Gold Mining Stocks and AI Bubble Reminder. Tmmrw Thurs. November 20th at 11:30 AM. Expert Panel: Mining Stocks, China, Anthropic, Declining Dollar and S&P 500 Peak.

Tyson Halsey, CFA The Market may be Topping

Expert Panel Discussion: https://youtu.be/X7ttG89RDP4 November 20th, 2025

S&P 500 peaked on October 31 up 41.5%.

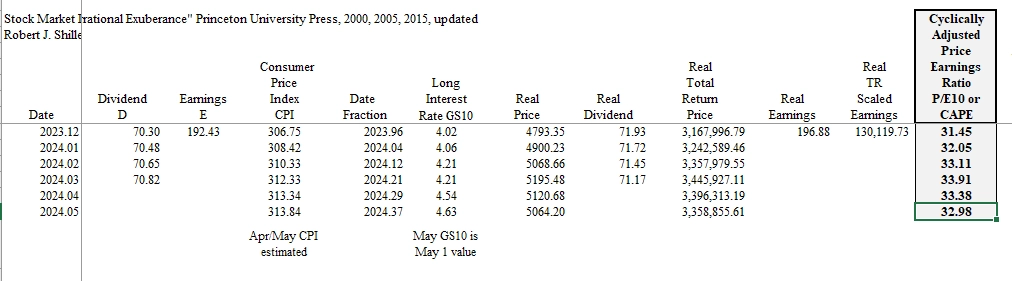

Peak S&P 500 Valuation: CAPE 41x near 2000 44x.

Warning sign: Margin Debt Record $1,100 billion, S&P forward Expectation -2-3%,

Megacap Bubble: Smart money Michael Burry, SoftBank, Peter Theil dumping NVDA.

Gold Mining Stocks are red hot—VanEck Jr Gold miner ETF (GDXJ) 129%, Van Eck Gold Miner ETF (GDX) 125%, SPDR Gold Shares (GLD) + 54%, iShares Silver Trust (SLV) 74%, Blue Lagoon Resources BLAGF up 332%.

Emerging markets up 32% YTD, Foreign stock up 28%. S&P 500 up 15.8% NASDAQ +19.2.

Blue Lagoon Resources should triple on ramping revenues and CF in 2026, but the resource play from drilling could establish Blue Lagoon as a District Scale (eg 10mm ounce AU) opportunity IBK Capital CEO and President Mike White said. 43-101 current Measured AU 25,000 ounces.

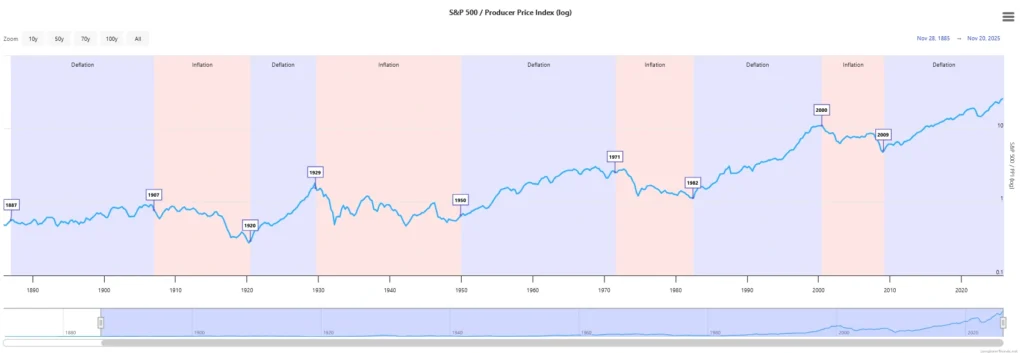

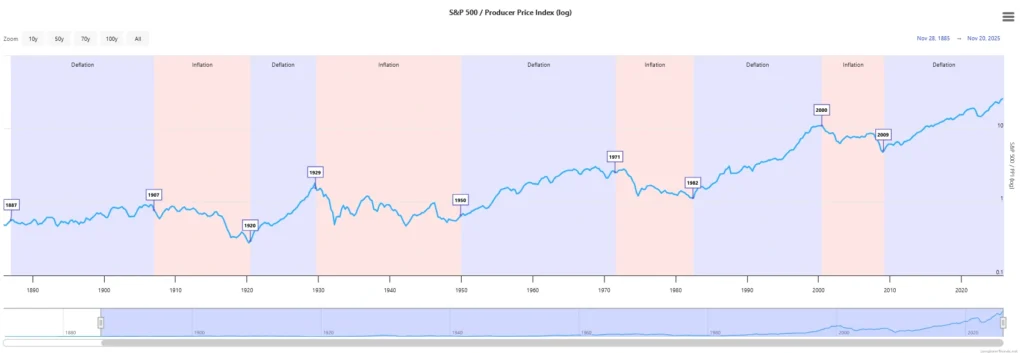

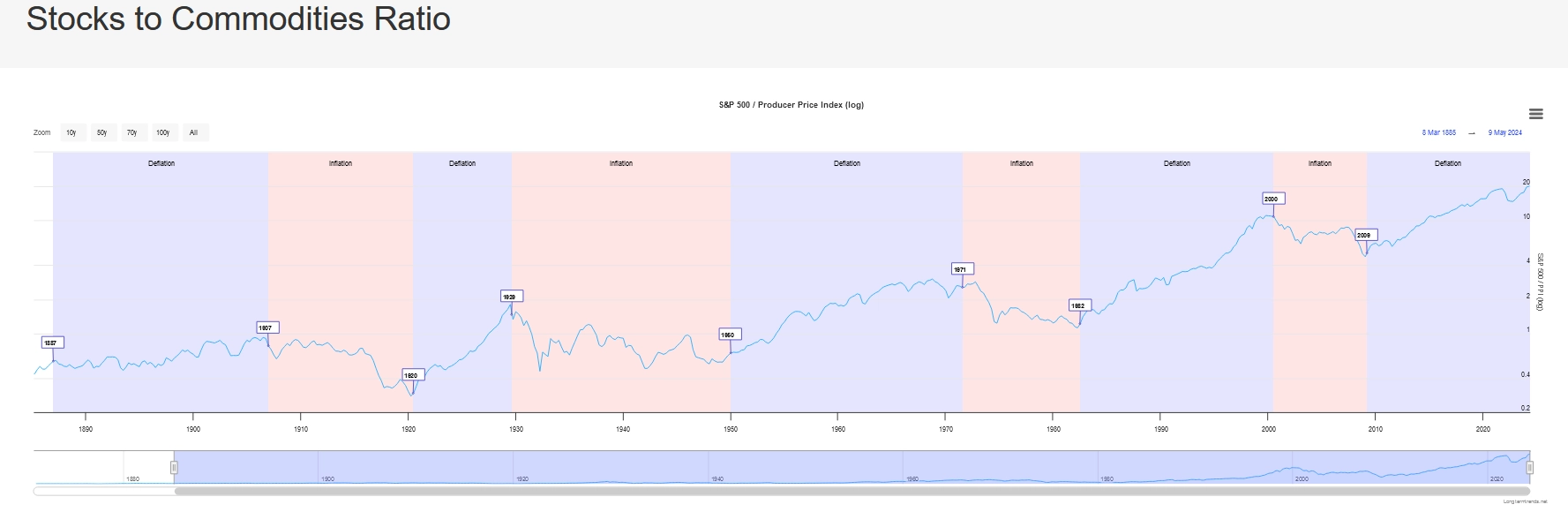

Inflation cycle to favor commodities over stocks for 10 years.

S&P 500 sector weights: Info Tech 36% vs 10% in 2008, Resource sector 4% down from 19%.

Asset allocations: 55% equities too high. We think 25% SPY 10% EM, 10% International, 10% commodities. Bonds 17% not appealing yield. Yields could rise even with lower ST rates. Cash 13% cash yields will decline with Fed Easing. Gold and gold mining stocks…5-10% consistent with Bridgewater’s Ray Dalio.

Dollar at risk after 20 Trillion in inflows after 18 years breaks lower.

Too much Debt. $38 Trillion and other major countries with debt well in excess of GDP.

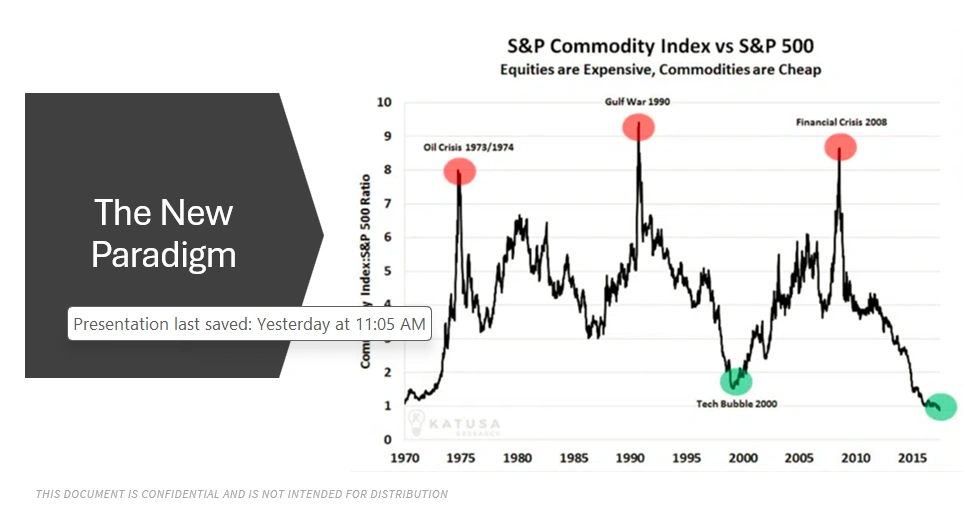

Marin Katusa. Critical commodity vs S&P index extreme.

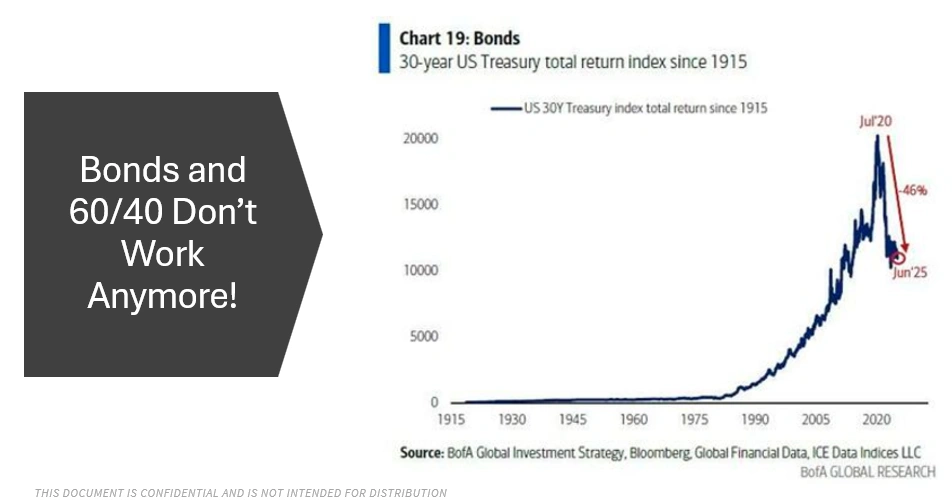

US Treasuries no longer as appealing due to performance collapse from July 2020 to June 2025.

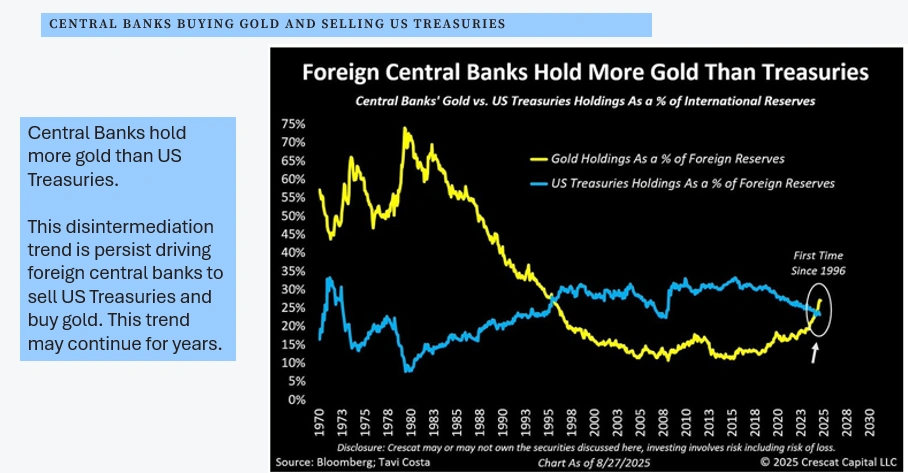

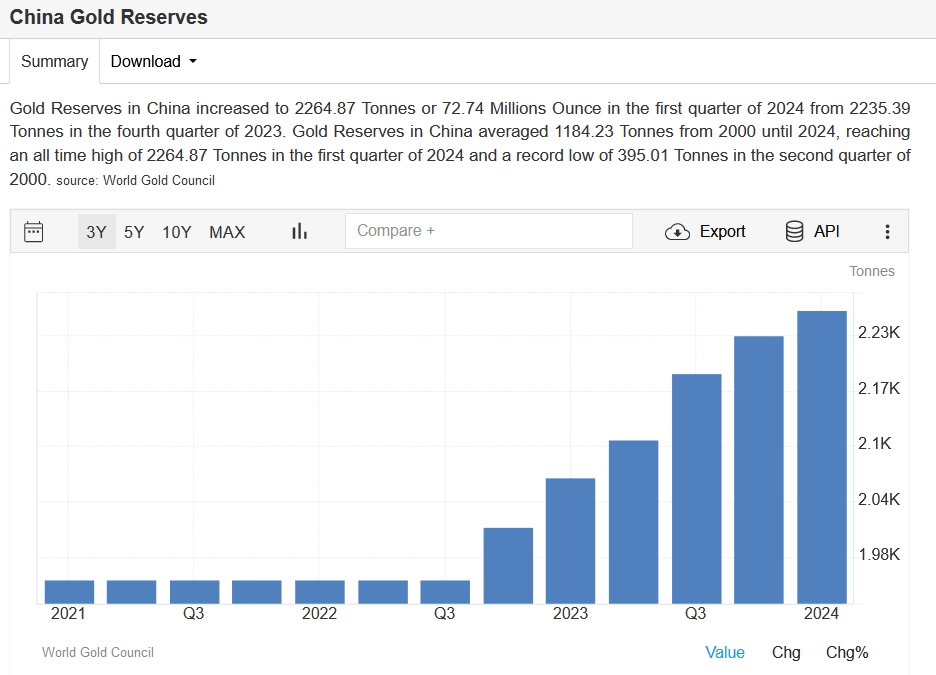

Foreign Central Banks now buying more gold for first time since 1996 than US Treasuries. That trend will continue.

