Between October 13 and February 2, the stock market enjoyed a healthy rebound on the optimistic market outlook that the Federal Reserve’s rapid 2022 tightening would bring lower inflation, a mild recession; and then the Federal Reserve would reverse directions and ease the Fed Fund rate leading to a continuation of the bull market as it had happened in 2008 and 2019. It almost felt like “Happy days are here again.”

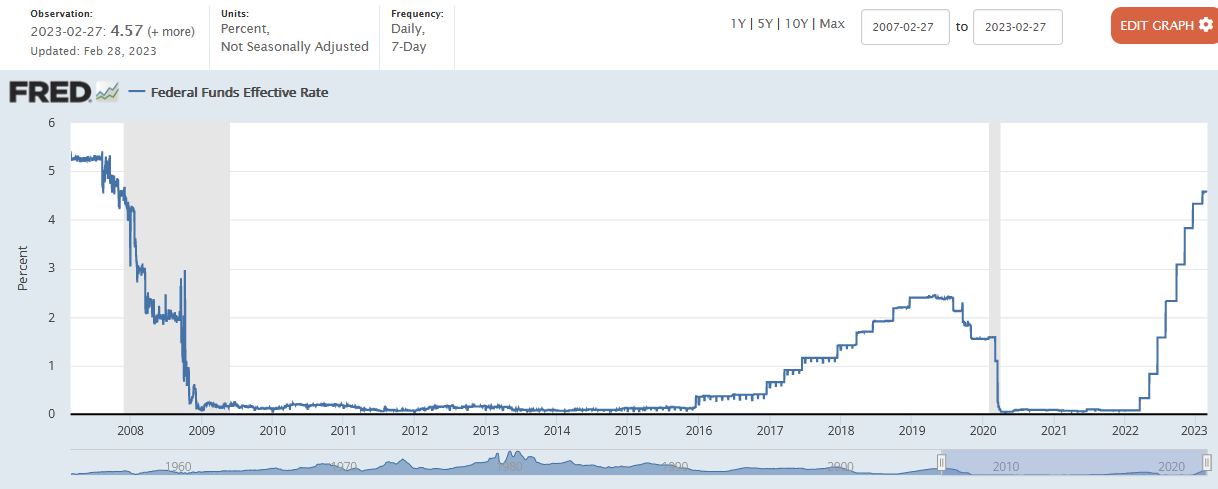

The chart below shows how Fed Funds fell following tightening cycles before 2008 and 2019. The Fed’s easy monetary policy following 2008 and 2018 led to strong equity markets. We are less optimistic.

Source: St. Louis Federal Reserve

Unfortunately, February’s strong employment numbers suggest the economy will not slow and persistent inflationary numbers go against the Federal Reserve’s dovish guidance which caused the fourth quarter’s equity market rally to end in early February.

February has been a tough month on the energy and gold markets. The XLE energy ETF declined from 89.93 to 83.69 a decline of 6.9%; furthermore, gold declined from 1929.50 to 1828.90 a decline of 5.2% as the Federal Reserve began telegraphing more tightening would be needed to tame inflation. This weakness creates attractive entry levels in energy and gold.

What is most troubling for the equity markets’ prospects is that competition from bonds makes stocks less appealing.

The Equity Risk Premium Model:

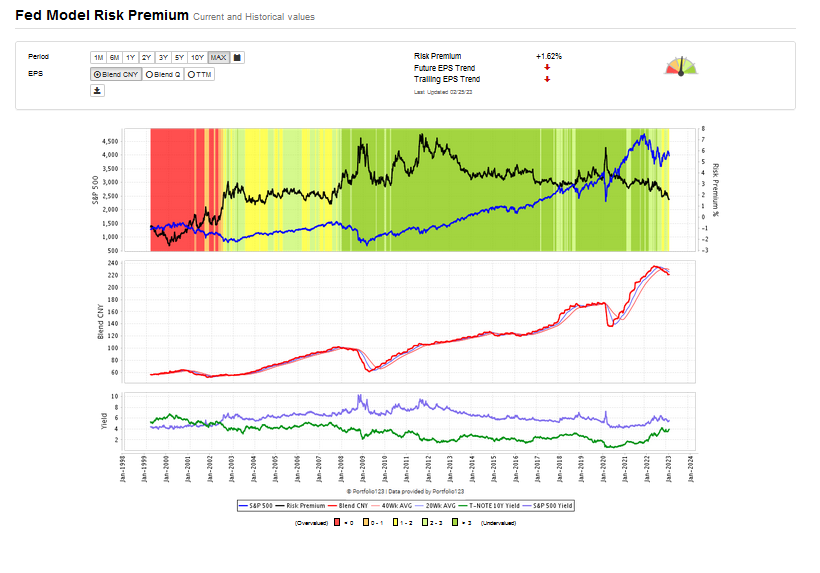

The Fed Model or Risk Premium model is very useful because it allows investors to compare how expensive stocks are relative to US Treasury yields. The model is designed to show how much the stock market will pay investors to invest in stocks versus bonds. The Risk Premium model compares the earnings yield of stocks to 10-year US Treasury yields. Post-Great Financial Crisis 10-year US Treasuries yielded around 1%. In other words, Treasuries gave investors paltry yields for their investment money. These low yields led to the phrase “TINA” for There Is No Aternative (to stocks). Today there is.

