The consequence of the re-election of Donald Trump is enormous. After the spike in inflation of over 20%, over the last four years, high hopes abound for the new administration’s initiatives to reduce inflation. With radical reform promised with the so called Department of Government Efficiency “DOGE” led by Elon Musk and Vivek Ramaswamy, markets and consumer sentiment indicate high expectations for a robust economy and low inflation. While the economy may grow and inflation may fade away, these aspirations are not assured and markets are richly priced, with little margin for error. Therefore, we recommend taking defensive moves at this moment of high expectations and high prices. Taking steps to reduce risks is particularly important for investors looking to retire, fund college educations and or leave their estates to their children and those with the risky 60% equity 40% bond asset allocations. This letter will highlight an asset allocation model that optimizes income, reduces duration risks, and reduces equity market risks.

Optimists can look to the prospect that the new administration could see a trimming of the budget by $2 trillion per year due in large part to radical reforms propelled by Elon Musk and Vivek Ramaswamy. If this happens, the current and mounting $36 trillion in US Treasury debt could be harnessed and a period of great economic dominance could evolve and lead to a more prosperous and peaceful world. However, virtuous aspirations are one thing – if efforts to curb the deficit and reduce inflation fail, the US equity and bond market could see several challenging years in the future. On the flipside, if reducing the deficit by $2 trillion a year does occur, we could see continued strength in US equity markets.

The Inflationary and Sentiment Risks:

Inflation is the pernicious economic phenomenon of rising prices which is most costly to those on fixed incomes and or those whose wages don’t keep up with inflation. Historically, the poor and middle class are often the greatest victims of inflation. The Federal Reserve mismanaged inflation commencing with their 2020 Jackson Hole’s generational policy shift away from inflation fighting based on its view that inflation would be “transitory”. We cautioned readers of this potential inflationary risk in our September 7, 2020 letter and today are again cautioning that the Fed’s and market’s hopes for a return to 2% inflation may prove overly optimistic. The Federal Reserve has targeted a return to 2% inflation, but that progress has stalled in recent months around the 3% level. The chart below shows the rise in core inflation over the last four years. While core rose to the 6% range and has pulled back to the 3% level, it has stalled, and markets have assumed that inflation rates will actually decline to 2%. If inflation does not drop, US equity and bond markets could be at risk.

The recent market surge has been called the “Trump trade” as it reflects the market’s belief that the new administration’s hopes for ending wars, revitalizing the economy, reducing government waste, and bringing the rule of law back to its citizens, will drive great economic prospects. Whether these optimistic prospects become a reality is an entirely different scenario. We believe that the market has discounted world peace, the eradication of inflation and solid economic growth. Consequently, we believe that this glowing forecast risks being overly optimistic. As they say, “easier said than done.”

Sentiment is very positive, and it is currently reflected both in recent stock market records and the recent rise in consumer confidence. Historically, sentiment is a contrarian indicator which means that when sentiment is bullish, equities are at high valuation levels because market participants have priced in all the good news and the market is susceptible to downside risk.

The VIX CBOE volatility index is 13.9 and near the low end of its range since 2020. This CBOE VIX index (^VIX) is a quantitative measure showing in the chart below that the capital market’s view of economic risks are at historically low levels, though not at its historical low of 8.87 July 2017. This volatility measure is calculated from option premiums in the marketplace, and it quantitatively expresses the collective opinion that markets do not see economic risks as high.

The chart below shows the heavy buying of the S&P 500 e Mini Futures and an overbought and or overvalued S&P 500.

“Gallup’s Economic Confidence Index in November is -17, an improvement of nine points from October. The current reading is the best since a -12 reading in August 2021” and shows great optimism for the new administration’s agenda. Unfortunately, that optimism suggests a low hurdle rate for disappointment if low inflation, world peace, and a strong economy do not prove out.

The S&P 500’s Concerningly Low Risk Premium:

The Federal Reserve Risk Premium Model is a very effective indicator that quantifies market risk. This “Fed Model” compares the yield of the 10-year US Treasury to the earnings yield of the S&P 500. When the risk premium is near zero it means the S&P 500’s earnings yield offers nearly zero incentive to investors to invest in stocks compared to investing in a 10-year US Treasury. The current 0.29 risk premium is near its lowest level in 22 years and suggests that a conservative investment posture would be prudent since it appears that all the “good news” is priced into the global markets. In March of 2020, during the COVID-19 crash, the risk premium reached 6.29% and was central to our March 2020 market call “Irrational Pessimism”. At the speculative pinnacle of the technology bubble in 2000, the risk premium reached a negative 2.58% in January 2000.

Asset Allocation to Reduce Risk:

The popular and conventional asset allocation model of 60% equities and 40% bonds is at high risk for today’s retirement minded investors. For lower equity risk, duration risk and higher inflation protection and income, we advocate a portfolio allocation of 25% cash, 25% commodity, 25% stock, and 25% bonds. We favor high yielding investments to maximize income and acquiring out of favor value investments.

We like to overweight high yielding investments to maximize income to manage risks and provide stability in an expensive market like today’s. Two areas with high yields that exceed traditional stock or bond investments are Master Limited Partnerships and closed end funds.