Gold will move to $6519/oz. Gold to gold miners suggest gold miners will now outperform gold! Gold Miners cheap with GDX 11x PE. Since 2009, GLD up 252% but GDXJ down 10%. This suggests protracted gold stock rally.

AI is in Bubble: Galbraith All bubbles look the same. A new idea casts a spell. Credit Expands. Prices rise. Everyone feels smarter. Source Forbes online. Feels like Shiller’s Irrational Experience.

AI stock Debt to Equity ratios are ominous. Circular financing between OpenAI, Microsoft, NVIDIA, CoreWeave, AMD and Oracle looks scary. Crypto or Bitcoin Bubble. The market appears to be topping and could break badly.

Mitch Bulajic

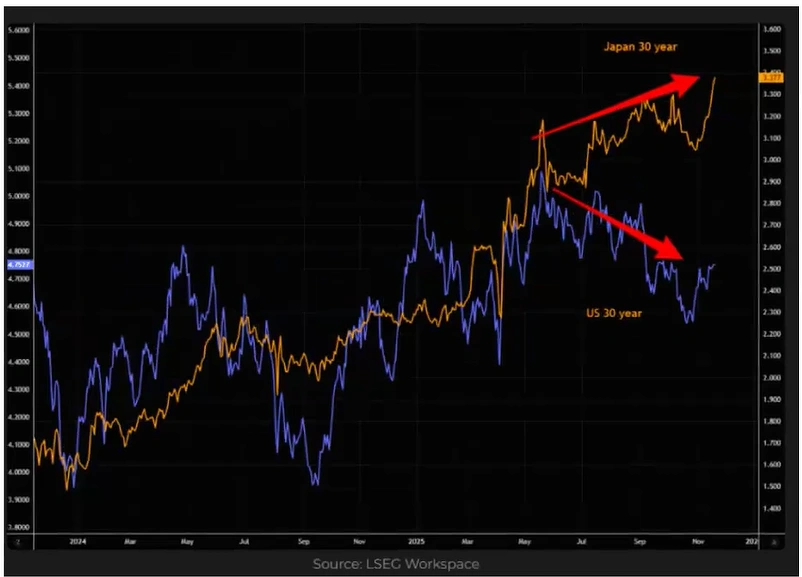

Japan Bond market looks like a brewing disaster in the making with spiking interest rates.

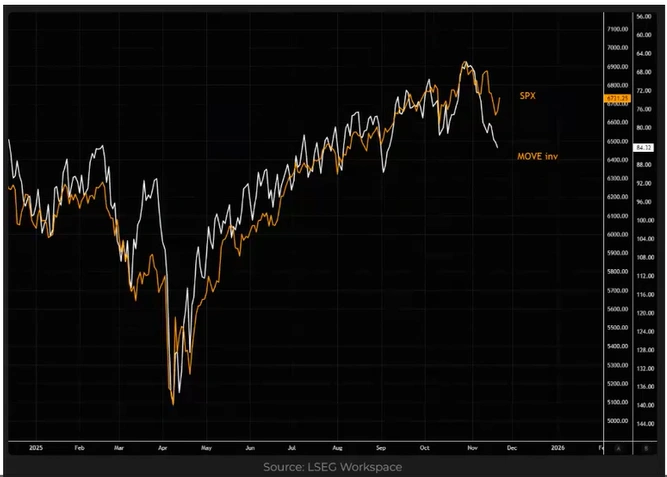

The MOVE index is turning down. Often precedes key market turns.

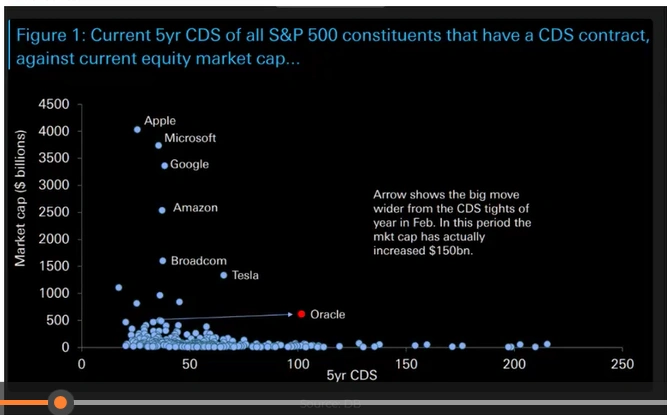

And the CDS prices are flashing red.

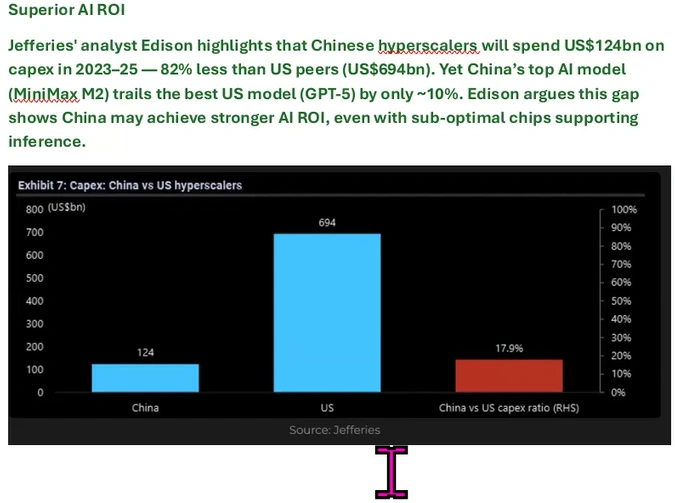

China AI is much cheaper than US AI. This could be a huge problem.

We me be at AI Peak Expectations

Michael White President and CEO of IBK Capital Corp. Toronto CA. Discussing gold mining. Invest along with customers. IB and family office. Focus on Junior space- exploration and development. Several huge winners from early stages.

Blue Lagoon Tremendous exploration upside. Series of parallel veins with very long strike lengths. Could be district scale eg 10mm ounce opportunity. 44:07 minutes. Real Upside could come production where from Tyson’s model of $1.50 from production from a couple drill holes and the stock could be $3-4/share very quickly. 46 minutes. Lasonde curve. IBK and customers own a couple million shares.

China and Chang Qiu PhD.

4th Plenary Session of 20th CPC Central Committee—Nine Generals were detained. (Got Sacked) Xi Jinping will be in power for next 6 years.

Taiwan may be safe for a while because the top military guys got sacked.

15-5 year plan. Slower more inwardly focused.

Exports to US dropped 25%.

China recent spat with Japan.

Fight with Europe too.

China consumption due to weak housing market.

Delist risks eg BABA.

- One suggestion-XNET

- Distributed cloud service, live streaming, overseas expansion

- Guided Q4 2025 yoy growth of about 60%

- Expect organic growth of 40% yoy

- Expect 2026 EPS $0.5

- Book value $24.98 per share (cash per share $4.43, Investment Gain $1.2 billion)

- Stock at $7.12, 100 DMA support

- Target $25 (20xEPS+cash 4.43+ half of LT investment)

Mike White 1:21:28-Great Bear 2016/17 commenced exploration model $0.25/share. Shares at 50 cents after 2 years of drilling before big discovery. When they hit the first big discovery then ultimately got bought for $29/share.

Tony Low Beer-NVDA has huge demand but Open AI 13 billion in revenues and will lose 75 billion, but they have 1.3 trillion in deal. This is reminiscent of Enron! Unsustainable financials.

Mitch Bulajic- Open AI has a bad business model. China much cheaper.

Getting in on the Ground Floor of the Gold, Gold Mining, and Mining Cycle Revival

Optima Process Systems, Inc’s sister company, Income Growth Advisors, LLC acquired over four million shares of Blue Lagoon spurred on by the company’s announcement that it had received its preliminary mining license on November 14th, 2024. Shares have rallied over 500%, as news of this rare and critical mining license spread.

Optima has historically studied energy transition technologies, CBD, and semiconductor robotics to find promising nascent businesses to fund. In this letter, through our experience with Blue Lagoon and its processing partners, see great promise in the growing gold, gold mining and mining business, which appears at the inflection point of a new investment cycle where hard assets, gold, gold mining and mining rotate into investment leadership positions at the expense of many large cap interest rate sensitive industries.

Following the mine opening ceremony on July 7, 2025, Blue Lagoon shares have had an orderly pullback of 30%, while working on final mine preparations concluding with the commissioning of its Moving Bed Biofilm Reactor. Within the next few weeks, we expect the MBBR to get commissioned, mine blasting will begin, followed by first ore removal and revenue generation.

Below is its six-year chart of Blue Lagoon, showing its 2020 high of $1.40/share and recent 500% runup with its British Columbian Mining License approval.

Based on recent conversations with the mining team, we modelled Blue Lagoon’s third and fourth quarters and estimate $14 million in revenues and $5.3 million in cash flows in Q4 2025. Based on average industry multiples for market cap to revenues and market cap to cashflow, we believe that this $61 million market capitalization company should double by year end. Streetwisereports.com published our thoughts and report along with two other analysts this past week.

We are reintroducing BATAIS: Gold Mining Alternative Strategy so that new investors can capitalize on the rare opportunity with Blue Lagoon, other resource-to-mining transitions, and undervalued leveraged LEAP calls on select large capitalization gold miners in the early stages of this multi-year gold, gold mining, and mining cycle. With the impending MBBR commissioning and rapid revenue growth commencing in Q4 please contact me directly if you are interested in learning more about Blue Lagoon, gold mining, or mining process systems which are coming out of a 14 year bear market.

BATAIS: Gold Mining Alternative Strategy is a high-risk high-return strategy designed for qualified investors seeking to “move the needle.” We target a 10 fold return opportunity in the gold mining space through resource-to-mining transitions and LEAPs on select gold mining investments. Once the growth objective is achieved, we tax efficiently reinvest in high yielding tax advantaged securities like Master Limited Partnerships. We seek to move the needle for clients’ risk capital and then convert those proceeds into tax advantaged securities creating material optimized income streams for your future.

While an investment in Blue Lagoon or BATAIS: Gold Mining Alternative Strategy may not be of interest or in your professional mandate, we believe there may be compelling investment opportunities in the coming years for investments in mineral mining in the US and Canada, that could be very early in the cycle as the world seeks to restructure its supply chains.

We welcome your thoughts and comments.

Sincerely,

Tyson Halsey, CFA

Mega Caps Are Sinking And Gold Is Hitting New Highs! Our 11:30 AM Thursday Zoom Call Will Examine New Leadership Markets.

The Trump Bump has turned into the Trump Dump as the MAG 7 stocks have turned to the LAG 7 stocks, like Tesla, in particular. Gold is hitting new highs and money is flowing into new markets. Our expert panel will identify new leadership and timely investment ideas. The Great Rotation which followed the 2000 Technology bubble is now engaging.

Tyson Halsey, CFA: will draw parallels to the 2000 technology bubble, and new markets which outperformed from 2000-2011. China, Argentina, Brazil, Hong Kong, mining stocks, gold stocks, in particular, commodities, European and emerging market stocks that look poised for years of strong performance. Halsey sees the fundamental factors which drove the parabolic Mega Cap rally changing and driving new global macro leadership.

Mitch Bulajic: is a former quantitative analyst and program trader with experience at Elliott Management hedge fund and Jefferies’ global equities desk. He will discuss varied global macro trades. Mitch currently serves as the Chief Strategy and Research Officer at Acora Group, a leading high-tech IT and AI solutions provider based in London, UK. In this role, he also leads initiatives as a Generative AI solutions consultant with Microsoft, helping businesses navigate and implement Gen AI adoption strategies.

orld is in the bleachers.

