The four decade era of declining or abnormally low interest rates is over. Both short-term and long-term interest rates are now meaningfully higher, and stock, bond, and real estate prices will no longer be significant beneficiaries of accommodative interest rates as they were in the past. Consequently, asset allocation strategies like the 60% equity 40% bond mix frequently recommended for retirement assets and retired individuals are fundamentally flawed. With two wars, a slowing economy, and still pesky inflation, we are advising our clients to employ an asset mix of 25% cash, 25% commodities, 25% bonds, and 25% stocks. This 25/25/25/25 asset allocation mix should provide better returns, better income, lower risk, and greater inflation protection than the conventional 60/40 mix which was championed from 1982 until 2020. We believe the capitalization weightings in the S&P 500 and NASDAQ 100 have led to bubbles in these indices and their constituents and now a performance reversion to the mean will deliver a decade of disappointing performance.

Asset class price adjustments will take time to work through the markets and global economy. We expect better performance in small capitalization value stocks, commodities, and out of favor geographies, like emerging markets (ex-China) and international stocks, analogous to what we observed in the two post-stock-market-bubble cycles of the 1970s and 1999-2011 period. Furthermore, we expect popular investment strategies like the Magnificent 7 and commercial real estate will lose their luster.

Gold Returns as a Market Leader:

Gold could provide the best return profile of popular investments in 2024. Gold historically has been an inflation hedge and safe store of value and now is starting to break to new highs. Gold has been relatively dormant since 2011 when the metal peaked in 2011 at $1823 per ounce after rising 624% from $255 per ounce in August of 1999. Crypto currencies, stocks, bonds, and real estate have all boomed and have made many investors fortunes in recent decades. Now the valuations of stocks, bonds, real estate, and crypto, are expensive, and gold is offering new price leadership, diversification, inflation protection, and safety, as well as a long performance runway if the market experience of the 1970s and 1999-2011 periods is prologue to the 2020s.

The chart below shows outsized gains in gold during inflationary cycles like the 1970s and the 1999-2011 period. We believe the risk adjusted returns of gold will lead quantitative strategies to increase gold allocations. This buying is in addition to central banks’ increasing acquisitions of gold. As traditional investment strategies underperform, gold should see greater accumulation as it grows into a new market leader.

In addition to gold ETFs VanEck Gold Miners ETF (GDX) and SPDR Gold Shares (GLD), we like two particular gold investments. GAMCO Global Gold, Natural Resources & Income Trust (GGN) offers a covered writing strategy with a compelling 9.57% yield. GoldMining Inc. (GLDG) is a mid-cap international miner which should provide high beta exposure to gold in the years ahead.

No Bargains in Stocks:

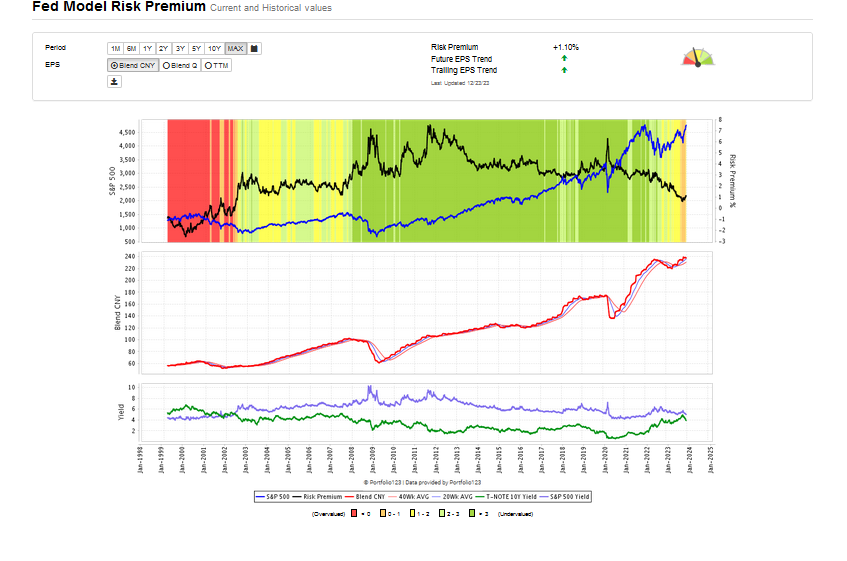

The 1.1% equity risk premium for the S&P 500 objectively shows in the chart below that investors are modestly compensated to buy stocks versus 10-year US Treasuries. The current 1.1% condition is sharply contrasted with the 6% risk premium levels reached during 2009 (the great financial crisis), 2012 (the European crisis), and 2020 (the COVID-19 crash), when the S&P 500 was quite inexpensive.