Master Limited Partnerships (MLPs):

MLPs provide a unique tax advantage in their distributions typically are about 90% return of capital which create effectively a tax free income stream in the 6-8% range. MLPs can trade with the price of oil, but with a new administration arguing for aggressive US energy development, these midstream pipeline companies should see increased volumes which will drive their income growth in the years ahead. We have been investing in MLPs since 2000 and have seen them trade with superior yields and returns, though they can be subject to significant moves in the energy complex like that seen during the COVID crash in 2020 when oil prices plummeted, and oil futures turned negative. At that time, we repeatedly recommended MLPs due to the historical fact that natural gas and oil demand remains steady as energy is a critical utility for necessities like cooking, heating, and driving. In 2020, we wrote four brilliant letters pounding the table on buying MLPs. They are listed and dated below:

- Coronavirus And OPEC Black Swans Create Rare 1987-Like Opportunity In MLPs March 22, 2020

- Irrational Pessimism March 31, 2020

- A Rare Opportunity For Income And Growth April 9th 2020 and

- The Coronavirus OPEC+ Double Black Swan May 4, 2020

The returns for our MLP clients and MLP investors since our letters 2020 letters detailed the “rare” and “black swan opportunities” created during the COVID-19 crash and energy collapse have been in the range of 400% cumulatively and 35% annualized.

The chart below of the Alerian MLP ETF (AMLP) further illustrates the tremendous returns MLPs have enjoyed since the spring of 2020.

MLP’s attractive rates come with the added work of K1 filings and price volatility. Seasoned MLP managers know that MLP prices are at risk of rising interest rates or declining oil prices. In 2020, Saudi Arabia ramped oil production to compete with US frackers, causing oil prices to collapse. Combined with the economic shock from COVID-19 pandemic oil and MLP prices cratered with the global market decline contagion.

The Income Appeal of MLPs:

MLPs yielding 7-8% are some of the most attractive income vehicles in the stock or bond market. This is because the MLP structure typically distributes a return of capital of about 90% and since a return of capital is not taxable, the 7-8% MLP yield is effectively a 7-8% tax free yield or a taxable equivalent 10.5-12% yield at a 33% tax rate.

The following MLPs we like, own and or recommend, though they have enjoyed a sharp rise in the last month and over last 4 years:

Energy Transfer LP (ET – 6.4%), MPLX LP (MPLX – 7.41%), Western Midstream Partners, LP (WES – 8.6%), Enterprise Products Partners, LP (EPD – 6.1%) are MLPs we favor.

For added diversification or inclusion in a retirement account Closed End Funds investing in MLPs are a good source of dividend income. Below are three MLP funds with attractive 7% yields and 8-9% discounts to their net asset value.

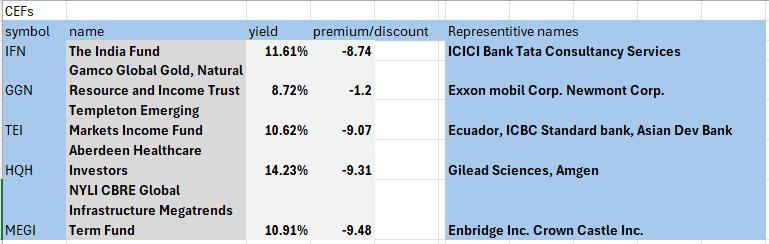

Closed End Funds (CEFs) can produce attractive yields in sectors that offer attractive values, have lower correlations to the S&P 500, and produce attractive yields:

These four CEFs: The India Fund (IFN – 11.61%), Gamco Global Gold, Natural Resources and Income Trust (GGN – 8.72%), Templeton Emerging Market Income Fund (TEI – 10.62%), Aberdeen Healthcare Investors (HQH – 14.23%) and NYLI CBRE Global Infrastructure and Megatrends Term Fund (MEGI –10.91%) offer investments with low correlations to the S&P 500 and the NASDAQ 100 (QQQ) and an average yield of 11.21%.

Interactive Brokers currently is offering a money market yielding 4.08% for accounts over $100,000.

There are attractive fixed income closed end funds yielding over 10% like:

- Neuberger Berman High Yield Strategies: NHS yielding 13.89% with a 0.89% discount to NAV

- Western Asset High Income II: HIX yielding 13.21% with a 2.65% discount to NAV

- KKR Income Opportunities Fund: KIO yielding 10.89% with a 0.37% discount to NAV

Sample $2,000,000 portfolio could be allocated 25% for money market, 25% bonds, and 50% for closed end funds and MLPs to yield

Annual Income

500,000 x 4.08% (IBKR money market) = $20,400

500,000 x 12.66% (Average yield of NHS, HIX, and KIO) = $63,300

1,000,000 in MLPs plus high yield Closed End funds

300,000 MLPs x 7.127% = $21,381

700,000 High yield CEFs x 11.21 = $78,470

Total estimated annual income $163,151 an 8.15% yield

Conclusion:

Market sentiment is bullish in America with promises of an end to inflation and wars in Ukraine and Israel. However, when sentiment is high and people’s optimism has powered markets to new heights, historically that is the time when caution should be embraced.

The Federal Reserve does not have a good record predicting inflation or interest rates, and I believe it would be wise to be skeptical believing the US will enjoy a soft landing or reduction in inflation to 2.0% or below.

The Risk Premium is 0.2% and is near its 22-year low when the market was in the post 2000 tech bubble decline.

High yields can be found in closed end equity funds that can yield 11.21%. High yields can also be found in high yield CEFs with yields around 12.66%. MLPs currently yield around 7.127%, but their favorable tax treatment offers a taxable equivalent yield close to 10.69%. Combined with a money market yielding 4%, portfolio derisking is prudent for those considering retiring, funding college tuitions, or passing wealth on to their heirs or charities. With yields this high, and equity diversification readily available far away from the S&P 500, we believe steps toward a defensive income oriented portfolio makes sense while visions of sugar-plumbs dance in our heads.

Happy Holidays!