Tony Low Beer: a former Neuberger Berman metals analyst and portfolio manager, still views the current market as a “Jonestown Market”. Tony will discuss China’s very cheap (DQ) Daqo New Energy Corp. a leading low cost provider of polysilicon and BYD Corp. China’s electric car juggernaut, weed stocks, gold and silver….

Chang Qui: will discuss (WB) Weibo, the “Chinese Twitter”, and (PDD) the “Chinese Amazon”. Chang had recommended China in September before the Chinese stimulus and 39% market rally. Trump’s threatened tariffs appear to be softening with greater US China discourse. What is on the docket and what to buy?

Charles Zhang: Will update our PEAD Post Earnings Announcement Drift strategy which had very powerful November returns. The PEAD Strategy had bought Tesla (TSLA), MicroStrategy (MSTR), and United Airlines (UAL), in q4 and currently is flat.

Richard Gula: Argyle Investment, LLC will provide his institutional technical and quantitative market overview. Gula set up the modern chartroom at Fidelity and worked for Dean LeBaron. Rich will point to areas of weakness, concern and opportunity around the world.

Halloween - Election - Zoom Call Thurs. October 31st 11:30 AM Covering Election Risks, China, Gold, Silver and Quant Strategies

Sign-Up for Zoom Call and Newsletter

Tony Low-Beer and Chang Qiu, who recommended Chinese stocks on Sept. 12, BYD Company LTD (BYDDY), Daqo New Energy Corp. (DQ), Weibo Corporation (WB) and PDD Holdings (PDD) – before the Chinese stimulus – will discuss the China market and their top ideas. Since September 12, BYDDY, DQ, WB and PDD are up 22.8%, 66.7%, 22.0% and 25.8%, respectively. China is still cheap, but it has both great risks and great potential.

Quantitative analysts Richard Gula, Mitch Bulajic and Charles Zhang will provide additional commentary on the Chinese market, as well as the election risks and opportunities for the global equity, bond, and commodity markets and their likely prospects under a Harris or Trump administration.

Tyson Halsey, CFA will update his “Irrational Exuberance” thesis in light of NVDA’s continued strength and historically rich market valuation measures. Rising interest rates are compounding the growth of US debt, the deficit, and debt service which are precariously high. These rising rates could hit the market like 1987, when the market declined 22% on October 19, or lead to a stagflation like the 1970s.

Market risks remain, but great opportunities exist in the the broadening market. Small caps, value, precious metals, emerging markets, and China are areas where we are seeing shares with significant upside potential. We remain cautious around “irrational exuberance” surrounding AI, parabolic stock market moves, and historically rich valuations that have occurred at generational market tops like in 1929 and the 2000 Technology Bubble.

See you Thursday!

China Zoom Call https://youtu.be/PraDnocqKpo October 3, 2024

We cover the recent parabolic move in the Magnificent 7 and NASDAQ 100 and compare that to the 2000 technology bubble. It is in the period following the 2000 bubble that gold and oil rallied 10x and China 5x. This is an apt analogue for today.

Mitch Bulajic discusses the enormous upside for China based on its targeting the Global South for export and infrastructure development and China’s superior technology strength. He cites a study saying that of the 42 most important technologies in the world that China leads US in 37 of those technologies.

Tony Low-Beer talks China saying it is very cheap and competitive. He discusses BYD hybrid which gets 1300 miles on a tank of gas. Its Seagull selling for $10,000 is huge disruptive price advantage compared to other EVs. Tony thinks solar is oversold and SMR technology is coming in late and over cost, so a swing to solar is likely and DQ has great long term potential.

MSOS is a Marijuana declassification play. American companies should benefit from a declassification before election but not Canadian MJ stocks.

Chang Qiu said surprising Sept 23 monetary stimulus of was result of Fed easing first which allowed the Chinese stimulus without weakening the RMB. He noted 18.8% unemployment with young people is also factor in dramatic Chinese accommodation. Despite extreme 50% move in many large stocks, many small stocks did not participate. Appreciation seen in BABA, PDD, BIDU, WB. Many stocks are still cheap value names at 6x earnings and growth names at 10x earnings. Sentiment is too skeptical. Some pullback, but should last.

Charles Zhang explains recent changes in Chinese growth model. For past 10 yrs China has relied on housing and infrastructure for growth, but this led to lots of debt at the local level. Demographics don’t look so good. China has been switching to a more consumer focused growth model. Ave Chinese family net worth 60-70% real estate vs 20-30% in US, so recent housing decline has been quite hard on consumer spending. This recent stimulus represents a philosophical shift which should empower Chinese individuals.

- “Post Earnings Announcement Drift” follow through following a major earnings announcement, industry change or company specific development. This is applicable to China move.

Rich Gula notes that China had major decline. Good break out in BABA, but be careful. In 2020, China was 40% of emerging market MSCI index then got to 24% now 27%. Tepper, European pension, and ETFs will be new sponsorship. Also mentions KWEB, FXI, HB, and HK…

Book Meeting with Tyson through Calendly!

https://calendly.com/incomegrowthadvisors/a-one-on-one-call-with-tyson

Zoom Video and Recap of Unconventional Market Insights September 12th 2024

Former macro strategist for Louis Bacon and Paul Tudor Jones, Robert Levin said “Excellent presentation Tyson. It is brilliant who you brought together”

With economic slowdowns and soft landings, there always is a risk of a recession. And recessions typically lead to a downturn in earnings and 30% decline in the stock market. Our Zoom gauges how Nvidia, the risk premium model, and S&P 500 earnings evolve over the next few weeks, months, and quarters will determine if a continued bull market, market collapse, or soft landing will ensue. Regardless of the US equity market’s prospects, gold and Chinese stocks appear to offer compelling alpha in the months, quarters, and years ahead. |

Gold is Poised for a Major Move Higher

As the inflationary Cycle Persists

Since 1981, interest rates and inflation have been declining and the investment environment has been deflationary. However, from 1999 to 2008, in the aftermath of the Tech Bubble environment, we experienced an inflationary cycle which led to major moves in gold and energy.

The chart below shows gold futures prices since 2000. Gold prices have recently broken above the $2000/oz. level, poised to move higher and potentially meaningfully higher.

Since the early 1980s, in combination with the academic arguments for the Modern Portfolio Theory advanced by Nobel Laureates Harry Markowitz and William Sharp, the 60% equity 40% asset allocation has been become the de facto asset allocation gold standard to portfolio management. “60/40 became the baseline investment strategy for pension funds, endowment funds, and high-net-worth individuals as well as retail investors. Wealth advising firms built the portfolios of many millions of customers around this simple rule because nothing succeeds like success. The 60/40 portfolio was a success on both risk and return measures and on widespread adoption.”

However, the component values for both stocks and bonds argue against the 60/40 portfolio today. Furthermore, the current inflationary cycle suggests commodities like gold and oil should outperform the S&P 500 for the remainder of the decade. For this reason we have been advising customers to tilt their portfolios to a 25% cash, 25% commodities, 25% stock, 25% bond allocation or 25-25-25-25 allocation for higher income, greater inflation protection and lower capital risk.

The chart below shows a cyclical delineation of inflationary environments and deflationary environments every 10-20 years since 1870. Based on the resurgence of inflation, and today’s overvaluation of equities, gold should outperform the S&P 500 over the next several years as it did in the 1970s and the 1999 – 2011 inflationary cycles. With the massive central bank accommodation that followed the pandemic, tremendous liquidity is available for investment in gold in the years ahead.

With inflation numbers not declining to the 2% range as the Federal Reserve has predicted and the S&P 500 sporting a Cyclically Adjusted Price Earnings multiple “CAPE” of 32.98, we expect that commodities and gold will see larger allocations as the investing world deemphasizes the 60/40 model in the years ahead.

Below is a snip of Robert Shiller’s dataset showing the CAPE at 32.98, a level over the 1929 highs but below the 2000 peak of 43.

History of Gold Moves

Below is a chart of gold prices with the moves for gold highlighted for the 1970 and 1999-2011 inflationary periods where gold prices moved a staggering 1834% during the 1970s and 612% during the early 2000s.

Gold also looks like it can continue to push higher. John Paulson told David Rubenstein last year that he thought gold could enjoy a larger move than during the post Great Financial Crisis because then Fed liquidity went to repair bank balance sheets and this post COVID accommodation saw surplus liquidity flow into the public’s personal accounts. If gold begins to attract investor interest over the coming years as a currency alternative, inflation hedge, and high return investment, upside is on the order of $3195/oz. to $5325/oz. (3x and 5x the 2015 low of $1065/oz.) Such a move could be achieved as asset allocators add gold as part of a commodity allocation as the 60/40 is revised to a more suitable allocation strategy like the 25-25-25-25 in the years ahead.

Our Past Gold Calls:

In August 2019 and September 2019 I wrote two letters where I recommended gold. We also advised exiting gold in August of 2020. During that period from September 9th 2019 to August 7th 2020, GLD — the SPDR Gold Trust – rose 35%, GDX – the Van Eck Gold Miners ETF – rose 55%, and SLV the iShares Silver Trust – rose 55%.

The five year chart below shows the move in the GLD SPDR Gold Trust which owns gold bars as opposed to gold stocks. We demarked the period of our earlier recommendation from September 2019 to August 2020. We also see the chart has been basing and now is breaking out to the upside.

Below is a chart of the GLD- SPDR Gold Trust (in red and green bars), the GDX Van Eck Gold Miners ETF (the green line), and the SLV the iShares Silver Trust (the gray line). All three are correlated and should rise; however, there are important distinctions between each ETF. GLD owns the actual metal and is correlated with the price of gold. GDX owns gold stocks. Gold mining shares should rise as the price of the metal appreciates because the gross margin earned by a miner will expand rapidly as the price of the metal increases. The gold spot price has risen this year from $2076/oz. to 2369/oz. or 14.1% this year. This will drive rapid earnings growth in gold stocks which are lagging the actual metal’s appreciation as of May 14th. The silver to gold ratio historically expands during bull markets, and consequently we expect silver to appreciate with gold and could outperform in the months and years ahead.

The chart below shows how in 2020, gold stocks shown through the GDX outperformed the gold shown through the GLD bar chart into August 2020 when we exited our positions. Likewise, there was similar outperformance in silver shown through SLV (gray line) from the COVID March low until our August 2020 exit. Today, we would own all three ETFs for a diversified participation in the precious metals space as part of the commodity allocation in a diversified portfolio.

We believe that momentum is a primary factor in quantitative investing. Consequently, the longer this rally persists, the more likely gold, gold stocks, and precious metals will enjoy growing investor participation. This anticipated tactical allocation and momentum buying will intensify with growing central bank investments in gold by central banks most notably the Bank of China.

Below is a chart of gold purchases by China over the last 3 years.

The New Tellurian Ex-Souki: New Executive Management Team, Same Model

Tellurian Inc. removed Charif Souki from his leadership and all operating roles on December 11th. This management change creates a more focused and professional organization which will continue to execute in the coming months as it seeks to secure a key equity funder for the Driftwood LNG facility. Tellurian Investor Representative, Matthew Phillips, spoke with me on January 4th, and said the company is having multiple discussions with both household names and smaller counterparties. If the company secures financing for Driftwood, Income Growth Advisors, LLC believes there is substantial upside for Tellurian stock.

The company outlined their plans in Chairman Martin Houston’s letter on December 28th. The addition of 13 million shares of TELL by Chatterjee Fund Management LP, brings its total holdings to 47 million shares, demonstrating new institutional investment into Tellurian’s new team and strategy. 8Ks filed by the company show that Tellurian is taking steps to address certain negative covenants on a convertible bond which triggered its going concern. The final restructuring of its convertible debt will likely follow securing an equity funder for Driftwood LNG, according to Matthew Phillips.

Speculation and industry news suggest that large household names could be Shell plc, BP plc, and Aramco. Smaller possibilities are TG Natural Resources LLC (the newly formed combination of Rockcliff Energy and Tokyo Gas) and Indian natural gas operator GAIL which issued and EOI in February 2023 to acquire a portion of a US LNG facility.

The most important takeaway appears to be Souki did not want to work with certain counterparties or visa versa. Last year, Souki told Bloomberg’s Alix Steel that he did not trust the Chinese, the largest buyer of LNG in the world, as a counterparty. However, following 12-18 months of not closing, the board now has new counterparties which were referenced in Houston’s letter. This may open the door for Martin Houston and Octavio Simoes, who also have highly accomplished records in the LNG industry, to engage other strategies and counterparties now that Souki is gone. Souki’s departure terms were amicable, and he will receive his full bonus when the company achieves Final Investment Decision “FID”.

Souki was criticized by some for lavish pay packages and taking high risks. His fatal error, in my opinion, was the collateralization of 25 million shares of TELL stock to help finance his Aspen Valley Ranch, which ultimately were sold by a creditor in Q1 of 2023. Souki claimed that the creditor promised not to sell his shares until Driftwood was financed. There has been private litigation surrounding this financing which is awaiting a final verdict this month. That share transaction, combined with the failure to secure critical financing, I believe, led to his ouster.