More glaringly expensive are the NASDAQ composite index and NASDAQ 100 (QQQ) index shown in the chart below which are up 43.42% and NASDAQ 100 up 53.79% for 2023. Hype surrounding the benefits of AI – artificial intelligence – and the feedback loop of capitalization weighted indexation have led to a bubble in the Magnificent 7 stocks, Apple Inc. (AAPL), Microsoft Corporation (MSFT), Alphabet Inc. (GOOGL), Amazon.com, Inc. AMZN, Nvidia Corporation (NVDA), Meta Platforms, Inc. (META) and Tesla, Inc. (TSLA) that should fizzle in the years ahead.

The 33 year chart below provides a more graphic illustration of the bubble in tech stocks like that in 2000. Parabolic moves never end well. The recent rally in bonds has helped drive large cap growth stocks to precarious levels like the right shoulder in of the major indices in August 2000.

Bonds Are No Bargain Either:

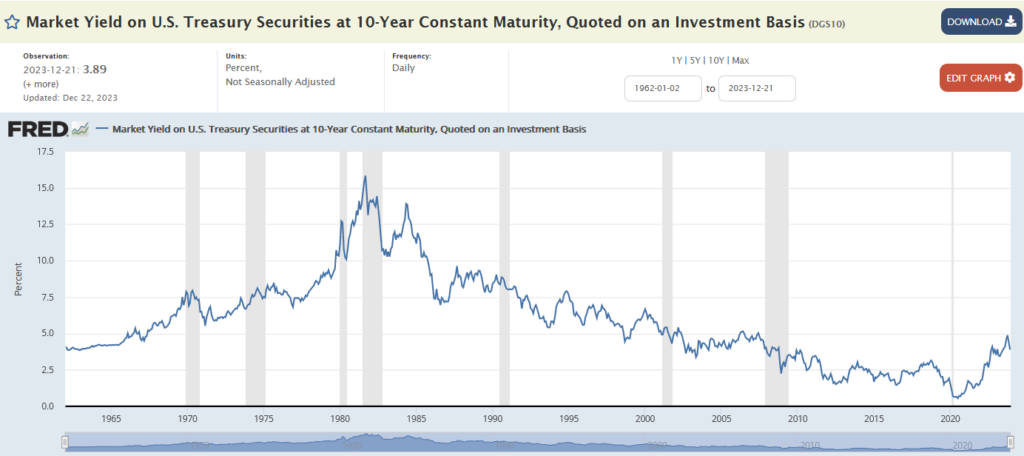

The 65 year chart below of 10-year US Treasury yields shows that rates have backed up into a more normal historic range. At 3.88%, 10-year Treasuries Notes offer modest yield for the duration risk, but for pensions, non-profits, and insurance companies, it offers a liquid safe vehicle.

The chart below shows how 10-year US Treasury yields have risen from 0.5% in August 2020 to 5% in October. However, the sharp decline in yields from 5% to 3.88% since October, drove a rally in bonds, but also the Magnificent 7, NASDAQ 100, NASDAQ Composite, and S&P 500 into yearend. At this point, both stocks and bonds are priced for perfection.

Consequently, we would be cautious about investments in both stocks and bonds. We fear that inflation has not been successfully quelled, and a rebound in inflation could occur like that experienced in the 1970s.

Real Estate:

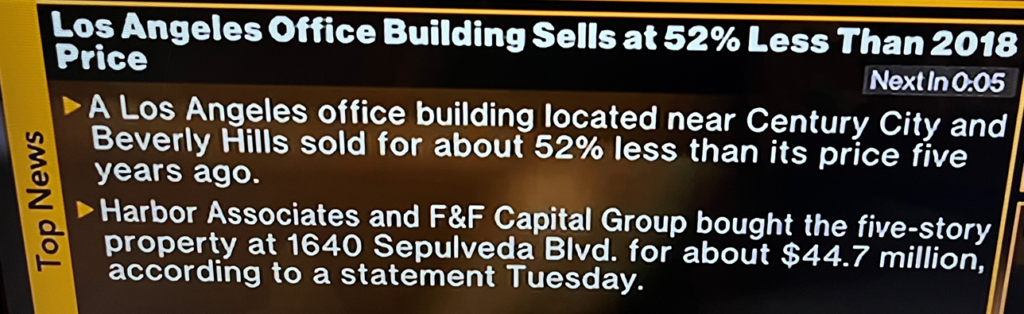

One of the great investment classes during the low and declining interest rate environment of the last 40 years has been real estate. The average American homeowner has been able to compound good returns for decades, benefiting from declining interest rates, cashing out, and refinancing again and again. Commercial real estate investors, likewise, have been able to gear their investments in commercial real estate and leverage that investment with lower and lower interest rates. But with inflation that low rate driver is gone. For “Class A” commercial properties, this sector too should not find the strong sponsorship it has in the past. Last year, difficulties at Blackstone’s B Reit, a $69 billion private commercial real estate investment fund run by private equity giant Blackstone, began limiting withdrawals. Furthermore, the COVID crisis forced many workers to work from home and created a change in employee’s desire to work at the office. With the loss of these key drivers, investment prospects for real estate are getting cloudy. Some real estate transactions are showing price declines, illustrating that investment money may not be as eager to invest as it has been during the last several decades.