The chart below shows that the Risk Premium is only 1.62%. That means the earnings yield (the earnings of the S&P 500 divided by the price) minus the yield on the 10-year US Treasury yield 3.94% is only 1.62%. To put this in perspective, the top panel of the chart below shows the risk premium in the 5-7% range in the 2009-2011 period when the stock market was very inexpensive compared to the yield offered by Treasury bond yields. The S&P 500 rallied four-fold from the 2009-2011 period until 2022. The risk premium yield dropped to negative numbers near the 2000 Technology stock bubble before the S&P 500 dropped about 50%. The technology stock bubble, when the risk premium was negative, was a terrible time to invest in stocks.

All the market would need to repeat the conditions of the Technology stock bubble is for interest rates to continue to rise and for earnings to decline. Persistent inflation and continued economic strength could force the Federal Reserve to tighten much further e.g. Fed Funds at 6% and then the stock market could be at risk for a serious downside move.

Source: Portfolio123.com

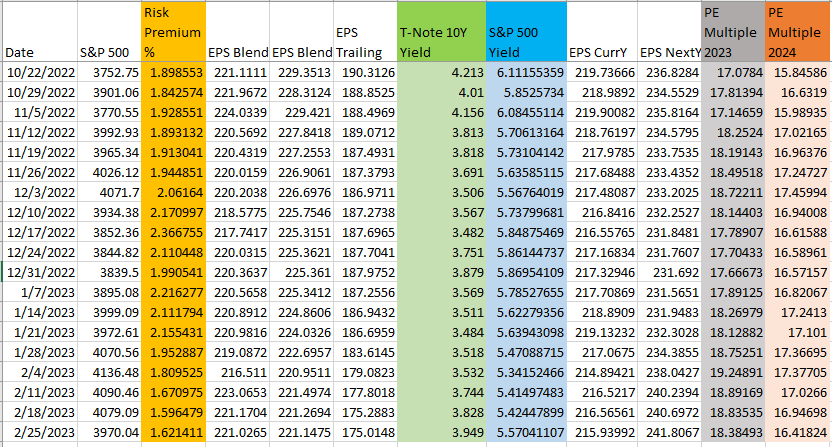

The amber colored column in the Fed Model data table below shows how the risk premium is declining. That decline is due to the yield of the 10-year US Treasury bond (3.994%) rising toward the earnings yield of 5.57% for the S&P 500. With a tight labor market, ample government regulations, the War in Ukraine and economics being an imperfect science, we cannot be sure that inflation and interest rates will quickly return to their pro-COVID levels. Stocks are not cheap at 18.38 times 2023 earnings and shown in the gray column below.

Source: Portfolio123.com

With the historically aggressive tightening the Federal Reserve implemented last year, many expected an economic slowdown which typically happens during tightening cycles. However, huge COVID related checks provided a healthy cash balance in individuals’ checking accounts and the Biden Administration’s tapping the strategic petroleum reserve to ease prices at the gas pump rendered the Fed’s tightening relatively muted when compared to historic tightening cycles. The Fed’s tightening did increase mortgage rates and the housing market has slowed sharply, but the rest of the economy has held up.

Consequently, we recommend owning high yielding investments to mitigate equity risk and lock in attractive interest rates.

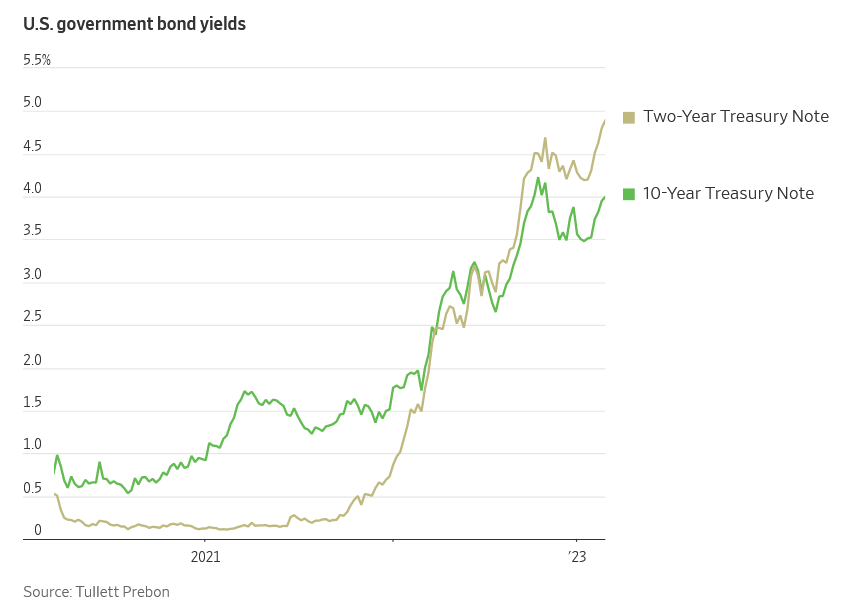

One very safe opportunity is the 2 year US Treasury which yields about 5%. We are not convinced that we want to accept the duration risk of a 10-year US Treasury note, but find the chart below reflects the rising yields of US Treasuries which are becoming increasingly competitive to stocks.

