokerage firm that offers low-cost commissions and margin rates. It operates the largest electronic trading platform in the U.S.

“Unfortunately, most people who buy [royalty trusts] don’t realize that they tend to be depleting assets,” says Tyson Halsey of Income Growth Advisors, an investment firm in Charleston, S.C. “They end up being bad for retired people who think they are getting a fixed-income alternative.”

The Intelligent Investor Column, Jason Zweig, Wall Street Journal

Your Existing Institution, Our Time-Tested Expertise.

Income Growth Advisors, LLC through Pontera (formerly FeeX) can manage your retirement assets, college savings and other assets at any of these leading financial institutions.

We can manage, monitor and rebalance your employer-sponsored retirement accounts, including 401k and 403b.

Let us take care of your 401k with a personalized strategy and manage your assets right where they are through Pontera.

Financial planning provides a quantitative and dynamic

methodology to achieve your hopes and dreams.

Working without a financial plan is like driving to a destination without a road map. You never want to find that you made a wrong turn, because you didn’t take the time and effort map out your life’s plan. Income Growth Advisors, LLC provides these services to help you develop a custom financial plan for all aspects of your family’s life.

Our introductory tier provides a one hour overview of your accounts, insurance, will, and discussion of your investment objectives, risk tolerances, and special needs. We will discuss what additional financial, tax, and estate planning software and services we can provide to address your particular needs. We will provide a written overview of your financial situation, a summary of your insurance and estate planning needs, an investment strategy summary by the firm’s founder Tyson Halsey, CFA and the CFP support team at Gradient. This introductory tier is billed at $350.

The Basic Plan is billed at $3,300 for the first year and then renewed annually for $1,900. This plan includes two coaching sessions, a written financial plan, an annual update to that plan and investment recommendations. We take all your financial statements and tax returns and submit them to our CFP team and generate financial plans for you including college planning, retirement planning, retirement income planning, and basic estate planning.

The Comprehensive Plan costs $4,700 for the first year and is then renewed annually for $2,600. It includes three coaching sessions, retirement planning, tax planning, estate planning and a customized investment strategy. This plan is designed for professionals with increasing wealth and financial complexity.

Subscribe to Our Newsletter

Income Growth Advisors, LLC publishes its monthly newsletter on Seeking Alpha and our letter has been selected as “Editor’s Choice”. Seeking Alpha costs $299.99/month. Our newsletter is free.