Investment Scenarios:

If TELL secures financing, the return potential is significant. We estimate that the company can earn $4 billion in cash flow a year with its pioneering integrated model of selling cheap US natural gas at higher prices internationally. At five times cash flow, we estimate the valuation of Tellurian could be worth $20 billion in 2032 when all five trains are built. Using a 15% risk adjusted discount rate, TELL’s market capitalization could be $7 billion in 2024, if Driftwood secures FID. That valuation is up from today’s market capitalization of $502 million. If TELL’s total share count grows to 1 billion shares outstanding, a share price of $7 could be achieved in 2024. This is the massive asymmetric upside I have been positioning clients for. And, now with the new team more focused on execution, the corporate news announcements over the next few months will decide whether Tellurian will be a ten bagger or simply a speculative investment.

Martin Houston, who owns 18 million Tellurian shares, believes in Souki’s vision of an integrated model where Tellurian sources their own cheap US natural gas and sells it internationally at a large premium as opposed to a traditional tolling model where the LNG processor simply captures a $1.5/mmBtu liquefaction fee. At a minimum, Houston wants to fully recover its billion dollar investment in Driftwood. Assuming Tellurian has invested $1.25 billion in Driftwood, add in their Haynesville properties and pipelines, and subtract their debt, their net assets should be about $1.25 billion. Assuming shares outstanding fully diluted are 800 million, the company’s asset value per share is approximately $1.56/share approximately twice today’s share price.

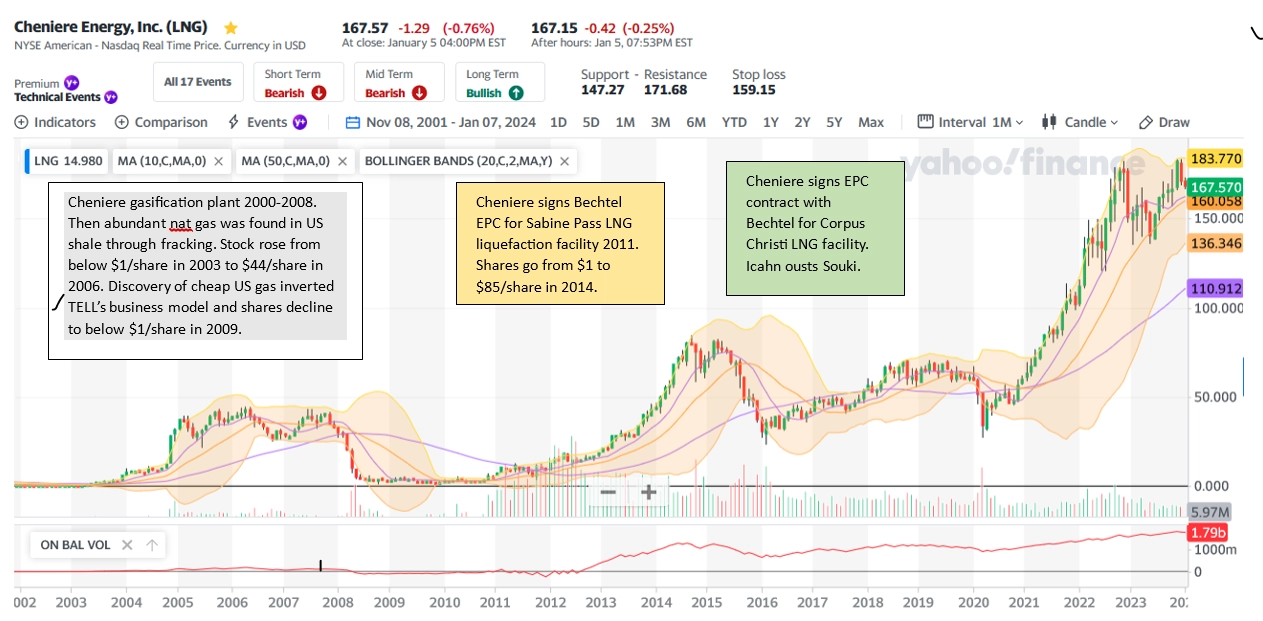

Cheniere Energy Inc. History:

A quick review of the chart of Cheniere Energy Inc (LNG) shows the extraordinary moves made when it financed and constructed its LNG facilities Sabine Pass 2011-2014 and then Corpus Christi 2014-2019.

Tellurian Inc. History:

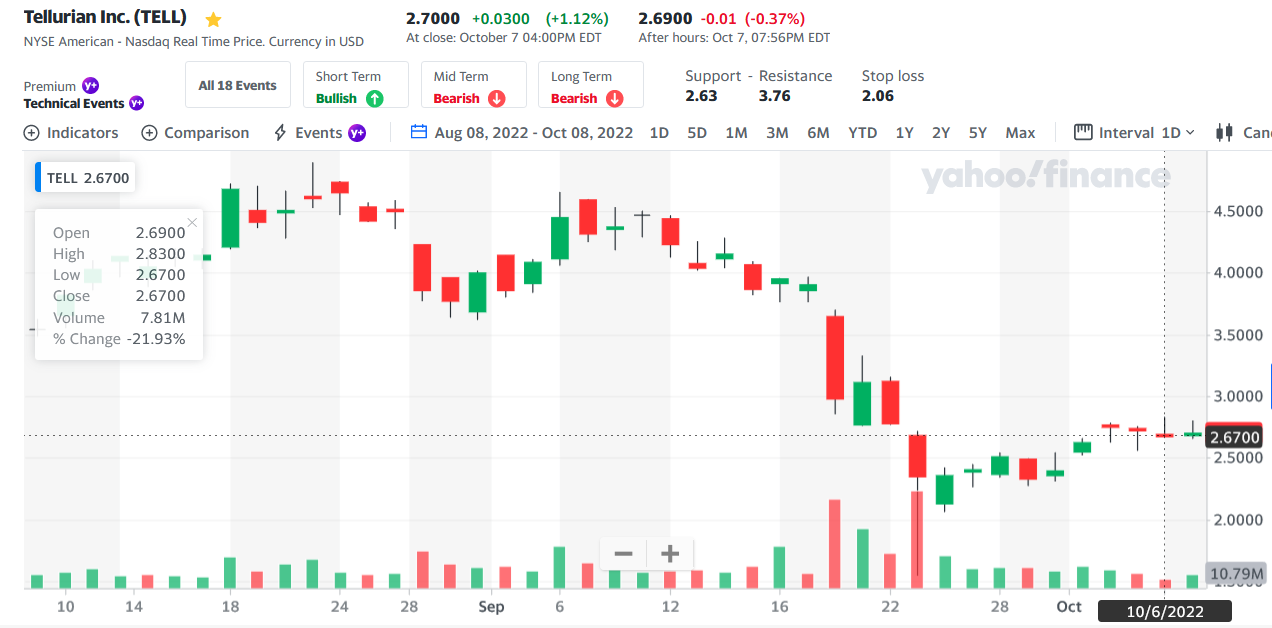

Tellurian was founded by Charif Souki and Martin Houston in 2016. The COVID-19 crash and the Petronet MOU expiration hurt TELL in 2020. 2022 saw a spike in natural gas prices due to the Russian invasion of Ukraine. Expectations of Driftwood LNG financing led to a move from below $1/share in 2021 to over $6/share in April 2022.

With the collapse in natural gas prices from $10/mmBtu to $2/mmBtu, failure to raise $1 billion in September 2022, withdrawal of Sales Purchase Agreements (SPAs), TELL’s FERC extension request, TELL’s ATM share issuance, and going concern language, led TELL shares to decline from $6/share to below $0.48/share while the company sought to finance Driftwood with strategic equity off takers. Despite positive announcements with Blue Owl, GAIL, and Baker Hughes the share price declined until November when share volume rose considerably. With Souki gone, expenses reduced, new counterparties, new institutional investment, and insider stock purchases, Tellurian is positioned to secure Driftwood’s financing.

Forthcoming news could bolster TELL shares and Driftwood financing prospects. The Federal Energy Regulatory Commission should soon announce approval of its Driftwood construction extension request which noted that “potential financing counterparties and customers require regulatory certainty that Driftwood will have sufficient time to construct and place the Project in service.” In September, Tellurian said they would entertain SPA agreements again, and a SPA could be announced before FERC approval, but more likely after announcing a financial partner. The revenues Tellurian generates are directly linked to natural gas prices, and rising prices could improve TELL’s cash flow rapidly. And, most importantly, an announcement of an investment or agreement to invest in the Driftwood LNG facility could change Tellurian’s prospects overnight.

Tellurian’s stock price appears to have bottomed out and the company is poised to benefit from news in the coming days, weeks, and months. From its current market capitalization and share price, Tellurian Inc. could prove a significant winner if news regarding its financing is announced in the coming months.

Income Growth Advisors, Inc and the author personally own Tellurian and may be biased in its analysis. I believe that Tellurian is in the right business, with the right team, at the right time to successfully finance Driftwood LNG; however, financing Tellurian’s innovative vertically integrated model is not assured.

November 1, 2023: Tellurian, Inc., A Generational Investment Opportunity?

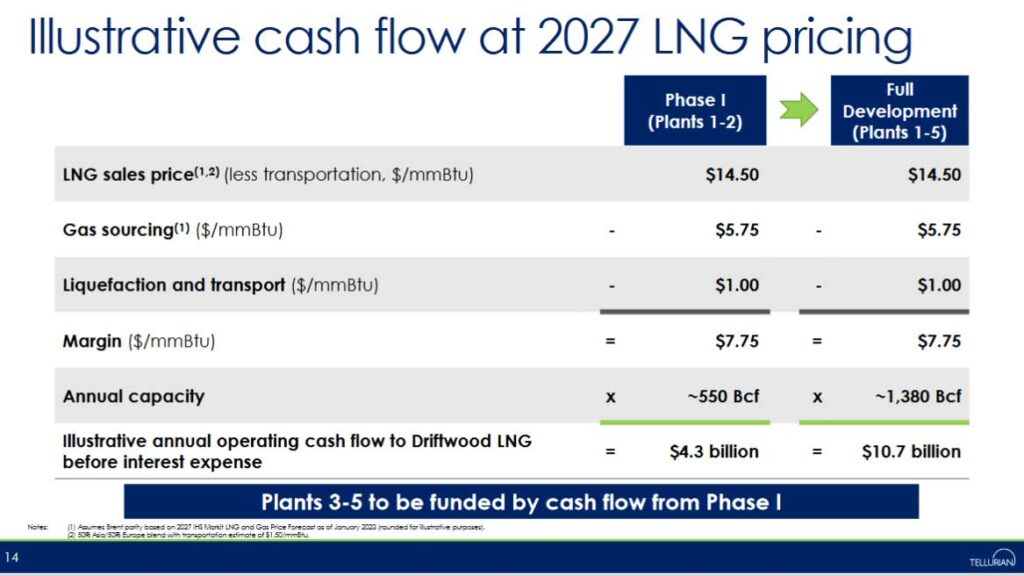

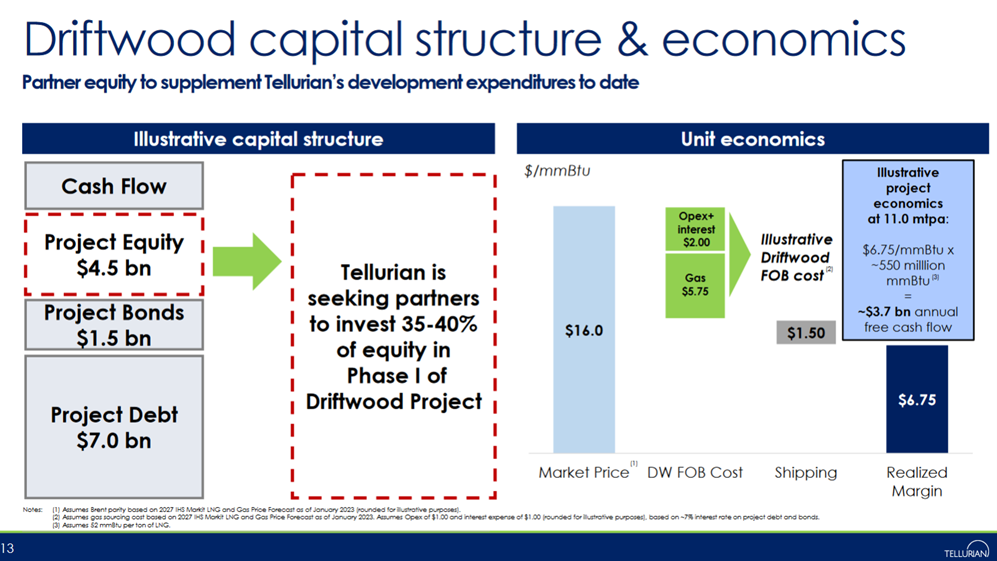

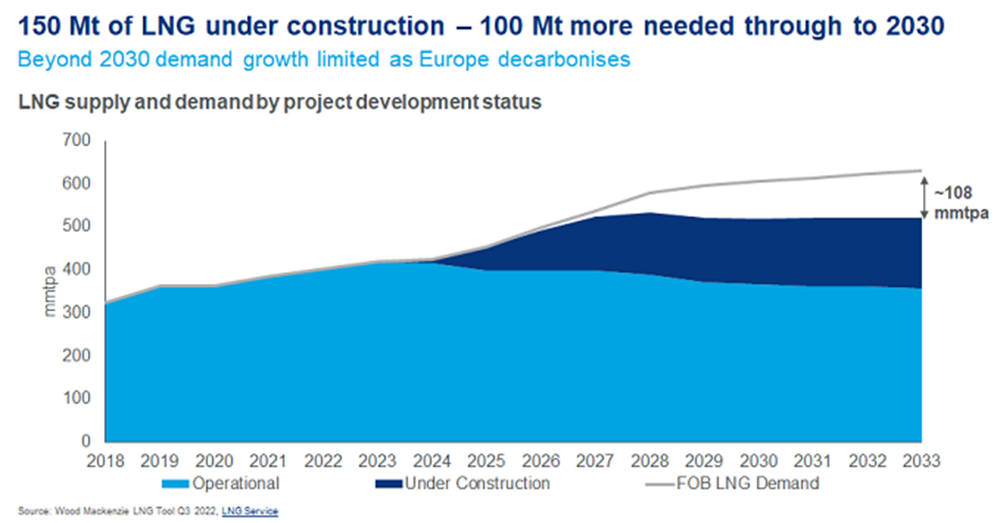

Tellurian, Inc. is a development stage LNG and natural gas producer looking to take abundant low-cost US natural gas and sell it into the international market. Tellurian’s 27.5 MPTA Driftwood LNG liquefaction facility is the last fully licensed major US LNG project designed to produce LNG this decade. The Driftwood facility benefits from the energy transition’s growing commitment to natural gas and capitalizes on the higher margin provided by Tellurian’s integrated business model.