Source: The Wall Street Journal, March 1, 2023

Two closed end funds offer attractive yields which spin off nearly 10% yields. The Templeton Emerging Market Income Fund (TEI) invests in government and corporate bonds in emerging markets and yields 11.11%. The GAMCO Gold, Natural Resources, and Income Trust (GGN) yields 10% with a covered writing strategy on a portfolio of gold and natural resource stocks. TEI and GGN combined with 2-year US Treasuries and corporate bonds could provide an attractive income portfolio for the first time in nearly 20 years.

Master Limited Partnerships (MLPs) is another area where an attractive high yielding tax advantaged total return portfolio can be created. Magellan Midstream (MMP) yields 7.88%. Enterprise Products Partners LP (EPD) yields 7.68%. MPLX LP (MPLX) yields 8.89% and is the MLP to Marathon Petroleum. Energy Transfer Partners LP (ET) yields 9.56%.

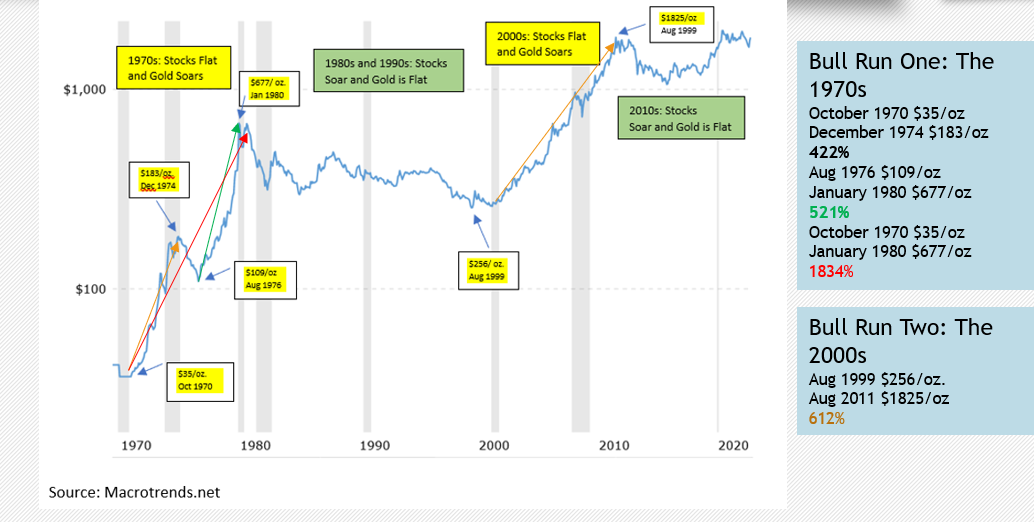

For substantial share appreciation over the next decade, we are keen on gold shares and Tellurian Inc. shares. We believe the 2020s will look like the 1970s and the 1999-2007 period when gold and energy outperformed equities by a significant margin. Gold stocks are correlated to the price of gold, but they offer greater price appreciation potential than the metal itself.

The price of gold from 1970 to the present shows, in the chart below, how when the metal is trending positively, gold stocks can produce significant return. In the 1970s it appreciated 1834% from trough to peak. In the 2000s move, trough to peak, gold appreciated 612%.

Gold historically is a store of value and we believe that current central bank purchases of gold will continue because gold is a good asset for central banks to own in an inflationary environment especially when currencies appear increasingly unstable.

Lastly, we see a potentially high return opportunity in Tellurian Inc. (TELL) a vertically integrated LNG liquefaction facility. Tellurian is building a LNG manufacturing facility called Driftwood in Louisiana. They are trying to raise about 13 billion dollars to complete building the facility. If they succeed in financing and building Driftwood, the company could generate $6 billion in cash flow in 2028. With a market capitalization of $840 million, it is possible that Tellurian’s market cap could grow to 40 to 60 billion dollars.

The appeal of shipping low cost US natural gas through LNG liquefaction that it provides countries with energy security and an ability to reduce pollution and carbon emissions by replacing coal fired electric plants with gas fired electric plants. Both China and India are large users of coal fired electric plants that would significantly reduce green house gases by the conversion of their coal plants to clean burning natural gas, a resource that the United States has in abundant supply.

Sincerely,

Tyson Halsey