The snapshot below shows a Los Angeles commercial real estate property near Beverly Hills that recently sold at a 52% price reduction to its purchase price in 2018. It is emblematic of a problem that is not limited to the US, nor real estate alone as banks may find their commercial real estate portfolio problematic as they did in the early 1980s and during the Great Financial Crisis of 2008-9.

Commodities:

Commodity prices tend to rise in post bubble inflationary periods like the 1970s and the 1999-2011 period. During both of the last two inflationary periods, both gold and oil rallied substantially. We expect gold should outperform in 2024 due to geopolitical uncertainty and slowing economy, but energy may struggle due to economic weakness. After the economy bottoms, we expect energy prices to firm with limited supply and growing demand.

Below is a chart of the CRB index which peaked in 2007, when oil was $175/bbl. The index bottomed out in 2020 when oil prices traded back to $20/barrel during the COVID-19 collapse.

We look for minerals, mining, and agriculture to recover after the US economy has bottomed out later in 2024.

Energy:

In the energy sector, broadly speaking, we are keen on natural gas investments and LNG (Liquid Natural Gas) as they are the best commercially viable means to reduce carbon emissions today while simultaneously providing affordable energy globally. Recent year’s experience has shown that the renewables only crusade is economically incapable of replacing all fossil fuels as many green enthusiast believe. A combination of energy options appears to the best solution to lowering carbon emissions and providing clean affordable energy in the years ahead.

We are cautious about the prospects for oil prices in the future because energy capital expenditures have lagged normal replacement spending for nearly a decade. The combination of systemic under investment with potential supply shocks from adverse geopolitical developments, like Russia’s invasion of Ukraine and Hamas’ attack on Israel, could lead to potential spikes in oil prices in the future.

Below are a few special situations where we see significant capital appreciation or compelling income opportunities:

Argentina’s state oil company, YPF Sociedad Anónima (YPF), is an $8 billion market capitalization oil and gas company in Argentina with the second largest shale gas reserve in the world Vaco Meurta. Vaco Meurta is comparable to Texas’ Permian Basin and with it, YPF could become a huge winner in global energy production in the years ahead. Argentina is also enjoying an economic revival under conservative President Javier Milei, an economist by training, who is committed to transforming the economy and plans to base their economy off the US dollar. YPF hopes to become a major LNG exporter and international energy competitor.

Tellurian, Inc. (TELL) is a natural gas producer and LNG liquefaction processor that seeks to replicate the success of Cheniere Energy Inc.’s success by building the Driftwood 27.5 MPTA liquefaction facility and ship cheap US natural gas abroad at a large premium. The company recently replaced their flamboyant Executive Chairman, after he failed to finance Driftwood and became ensnared in a bankruptcy where he had collateralized 25 million shares of Tellurian stock he had owned. Charif Souki’s departure may prove to be a blessing, even though he is recognized as the creator of the US LNG export industry. Tellurian’s Co-founder Martin Houston is now Chairman of the Board of Directors and Octavio Simoes remains Chief Executive Officer. Both have substantial executive experience in the international energy business.

TELL shares declined to $0.48/share down from $6/share in 2022. Since November, the stock rose over 100%, announced a new investor — Chatterjee Fund Management with over 47 million shares — and has taken steps to remove a going concern. Tellurian insider John Gross has been a buyer of Tellurian shares. Sentiment appears to be turning positive with Motley Fool turning from bearish to bullish and Simon Lack of SL Advisors retracting his negative view on the company. If progress continues, we expect to see continued rapid upside knowing that, if Tellurian can finance Driftwood, its future cash flows could be $4 billion per year up from $400 million from its upstream exploration and production business. With Blue Owl staking $1 billion in a sale lease back agreement, if Tellurian can secure the remaining financing, TELL could enjoy a rapid rise, much like when its shares rose from $2.23/share to $6.54/share from January to April in 2022.

Two MLPs make great sense as income vehicles. Energy Transfer LP (ET) is a $46 billion market cap Master Limited Partnership with a 9.06% distribution yield and solid growth profile. MPLX LP, the Master Limited Partnership of Marathon Oil Corporation, is a high quality and high yielding MLP with a distribution yield of 9.26%. With tax advantaged yields over two times the 10-year US Treasury Note yield, allocating to high yielding vehicles like select MLPs is an excellent investment and source of diversification for retirement income.