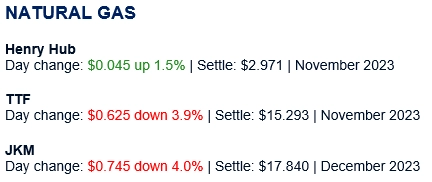

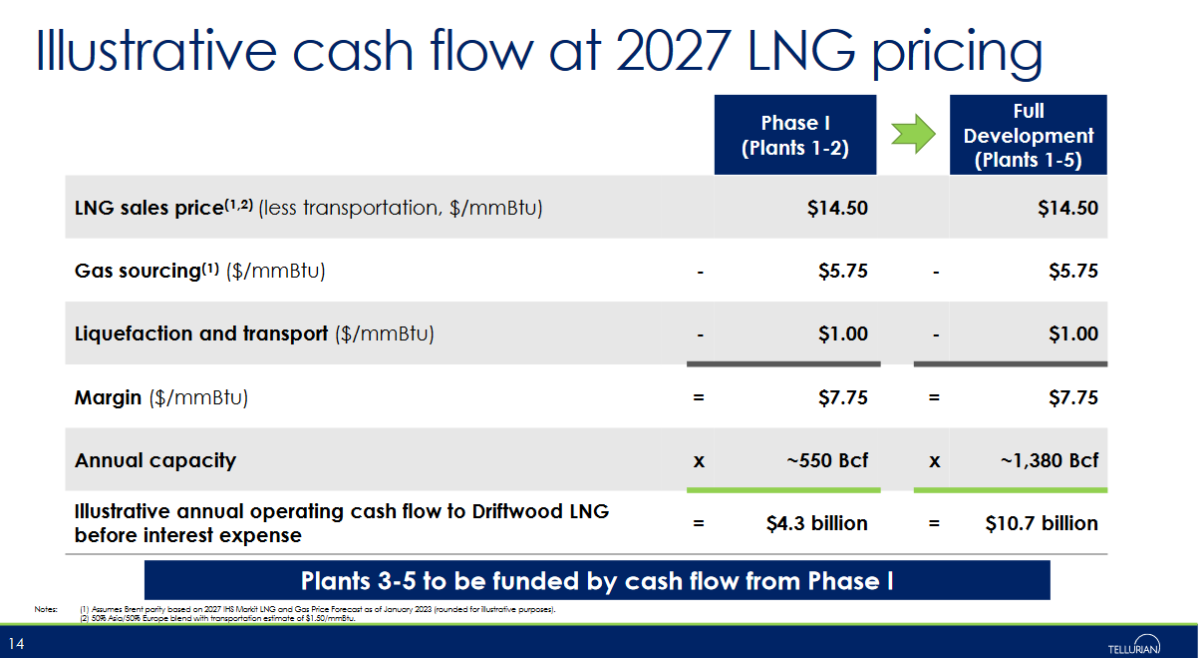

Tellurian’s model differs from its competitors by capturing the spread between cheap US natural gas $2.971/mmBTU and international prices — TTF (Euro Benchmark) $15.293/mmBTU and JKM (Asia Benchmark) $17.840/mmBTU — versus a tolling model which limits profitability to a few dollars per mmBTU of LNG produced. See HH, TTF and JKM benchmark prices on 10/24/2023 listed below. Tellurian will share this attractive spread with its shareholders and equity partners. By funding its Driftwood liquefaction facility with equity partners, Tellurian shareholders should benefit from its potential $4-5 billion in annual cashflow once Driftwood is operating.

Executive Chairman Sharif Souki has argued that traditional LNG financing models based on long-term tolling contracts are not sufficiently profitable to meet current development costs and future maintenance costs. Recently reported problems at competitors Venture Global, Freeport LNG, and Next Decade suggest that Souki is right. Off taker delivery problems, deficient maintenance and op ex, and shareholder participation at Venture Global, Freeport LNG and Next Decade suggest the toll road business models with thin margins have created these problems. Tellurian’s integrated model better allocates development and operating costs which will lead to off takers receiving their expected cargoes and fewer plant disruptions (e.g. explosions). Consequently, Tellurian’s lucrative integrated business model should avoid these industry problems because its funders will be fairly paid for their participation.

The energy transition has evolved from an effort to cancel all fossil fuel production and nuclear energy and replacing those energy sources with wind and solar. Europe had embraced this strategy but found itself in an energy crisis before Russia’s invasion of Ukraine. Today, natural gas, LNG, and nuclear are increasingly recognized as transition fuels. They provide a pragmatic balance of energy generation and lower carbon emissions targeting net zero 2050. Thought leaders like this Japanese think tank concluded recently that $7 trillion in natural gas development will be needed by 2050. This forecast, like Wood Mackenzie’s market analyses, suggests that facilities like Driftwood will be needed to fill an LNG production gap in the years ahead.

Tellurian’s management team has helped to build 79% of US LNG facilities and is working with Bechtel to construct Driftwood. Furthermore, because liquefaction is a commercially proven technology, the primary challenge to Tellurian is securing the financing of the $14-15 billion Driftwood facility. If Tellurian successfully finances Driftwood in the coming weeks and months, we believe there is a five to ten fold return potential for its shares by first half 2024. Assuming a five times EBITDA multiple on projected annual cash flows of $4-5 billion, when Driftwood is fully operational, Tellurian could trade at a $20-25 billion market capitalization around 2030. Based on Tellurian’s $379 million market capitalization, Tellurian’s market cap could grow fifty-fold.

The Global Economic-Environmental Case for LNG:

Natural gas is the cleanest fossil fuel in terms of carbon emissions. Natural gas emits about one half the carbon which is emitted by coal. In recent years, activist groups have promoted banning all fossil fuels and switching to renewables – primarily solar and wind. Unfortunately, physics has shown that eliminating all fossil fuels and nuclear power will lead to an energy crisis and food shortage. Powerful arguments have suggested that transitioning to renewables is a process that will take decades. Furthermore, policies which seek to accelerate that transition will lead to energy and food crises.

Mark Mills, a world class energy expert provides an entertaining short video highlighting the fallacy of a rapidly deployed renewables only energy strategy. Please watch his video.

Europe, which aggressively adopted a rapid transition to renewables at an unrealistically fast pace found itself in an energy crisis and then Ukraine was attacked by Russia. Russia went on to use energy as a weapon of war. Today energy security has become an important new strategic consideration for energy policy and investment decisions. Once natural gas is liquefied and placed on an LNG ship, that cargo can be easily shipped around the world. This allows energy users to diversify their energy supply sources to reduce carbon emissions and increase energy security.

UN Sustainability Goals’ top priorities are ending poverty and ending hunger. Natural gas addresses both of these top UNSDG goals while simultaneously reducing carbon emissions. An energy transition emphasizing natural gas can reduce carbon emissions, provide fertilizer to feed billions and energy to lift the world’s poor out of poverty.

EQT Corporation, the largest US natural gas producer, makes the following argument for international LNG. “Unleashing U.S. LNG and replacing international coal with American natural gas is the largest green initiative on the planet and the world’s best weapon to address climate change.” EQT states that “the emissions reduction impact of an unleashed US LNG scenario is equal to:

- Electrifying every US car

- Powering every home in America with rooftop solar and backup battery packs [and]

- Adding 54,000 industrial scale windmills, doubling US wind capacity.”

Furthermore, “By 2030, an unleashed US LNG scenario would reduce international CO2 emissions by an incremental 1.1 billion metric tons per year” and US citizens would be paid for this initiative (tax revenues and an additional $75 billion in royalties3, as opposed to paying for it.”

The institutional energy market is moving in the direction of greater reliance on natural gas. This week, Bloomberg energy analyst Steven Stapczynski reported that Europe is signing long-term LNG contracts despite political pledges to rapidly reduce carbon emissions. Furthermore, the Biden administration seeks to increase US LNG supplies to Europe and replace dirtier Russian sourced natural gas. The Presidential joint declaration of March 2022 helped to lift Tellurian share prices to $6 per share. Europe did not consummate those import deals in 2022 due to Europe’s lack of degasification facilities — at the time — and the EU’s preference of a hydrogen solution. Today, that thinking may have changed.

For a comprehensive overview of the US shale boom, please watch Peter Zeinan’s The First Shale Revolution: Humble Beginnings and then The Second Shale Revolution: Industrial Expansion. The first video describes the early development of the US natural gas business and how it made the US energy independent. This revolution explains how the US turned from an LNG importer to an LNG exporter. From 2000 to 2006, Cheniere Energy shares rose from $1 to $40/share when it initially built a gasification facility to import cheaper international LNG; however, when abundant natural gas was found in US shales with hydraulic fracturing and horizontal drilling, Cheniere found its business model was upside down and its shares declined from $40/share to $1/share. Note the share prices of Cheniere Energy, Inc. from 2000 to the present.

Souki, the former co-founder and co-CEO of Cheniere Energy, Inc., then restructured the company into a liquefaction company and Cheniere today is the largest LNG producer in the US. Cheniere’s stock rose from $1/share to $183/share. The second video discusses how the US took its shale oil and natural gas and turned it into low-cost powerplant fuel for electricity which then broke the US dependency on coal and made the US the leading reducer of carbon emissions on a relative and sustainable basis on the planet! This shale history helps to explain the recent $60 billion acquisition of Pioneer Natural Resources by ExxonMobil and Chevron Corporation’s $53 billion acquisition of Hess Corporation.

Tellurian Financing Prospects:

Tellurian’s valuation reflects a distressed liquidation value. However, if Tellurian is able to secure additional financing for its upstream business and grow its upstream business to $400mm/year by 2027, Tellurian’s upstream business could be worth 3 to 5 times EBITDA multiple or $1.2 billion to $2.0 billion in the next 4 years.

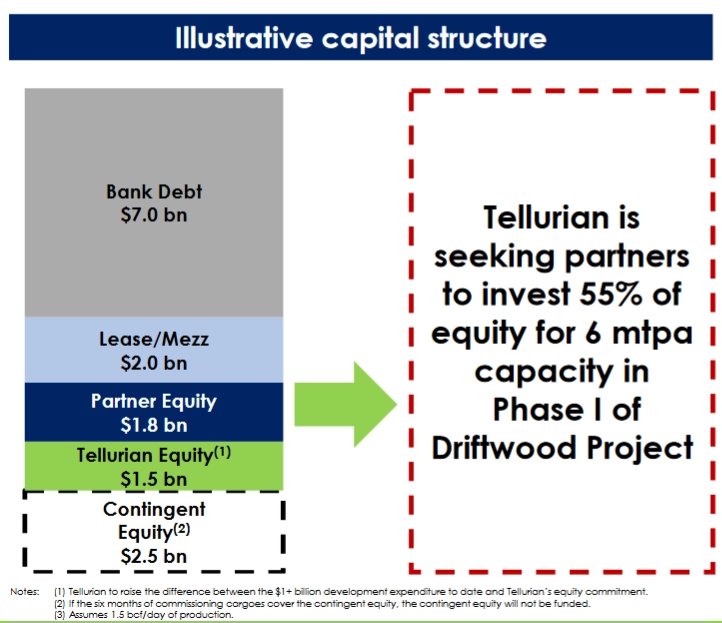

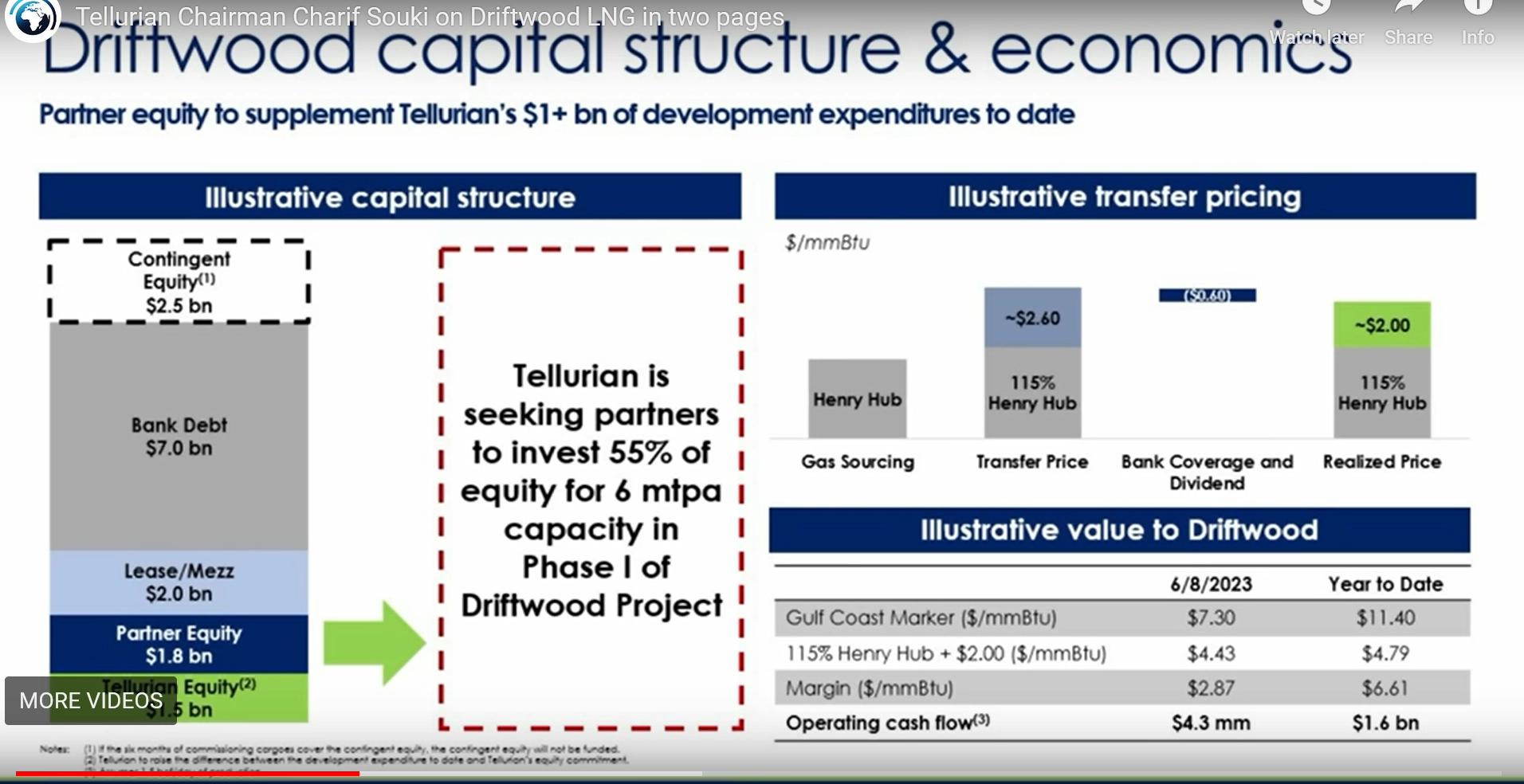

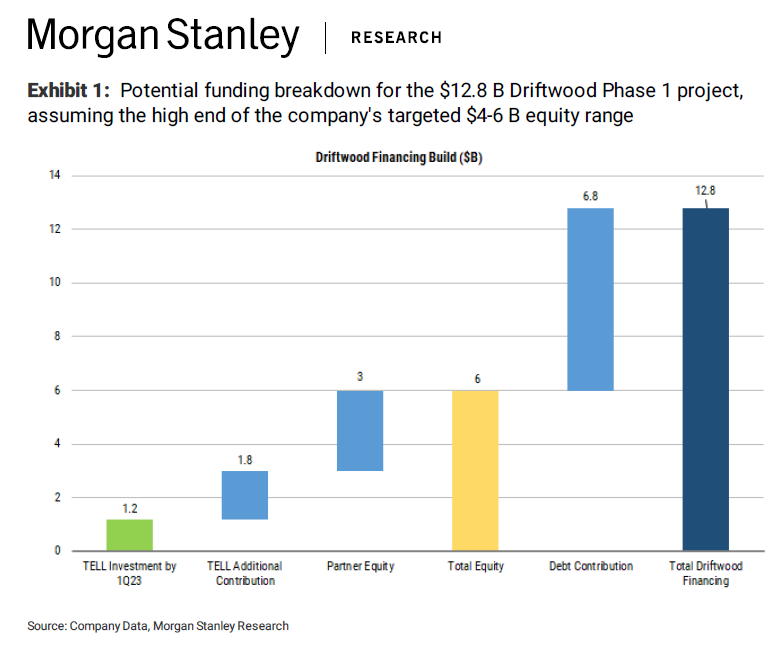

Overwhelmingly, the biggest variable in valuing Tellurian is tied to Driftwood LNG’s financing prospects. Below is a diagram of the capital structure that has been proposed by Tellurian to finance Driftwood LNG.

Below each segment of the capital structure is assessed for the risk associated with each component.

Bank Debt $7.0bn

Project finance is a particular type of long-term financing of infrastructure or industrial projects that is based upon projected cash flows of a project as opposed to the balance sheet of the sponsor. These loans are financed off of a bank’s balance sheet. Port Arthur, for example is priced at 2 ¼ over the SOFR Secured Overnight Financing Rate. SOFR is short term rate like the fed fund rate and LIBOR London Interbank Offered Rate. SOFR, like the fed funds rate and LIBOR, has risen to 5 1/4% following a sharp run upsince 2020 and has paused. Unlike 10 and 30-year Treasury yields which have been rising this year, this huge loan should be priced in the 7 ½% range. The loan will be similar to a credit line for a construction project, where a combination of equity and bankline are drawn down to pay Bechtel’s monthly EPC fee. The liquefaction equipment which will be the majority of the $12 billion. These project loans are considered low risk loans. Jamie Dimon CEO, of JP Morgan, would likely lead a syndicate of banks to fund this $7.0 billion bank line. Project finance is an easy spread business for a bank to book where the banks’ capital costs lies between its deposit rates, the fed fund rate, or LIBOR rate.

Lease/Mezz $2.0 bn

The lease has been publicly offered by Blue Owl in its sale leaseback agreement for $1 billion. Blue Owl will pay Tellurian $1 billion for ownership of the Driftwood project and site with a 40 year lease at an 8.75% cap rate (rent = $87.5 million/year) with a 3% annual escalator. Blue Owl is a sophisticated publicly traded finance company with Doug Ostrover as Co-CEO. It is intriguing that Ostrover “was a founder of GSO Capital Partners (GSO), Blackstone’s alternative credit platform and a Senior Managing Director at Blackstone until 2015.” Blackstone was a key private equity funder to Cheniere Energy, Inc. We suspect Ostrover is familiar with or was involved with the debt and or private equity financing of Cheniere Energy, Inc. and may have worked with Souki in the past.

The other $1 billion in mezzanine finance is where we believe the Driftwood project has been held up. In the spring, Souki had said the company had a term sheet out with an equity investor with whom they had worked in the past. We speculate that this could be John Paulson, because John Paulson is a Tellurian shareholder and was involved with financing Cheniere Energy, Inc. I met John Paulson when I worked at Alex Brown in the 1990s. Earlier this spring, in an interview with David Rubenstein, Paulson said he liked asymmetric investment opportunities. Paulson is a Wall Street phenom whose firm made 20 billion dollars buying credit default swaps on sub-prime mortgages during the Great Financial Crisis and may have been the true inspiration for the book and movie “The Big Short” and not Michael Burry another investment genius who also owned credit default swaps on sub prime mortgages during the GFC. Paulson’s investments in credit default swaps were in the billions through various hedge fund vehicles he set up at the time. Burry’s investments were much smaller. Paulson could easily be attracted to the potential asymmetric return from the spread between international LNG prices and Henry Hub prices. A private equity convertible stock with an equity upside would be consistent with financing structures used by Cheniere Energy, Inc. in the past and could be attractive to private equity and infrastructure investors.

For a non-strategic equity partner (an entity not interested in owning or handling the LNG like John Paulson) the signing sales purchase agreements (SPAs) would give financial or infrastructure investors a steady tolling fee for risk mitigation, but also the spread between international natural gas prices and domestic prices. On Souki’s September 13, 2023 weekly video, Souki stated (4:20 in video) that if the company is able to secure a $2.75/mmcf, they would have about $0.50 to give to infrastructure funds that are now investing in the LNG space. A compelling example of a private equity investment in the LNG space is Warren Buffett’s $3.3 billion July investment in Cove Point. Buffett paid about 10 time cash flow for his investment and the Driftwood equity is being offered at about one times cash flow. The obvious difference is that Cove Point is built and currently cash flowing. Driftwood is not. Driftwood should start generating its first LNG revenues in 2027. Until the company begins generating cash flow, investors will be assuming the risk that the project won’t be completed and generate cash flow as expected. Actual interest payments can be made in PIK (pay in kind) equity until the company begins to generate cash flow in 2027.

Consequently, we believe that if Tellurian has 11 MPTA in SPAs, they could comfortably secure $1 billion in infrastructure financing for this mezzanine financing. Martin Houston reported on Bloomberg this week that they are working on their portfolio of SPAs.

Partner Equity $1.8 bn

The private equity partners have been the focus of Tellurian, since last September when they pulled the $1 billion 11 1/4% 2027 notes with warrants. The equity partner strategy alternatively focuses on the sale of a share of equity ownership of Driftwood. For strategic partners, Driftwood is an appealing piece of energy infrastructure which will give each equity partner a share of the equity economics of Driftwood LNG. Tellurian is seeking $1.8 billion. The Blue Owl deal required that Tellurian reveal who these entities are to preapprove them and that they have the financial capacity to be “contingent guarantors”. We believe several have been preapproved by Blue Owl or they would not have converted their original letter of intent into a binding commitment. The profile of an equity partner, strategic equity partner or contingent guarantor is a substantial entity capable of paying its share of rent, mortgage, and operating expenses for decades. Logical partner prospects include Shell plc, Saudi Aramco, Tokyo Gas Co. Ltd, as well as European, Korean, or Indian energy companies or utilities who want access to low-cost high quality US LNG.

Tellurian Equity $1.5 bn

Tellurian itself is an equity owner of the Driftwood project and has invested $1 billion in the project and will continue to fund its construction. Its share — inflation adjusted — is estimated at $1.5 billion. That funding piece is assured as one billion is already invested.

Contingent Equity $2.5 bn

Contingent equity is what Tellurian will invest into the Driftwood LNG project from commissioning cargoes. Commissioning cargoes are the first (approximately six months) of cargoes from a new facility while the sponsor is testing its equipment and output to assure that it meets specifications. Tellurian has committed six months of commissioning cargo proceeds to the project. This is one area where significant controversy, regarding Venture Global, has arisen. Venture Global built a huge low-cost prefabricated facility and sold its off taker fees at very low prices. However, when the commissioning cargoes were set to end and Venture Global was to send their customers their LNG, the company — Venture Global — argued that those cargoes were theirs due to there being equipment issues. According to Reutters “U.S. liquefied natural gas (LNG) company Venture Global LNG sold over 200 LNG cargoes worth about $18.2 billion since its first export plant started operations in March 2022, according to vessel data and Reuters gas price calculations.

Those shipments have become a flashpoint for gas buyers and marketers who insist they should have received some of the supplies under long-term contracts for Venture Global’s Calcasieu Pass export plant in Louisiana. There have been at least three contract arbitration cases brought this year.” Tellurian has said it will be fully transparent in its financial model and contracts implying that in working with their team, long-term off takers will get the cargoes when they expect them. We believe Tellurian has had the time to study this problem and the Freeport LNG explosion and shape a financing model which will be more reliable in the future.

We believe that Tellurian has been speaking with counterparties for each segment of the funding stack. While contracts have not been finalized, we believe the management has shown contract terms with each counter party. We believe with the completion of their off take portfolio with SPAs as an option, they will be able to fine tune prices to secure the best terms for the company and its shareholders.

Tellurian’s Attractive Shares Valuation:

We value Tellurian’s shares by separately analyzing its upstream E&P business and its downstream Driftwood LNG facility. Tellurian’s upstream natural gas business generates 200mmBCF/day of natural gas on 31,000 acres of land in the Haynesville and should generate $100mm in EBITDA this year according to Charif Souki on September 19th, 2023. Cash flow multiples for gassy E&Ps run in the 3-5 times area. Due to Tellurian’s 31,000 acre Haynesville property ownership, the value of its pipelines, and LNG value add prospects, we a 5x 2023 EBITDA multiple on its upstream business is fair value. However, conservatively valuing the cash flow the cash flow at three times, we estimate its upstream business is worth $300mm.

Natural gas prices are firming and up 2.36% today, 6.63% this month, and 40.17% year to date in the table below as of October 27th, 2023.