Commodities:

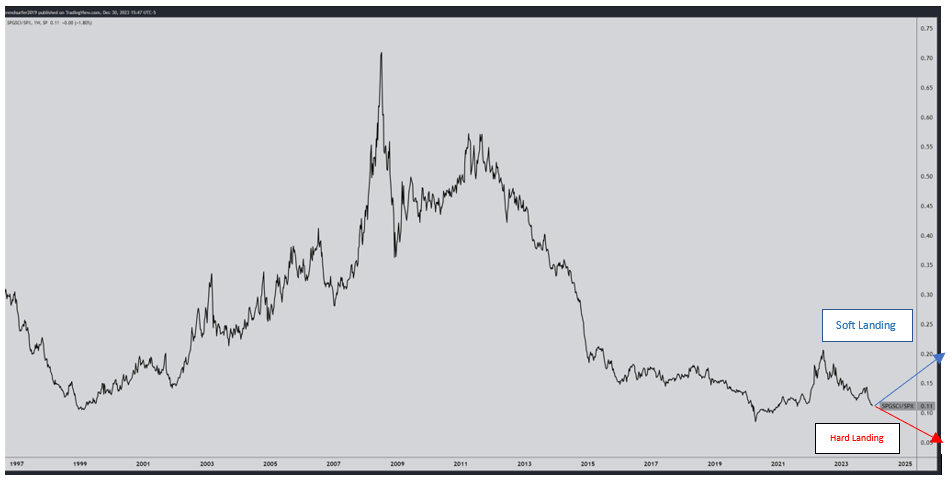

We believe there is an inverse correlation between commodities and the S&P 500. This is displayed in the chart below which shows the ratio of the Commodity Research Bureau Index “CRB” to the S&P 500. Recent weak economic data has led to weak oil prices — the leading component in the CRB index – the CRB index also dipped in recent months in the chart below. If the economy does not experience a recession in 2024, energy prices and commodity metals like copper and steel should see a recovery and the CRB should rally in 2024. However, in a soft landing, gold and other precious metals should continue to outperform in the first half of the year while hard assets bottom.

The chart below shows the CRB index consolidating following a powerful rally from 2020 to 2022.

Conclusion:

We are in a multi-year transition from an accommodative low interest rate environment where financial assets like stocks, bonds, real estate, and even crypto currencies boomed to a higher interest rate environment with new leadership. With inflation still not eliminated and asset values priced for perfection, we are advising reallocating from the interest rate sensitive 60% stock and 40% bond asset allocation to a 25% cash, 25% commodities, 25% stock, and 25% bond allocation for retirement plans and retired investors. Cash no longer “is trash” and can pay up to 5%. Commodities and precious metals could prove solid performers and they did in the past two post equity bubble periods – the 1970s and the 1999-2011 inflationary cycle.

One of the benefits of high interest rates is the return of attractive yield investments which are particularly valuable to retired individuals. High yielding MLPs like Energy Transfer LP (ET) and MPLX LP (MPLX), in addition to the GAMCO Gold and Natural Resource Income Trust (GGN), all yield over 9% and make good sense in an attractive retirement income portfolio. When 2-year US Treasuries Notes reach over 5% in yield, as they did in 2023, those too are compelling yield investments in a fraught marketplace.

Reducing exposure to the parabolic capitalization weighted indices like the S&P 500 and NASDAQ 100 (QQQs), and their constituents like the Magnificent 7, is prudent. Adding to small cap value, foreign, and emerging markets through ETFs like Cambria Shareholder Yield ETF (SYLD), Cambria Foreign Shareholder Yield ETF (FYLD), and Cambria Emerging Shareholder Yield ETF (EYLD) will rotate portfolios from overvalued beneficiaries of capitalization weighted indexing and reallocate equity to undervalued cash flow yield weighted equity ETFs.

In closing, 2024 should be a great year for investing. But success will not come from old leaders and strategies. Small cap value stocks should outperform, and we have highlighted some which can drive robust returns. Off of the 2020 low, Income Growth Advisors, LLC racked up some great performances in energy stocks like Antero Resources (AR), Antero Midstream (AM), and Kayne Anderson (KYN) which had become deeply oversold. We believe the current market could serve up some similarly attractive investments which we plan to redeploy into attractive yield investments over the course of the year.

Income Growth Advisors, LLC is emphasizing financial planning to transition portfolios to the new investment environment of the 2020s. If you have not already reviewed your investment goals and risk tolerances with us, please contact us at your convenience for a review or discussion.

Sincerely,

Tyson Halsey, CFA

Managing Member