As a result of Russia’s invasion of Ukraine in 2022 natural gas prices spiked to $10/mmBtu which prompted a rapid expansion of US natural gas production that ultimately led to a collapse in natural gas prices back to $2/mmBtu. Today, natural gas well counts are declining, and natural gas prices are reversing upward as shown in the chart below. Furthermore, as LNG capacity ramps in the years ahead, natural gas prices should firm further helping Tellurian’s upstream cash flows. Tellurian’s natural gas production break even is $1.8 to $2.0/mmBtu. Consequently, Tellurian’s operating leverage is significant. Continued strength in natural gas explains the decline in operating profitability from 2022 into the first half of 2023.

Tellurian’s upstream business will need to scale significantly to produce the needed feedstock for Phase 1 of its 27.5 MPTA Driftwood facility. Tellurian plans to double its production from 200mmcf/day to 400mmcf/day and the company stated it plans to do a financing before year end to fund this additional production according to Souki’s September 19th video. This will be a private transaction and the counterparty might split upstream or midstream cashflows and or get liquefaction rights with Driftwood LNG. Logical equity partners are public and private natural gas E&Ps like those which have expressed an interest in selling their natural gas internationally. Potential upstream funders include EQT Corporation (EQT), Chesapeake Energy Corporation (CHK), Rockcliff Energy, Comstock Resources, Inc. (CRK), Devon Energy Corporation (DVN), Antero Resources Inc. (AR), Range Resources Corporation (RRC), and Southwestern Energy Company (SWN). Earnings are expected to be released November 1st, 2023 and with those latest cashflow numbers, a transaction could be negotiated by year end.

Tellurian’s second quarter’s earnings were poor due to low natural gas prices, low volumes, and drilling expenses. The third quarter should be much better as the company stopped drilling, natural gas prices are rising and production volumes are growing. With those improved cash flows, Tellurian should be able to continue funding Driftwood construction until they complete their financing. Below are our rough estimates of the company’s financials for Q3.

Net Production 17.2 BCF

Revenues $31.9

EBITA $8mm

HH ave. price 2.15 in q2 (actual basis 1.85)

Q2 Earnings we loss $32mm.

Estimated Q3 Report (est. Nov 1)

Net Production 18 BCF

Revenues $46.8mm

EBITA $21.5 = ((2.6-1.85 basis)

HH ave. price 2.60 in q3

Q3 estimated loss $21mm.

The newly restructured convertible cash covenant was reduced to $50 million. See Note 17 10-Q August 8 2023. The company will have $107mm-50mm=$57mm in cash to draw down and an ATM to draw on to cover out estimated $20 million quarterly cash burn.

Valuing Driftwood LNG

Without the facility being fully constructed and without financing, we conservatively value Driftwood at $100 million. Driftwood is the last large fully licensed LNG project expected to produce LNG this decade. This $100 million resale estimate is “10 cents on the dollar” despite Tellurian having invested over $1 billion. Once financing progress is announced, such as an SPA or binding letter of intent, Driftwood’s valuation would increase immediately.

If Tellurian secures the $14.5-15 billion for construction, then the value of Driftwood should jump as the public market risk-adjusts future cash flows of $4-5 billion a year. From a market capitalization of $400 million to $20 billion in 2031, the annualized equity return is approximately 63%. Consequently, Tellurian’s abnormally high volatility is directly related to its financing prospects.

The giant opportunity for Tellurian is to sell its LNG abroad. The European TTF index chart below shows that prices are firming. LNG prices are also improving for the Asian JKM. Higher international prices should stoke interest in signing LNG deals with Tellurian.

Based on Tellurian’s proposed pricing structure with a third party buyer (SPA) at Henry Hub + 15%= 2.97 x 1.15= $3.642 plus transfer fee of $2.75/mmBtu = $6.39 LNG cost. The TTF is $16.73/mmBtu which is a $10/mmBtu spread.

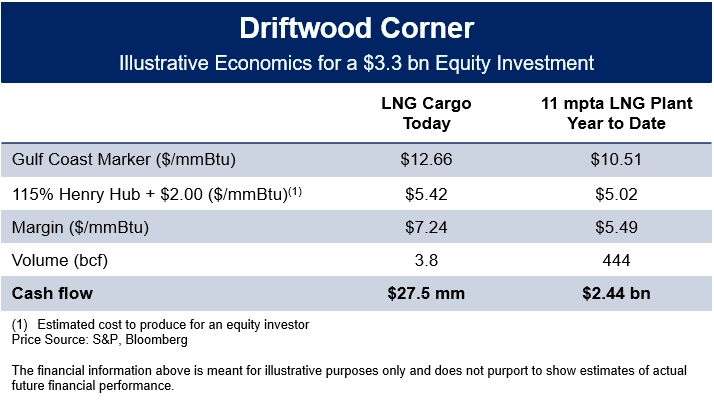

See Tellurian’s Driftwood model emailed daily below:

Tellurian shows a Gulf Coast Marker a metric Platts uses to reflect the “daily export value of LNG traded free on board (FOB) from the US Gulf Coast.” This gives an indication of what the profitability of the Driftwood plant would be for this year to date and based on prices this year and tabulated daily.

The box diagram above shows that the entire 11 mpta through October 24th, waould have generated $2.44 bn in cash flow. Annualizing that cash flow number equals $3.34 bn for all 11 MPTA. Tellurian is offering strategic equity investors 55% of Driftwood for a 55% share of its cash flow. Conseqquently, the strategic funders or contingent guarantors should earn $1.834 bn in CF for 2023 according to the illustration above and on investment of $1.8 billion. This prospectively illustrates a very attactive one times cash flow return.

Tellurian which has or will invest $1.5 billion should get $1.5 bn in cash flow prospectively based on this illustration based on prices year to date. Both Tellurian and its strategic partners are getting paid out at one times cash flow. We believe there are interested funders “Contingent Guarantors” who have been preapproved by Blue Owl. These could be BP, Shell, Saudi Aramco, or Tokyo Gas based on their scale and interest in LNG.

So when funded, the Driftwood facility could be valued at $3.34 billion based on adjusted year to date cash flow example. Consequently, we believe a $100 million valuation for Driftwood is a conservative valuation.

Combine Tellurian’s conservative $300mm upstream value plus Driftwood’s $100mm valuation,

Tellurian’s conservative market capitalization is $400 million. $400 million/583 million shares = $0.686/share. Positive news on earnings, the FERC permit extension, and or an SPA could lead to prices around $1.70 when Blue Owl’s financing was first announced and they signed a binding commitment letter July 18th.

A Rare Investment Opportunity:

Compelling investment opportunities are typically contrarian investments. For example, when selling, the shrewd investor sells when everyone is buying and ideally in a state of “irrational exuberance.” Nobel Laureate Robert Shiller wrote his brilliant and exquisitely timed book Irrational Exuberance in March of 2000—the tech bubble peak. Alternatively, buying when others are selling, panicked, or completely disparaged also makes sense. Severe negative sentiment often occurs when a security is priced at low or distressed valuation levels. Many owners of Tellurian are discouraged with its shares down 90% from when it peaked in May of 2022, following the Russian invasion of Ukraine. Furthermore, since July, Tellurian shares have declined 62% from $1.71/share to $0.65/share. This was caused by weak second quarter earnings, Gunvor’s SPA cancellation, and the FERC construction permit extension overreaction.

On the positive side on September 4th, Baker Hughes agreed to supply eight key refrigerant compression packages for Phase 1 for 2027 production. To deliver Driftwood on schedule, maintaining long lead time orders “in the queue” is critical to avoiding delays in construction and maintaining cash flow forecasts. Compressors and refrigeration units are in great demand and this Baker Hughes agreement keeps Tellurian on schedule even though the company’s financing has not been completed. Additionally, Blue Owl pre-approved Tellurian’s equity partners as “contingent guarantors” by signing its binding commitment letter, but closing expectations slipped from H2 2023 to H1 2024.

The chart below shows how Tellurian rallied from its nadir, below a dollar, and during the COVID 2020 market crash to over $6/share in the wake of the Russian invasion of Ukraine. Its share reversion back to below one dollar, despite development at the Driftwood LNG site, suggests despondent sentiment. The recent weeks’ jump in volume from about five million shares a day to 25 million shares a day suggests major turnover in shareholder ownership. The spike in volume may be the handiwork of the shorts working to cover their 85 million share short position by scaring the longs into selling. We would not be surprised if new shareholders emerge and seek to gain control of Tellurian not unlike Carl Icahn’s activist investment into Cheniere Energy Inc. in 2015, when Icahn famously ousted Souki just as Cheniere Energy was poised to begin producing LNG.

Last September, Tellurian withdrew its billion dollar offering and Tellurian announced that it intended to work with strategic equity partners whose businesses made those equity partners natural LNG off takers or natural gas feedstock providers. Partnering with strategic partners created mutually beneficial commercial relationships and not simply financial investors seeking attractive returns by investing in Driftwood. With these key strategic equity partners, Tellurian would finance the Driftwood project. Consequently, with the strategic equity partner model, subsequent SPAs cancellation were no longer essential since Tellurian planned to work with its equity partners who were natural off takers, feedstock providers, and or symbiotic business partners.

The SPA agreement is the traditional complement to the long-term tolling contract model that the Tellurian model seeks to outmode. This September, with its contingent guarantors approved and liquefaction fees rising, Souki declared that if Tellurian could get HH x 115% plus $2.75/mmBtu, they could attract infrastructure funding. On September 13th, Souki announced that the company was going to reintroduce standard SPA offtake agreements. If Driftwood can sell liquefaction for $2.75/mmBtu, Souki said the company would have a $0.50 spread to attract infrastructure and private equity funding after $2.20 in operating, pipeline and interest costs per mmBtu.

On October 6th, the LNG Journal reported that Poten and Partners, an institutional natural gas research publication, reported that off takers are now looking at paying liquefaction fees between $2.60/mmBtu and $2.80/mmBtu. “Poten shipbrokers heard that some developers are actively trying to market US LNG for about $2.60 to $2.80 liquefaction fee ‘and we see some customers buying even at that prices,’ he pointed out. This is largely because contracts linked to Henry Hub prices are still relatively cheap, compared to Brent-linked contracts.”

This credible third party report showed us the market now trading at the levels which are sufficient to attract private equity to invest in LNG facilities like Driftwood. Souki can now sell LNG to strategic equity partners and or private equity firms at levels. Additionally, a combination of tolling and equity participation can now be offered with the SPA they are now securing. This should now allow Tellurian to finance Driftwood LNG.

The Poten article also described the US LNG market this year “Three substantial FIDs already took place in the United States in 2023 so far, all of them “junky projects,” Poten’s global head of business intelligence Jason Feer said.” This confirmed Souki’s assessment of the LNG market and that Tellurian’s competition is offering “junky projects”. This Poten report gives us comfort that Tellurian is in a position to finalize Driftwood financing.

Who are these private equity partners? BlackRock and Blackstone are two prominent and likely funders of LNG projects. Warren Buffett’s Berkshire Hathaway recently invested in $3.3 billion in Cove Point at 10x ebitda. Cove Point is a fully developed LNG facility owned by Dominion, but that compares to the 1 times ebitda multiple that Tellurian is offering strategic equity partners to invest directly in its Driftwood facility.

Because the cash flows from Driftwood are not expected until 2027, a significant discount to future flows is reflected in the equity price. However, historically, when the financing prospects for Driftwood have appeared likely, Tellurian’s shares have rallied sharply and sometimes ten-fold. This potential ten-fold return potential is why Tellurian is so attractive to investors.

Co-Founder Martin Houston said this week that the company is “putting together our portfolio of buyers (off takers) as we speak.” Furthermore, if we see a cold winter, we could see the $25/mmBTU or higher in one or both the European benchmark TTF or the Asian benchmark JKM.

We are not alone in recognizing Tellurian’s significant upside potential. Wolfe Research’s Sam Margolin put out a research report with a $10/share price target.

Conclusion:

Tellurian is an exciting investment opportunity due to its attractive valuation and extraordinary upside potential, if the company successfully finances its Driftwood LNG project. Tellurian shares are conservatively valued at $0.68/share or three times expected cash flow of $100 million for 2023 plus “ten cents on the dollar” for the $1 billion Tellurian has invested to date in Driftwood LNG – the last large fully permitted LNG facility to produce LNG this decade in the United States. While not without risk, Tellurian, if it successfully finances Driftwood LNG, could see its market capitalization rapidly rise to a valuation of $4-5 billion, based on forecast future annual cash flows of $4-5 billion in the 2030s. Due to the unique asymmetric upside opportunity versus downside risk, we believe Tellurian is a generational investment opportunity.

Tellurian has attracted some of Wall Street’s smartest hedge fund investors like Paulson & Company and Shaw, D.E. & Co., Inc. as well as some of Wall Street’s largest institutional investors including Vanguard Group Inc. with 41,110,453 shares, Blackrock Inc. with 24,623,898 shares, and State Street Corporation with 24,924,075 shares. Tellurian’s management has built 79% of US LNG export capacity and has great contacts which could prove critical in pulling together Driftwood’s capital structure.

The stock market today is largely driven by quantitative models used by institutions and those models frequently rank momentum as a top algorithmic input. Furthermore, the last four decades has watched Wall Street being made readily accessible to Main Street with low-cost online trading. Legions of retail investors look to online and social media forums for investment advice and this phenomenon has manifested itself in the “meme stock craze” in 2021 where stock valuations reached irrational valuations. With the high volatility surrounding Tellurian, we believe that its 90% decline since 2022 has been compounded by institutional momentum trading and social media.

While Tellurian’s cash flow dropped sharply due to the decline in natural gas prices from 2022 to 2023, neither momentum rankings nor social media commentary are designed to capture technical funding and valuation factors. Tellurian seeks to pioneer its integrated business model and shift the industry away from it historic SPA and toll road business model. Consequently, the declining importance of SPAs to Tellurian’s financing success has been lost on the majority of investors, in our opinion. Likewise, most online commentary over the last month may have overstated a routine permit extension with FERC as a consequential delay. Herein lies the unique opportunity with Tellurian. Momentum investing works until it doesn’t.

Now that a conservative valuation case can be made for Tellurian’s shares, we believe panicked retail and momentum investors have sold their shares to sophisticated institutional shareholders educated in valuation analysis, project finance, and LNG contracts, manufacturing, and trade knowhow. This may be an excellent time for investors to consider doubling up on their investment in Tellurian, especially if they have an unrealized tax loss in the shares. Regardless of TELL’s price action before year end, those who double up can realize a capital loss after 31 days and until year end and maintain their position in the shares. If positive news ensues, those who have doubled up will be especially rewarded for their increased investment at these levels.

Human nature is a constant in the market. Ben Graham famously wrote that in the short-term the market is a voting machine but in the long-term it is a weighing machine. While social media buzzes about a permitting delay and Tellurian’s decline, Charif Souki was the keynote speaker for the International Energy Forum on Thursday in Riyadh Saudi Arabia. Natural gas prices and geopolitical risks are rising. With Poten ship brokers saying deals are getting done at the levels Souki said can bring in private equity and infrastructure investors, we believe that Tellurian’s asymmetric return profile is a generational investment return opportunity much like Cheniere Energy, Inc. has been.

July 18th, 2023: Tellurian's Driftwood Funding Prospects Tick Up.

- Tellurian’s prospects are improving with Driftwood LNG now poised to raise $12-15 billion in the coming weeks and months. If Tellurian (TELL) funds Driftwood LNG, we believe that TELL shares could rise five-fold by year end or $8/share.

- Today’s benign extension of the convertible note suggests Tellurian has identified equity funders that are acceptable to the sale leaseback buyer.

- Successful financing and construction of Driftwood LNG could create a $32 billion market capitalization company by 2030, up from today’s $810 million market capitalization.

Tellurian’s share price has been extremely volatile since 2015. TELL’s price volatility is primarily a function of the odds that Driftwood LNG facility will get funded. Driftwood’s business model is different than traditional liquefaction companies, like Cheniere Energy Inc (LNG), in that TELL seeks to be a fully integrated LNG producer. Tellurian seeks to source its own cheap US natural gas, liquefy that gas, and then sell the LNG abroad at a large premium in international LNG markets. Cheniere and typical liquefaction facilities charge a processing or tolling fee for a fraction of the margin that Tellurian seeks to capture through its vertically integrated model. Cheniere and traditional liquefaction facilities sign long term tolling contracts and then use those tolling fees to fund the LNG projects.

Below is a chart of Tellurian’s stock price over the last five years. The COVID Crash decimated demand for energy and Tellurian’s stock price in 2020. In 2021, the company began discussing announcing a bank funding group to help finance Driftwood. In 2022, the Russian invasion of Ukraine led to a spike in energy prices and natural gas with Russia threatening to shut off energy to Western Europe. This appeared to be an ideal opportunity for Tellurian to secure funding and significant European demand. Unfortunately, Europe did not have degasification facilities and was partial to a hydrogen solution over LNG. In September 2022, with interest rates rising, Tellurian pulled a $1 billion high yield deal and stated that Driftwood’s LNG production would likely be delayed. This deal cancellation crashed the stock from $4.66 to $1.54/share. In the second half of 2022, commodities and natural gas prices turned lower further weighing on Tellurian’s natural gas operating income and share price. In the first quarter of 2023, 25 million shares of stock that Charif Souki had pledged in a $100 million Aspen ranch development project, was seized and sold by Souki’s creditors. This apparent sale by Souki created terrible Optics for the company which led to the company stock to bottom at $0.94/share on March 24th. Furthermore, two board of directors and the Chief Financial Officer resigned.

Our History of Reports on Tellurian:

Due to the significant potential cash flow benefit of about $9 billion per year, compared to Tellurian’s recent $150-400,000,000/year cash flow from its natural gas production business, Tellurian’s shares swing wildly around the funding prospects for Driftwood LNG. Consequently, updating the company’s boom bust funding prospects has led to multiple updates and this, our eighth, report on Tellurian. Our first article in October 2021 highlighted the exceptional return potential of Tellurian by quantifying Cheniere’s 269% and 138% annualized rates of appreciation during Cheniere’s funding and construction phases. Our second article in August 2022 covered the company’s change to an equity first funding strategy. Our third article predicted that funding was imminent and was published a day before its debt with warrants offering. Our fourth article, October 2022, analyzed the bond offering cancellation, 50% share decline, and revised investment prospects. Our fifth article, February 2023, identified the first commercial sign that funding was still probable. Our sixth article highlighted a potential strategic equity prospect through GAIL’s “EOI” Expression Of Interest announcement. Our seventh article highlighted a $1 billion sale leaseback LOI that will provide $1 billion in equity/mezzanine capital for TELL.

Why Now?

Central to the April 4, 2023, Sale Leaseback LOI which could provide $1 billion in equity, is the requirement that the equity funding parties need to be disclosed to the buyer by July 14, 2023. The Equity funding parties are expected to invest an additional $1.8 billion in equity for the Driftwood construction. The precise language requires that the co-owners or strategic equity funders aka “contingent guarantors” will have the financial means to cover their share of the debt, rent, and other expenses to the satisfaction of the buyer. Those equity investors must be identified by July 14th and accepted by July 31, 2023 or the agreement will terminate.

“a requirement that the equity investors in Driftwood LNG or its affiliates be joint and several contingent guarantors of the Master Lease (the “Contingent Guarantors”) and (v) a requirement that the Contingent Guarantors hold an investment grade rating of BBB or higher or attain an equivalent shadow credit rating, or be otherwise acceptable to the Purchaser. The LOI contemplates that the parties will use commercially reasonable efforts to finalize the Purchase Agreement and Master Lease on or before July 14, 2023. The LOI will terminate on July 14, 2023 if Driftwood LNG fails to identify the Contingent Guarantors by such date and will terminate on July 31, 2023 if the Purchaser elects, in its sole discretion, not to approve such Contingent Guarantors. The LOI is binding on the parties but is subject to the negotiation of definitive transaction documents and the approval of those documents by the Company’s board of directors.”

Souki has stated in his June 13 YouTube video that they have counterparties for the $7 billion in bank loans, $1 billion in mezzanine funding, $1 billion in sale lease back funding, $1.5 billion Tellurian Driftwood (past and future) funding, and are seeking $1.8 billion in equity investment to fund Phase 1. With the identification of the equity funders, then it is simply a matter of bringing about the simultaneous closing of these varied parties within 90 days of the buyer’s acceptance. The snip below from the June 13 video shows the nearly $12.3 billion in funding has been identified. And the operating cash flow of Driftwood Phase 1, based on year to date prices and the Driftwood model, is $1.6 billion year-to-date through June 8th.

What is encouraging about this illustration is that the equity partner’s $1.8 billion investment — for its 55% ownership of Driftwood — should generate a cash flow of about $1.6 billion per year. Since there are two trains in Phase 1, both the equity investors and Tellurian get approximately $1.6 billion per year per train. This illustration allows us to extrapolate to when Phase 2 is complete in 2029, when Driftwood will have five trains, four will owned by Tellurian and one by its strategic investors. Consequently, in 2030, Tellurian could generate 4 x $1.6 billion or $6.4 billion in cash flow per year.

This week LNG facility investing got a powerful endorsement. Warren Buffett’s Berkshire Hathaway announced its planned purchase of Dominion Energy’s Cove Point LNG facility for $3.3 billion at 10.8 times 2025 EBITDA. Of course, Cove Point is operating today, and Driftwood Phase 1 will not start producing LNG until 2027. But Tellurian is offering its equity at one times cash flow while Berkshire is paying about ten times cash flow. Our belief is that the biggest risk for Tellurian is closing this funding, because Tellurian’s team has built 70% of US LNG capacity and Bechtel, their construction partner, is the world leader in liquefaction facility construction.

Positive Signs:

There still is a great deal of work to be done beyond identifying the funders and closing these contracts; however, Tellurian did hire an LNG investment banking ace, Simon Oxley, two months ago. Furthermore, we believe other announcements by insiders support the idea that funding is increasingly likely.

On July 17, 2023, Tellurian announced that the Hudson Bay Capital Management Group had extended a cash waiver for the third consecutive two week period. Hudson Bay Capital Management bought a $500,000,000 convertible from Tellurian in June 2022. The note pays off in three tranches of $166,000,000. Tellurian paid off the first tranche, which was due May 1, 2023, on March 31, 2023. The next tranche of the 6% $5.74/share convertible note is due May 1, 2024. This tranche is now a short term liability and Tellurian may want to restructure the remaining notes to help secure the $7 billion bank line.

This reduction of a cash balance minimum from $100 million to $60 million suggests that they are negotiating and they are probably negotiating a debt restructuring to remove the tranche which expires May 1, 2024 because it is a short term liability.

Item 1.01 Entry Into a Material Definitive Agreement. On July 14, 2023, Tellurian Inc. (the “Company”) and Wilmington Trust, National Association (the “Trustee”) entered into a fifth supplemental indenture (the “Fifth Supplemental Indenture”) to the base indenture dated as of June 3, 2022 by and between the Company and the Trustee, as trustee (the “Base Indenture”), as supplemented by the first supplemental indenture dated as of June 3, 2022 among the Company, the Trustee, and the collateral agent named therein (the “First Supplemental Indenture”), the second supplemental indenture dated as of July 18, 2022 between the Company and the Trustee (the “Second Supplemental Indenture”), the third supplemental indenture dated as of June 16, 2023 between the Company and the Trustee (the “Third Supplemental Indenture”), and the fourth supplemental indenture dated as of June 29, 2023 between the Company and the Trustee (the “Fourth Supplemental Indenture” and, together with the Base Indenture, the First Supplemental Indenture, the Second Supplemental Indenture and the Third Supplemental Indenture, the “Prior Indenture”), which collectively govern the terms of the $333,334,000 outstanding principal amount of the Company’s 6.00% senior secured convertible notes due May 1, 2025 (the “2022 Notes”) issued by the Company to an institutional investor (the “Investor”) on June 3, 2022. The Fifth Supplemental Indenture amends Section 3.14 of the Prior Indenture to reduce the Company’s minimum cash balance requirement from $100,000,000 to $60,000,000 during the period from July 18, 2023 to July 31, 2023.

Nothing was given by Tellurian in return for this waiver leading us to believe that that a negotiation is occurring to facilitate Tellurian’s Driftwood financing.

Furthermore, had the equity funders not been identified to the sale leaseback buyers wishes, I am not sure that the convertible waiver would have been extended in today’s benign form.

On July 5th, 2023, Tellurian, Director, Jonathan S. Gross bought 100,000 shares of Tellurian stock for $1.38/share.

The chart below suggests Tellurian is bottoming and should exceed previous highs if it successfully finances Driftwood LNG.

In sum, the sale leaseback LOI, the hiring of Simon Oxley, the July 14th equity partner identification date, the Hudson Bay Capital cash minimum accommodation through July 31st, 2023, Souki’s confidence in the $7 billion bank line and additional $1 billion in mezzanine finance, and the insider stock purchase by Johnathan Gross give us comfort that Tellurian is moving to funding completion in the coming weeks and months and by year end as described in their weekly updates and interviews.

Valuation:

Tellurian’s upstream business is worth about $500 million based on $200 million in revenues per year at a $2.50/mmBTU gas price. Last year, Tellurian’s upstream business was generating about $400 million in operating cash flow when gas prices rose to $10/mmBTU. Gas prices appear to have bottomed with gas rigs counts declining and LNG exports increasing. Consequently, Tellurian’s upstream business is probably worth $750 million or $1.3 per share.

Tellurian has 563 million shares outstanding and invested at least $1 billion in Driftwood. If the project looks viable, then Tellurian’s Driftwood investment should be valued at $1 billion. Combine the upstream $750 million valuation and the downstream Driftwood LNG valuation of $1 billion and then divide the shares outstanding, TELL shares are worth $3.125/share.

The cash flow illustration provides a snapshot into the operating profitability of Driftwood of $1.6 billion per train. If Tellurian trades at five times cash flow of $1.6 billion in 2027, then Tellurian’s market cap will be $8 billion. During Phase 2 the company hopes to add another train every 9 months bring a total of four trains and $6.4 billion in annual cash flow in 2029 or 2030. A conservative five times cash flow would imply a future market capitalization of $32 billion.

Natural Gas Demand: