The collapse of Silicon Valley Bank (SVB) has quickly uncovered a systemic banking vulnerability that will diminish the return prospects of both the stock and the bond markets. The collapse of SVB started on Wednesday, March 8th, when the company announced, it was looking to raise more than $2 billion in additional capital after suffering a $1.8 billion loss on asset sales from its bond portfolio. This was an avoidable failure and textbook case of regulatory and bank management incompetence. Silicon Valley Bank had grown its deposit base quite rapidly to $190 billion with an unusual concentration of large institutional “venture capital” depositors like stable coin issuer Circle and Roku, Inc. When panic hit and social media accelerated this process on Thursday March 9th, customers tried to transfer $42 billion in deposits out of the bank. Customer requests for an additional $100 billion in withdrawals the next day led to regulators closing the bank. Over the last decade, the speed of withdrawals in combination with the ubiquity of social media to spread panic created a vulnerability of a bank run or panic that could unfold in a matter of days. Ideally, this failure should have been anticipated by regulatory stress tests and clear eyed bankers, but the indefensible and unforgivable management failure was Silicon Valley Bank’s non-existent duration risk management. As matter of the fact, the bank was a key lobbyist in repealing the laws that would subject it to more stringent stress tests.

In the age of online brokerage and real-time margin risk management, how both the regulators and bank manager were so unprepared is a case of textbook ineptitude. This risk was in plain sight for years. For example, this unknown South Carolina investment advisor has been warning of the potential duration and market risk since the Federal Reserve’s policy changed at Jackson Hole in August 2020:

“On August 27th, Federal Reserve Chairman Jerome Powell presented the Fed’s new policy that ‘will likely aim to achieve inflation moderately above 2 percent for some time.’ This marks a profound shift in a four-decade policy – the inflation fighting posture championed by Federal Reserve Chairman Paul Volker now takes a backseat to fuller employment. The critical consequence of this policy change is that future returns on stocks and bonds will no longer be bolstered by declining interest rates. The investment management dogma of the 60/40 stock bond allocation model is being undermined by this Fed’s new policy…. If inflationary tolerance broadly permeates central bank policy, a failure to reallocate could have profound investment consequences. All investment pools, especially long term vehicles such as pensions, retirement accounts, endowments, and taxable investments could be impacted.”(Emphasis added.)

The SIVB panic has been averted with promises that all depositors will be protected even though that has not been written into law. The regulators’ actions will create a greater moral hazard by rewarding bank management incompetence with a bailout paid for by the public. Furthermore, the Federal Reserve must surrender its inflation fighting policies to assure that a banking crisis does not ensue. Inflation hurts the poor and elderly the most, and that inflation will undermine business profitability and the bond market. This banking crisis at a minimum increases market uncertainty which will hurt the economy, stocks, and bonds, but it will help investment alternatives and safe havens like gold.

The previously highlighted writer’s warning was not limited to September 2020, we wrote repeatedly of the market risks due to the normalization of interest rates following a decade of artificially and historically low interest rates: October 2021, “We are in an historic asset bubble benefiting from 40 years of declining interest rates.” February 2022, “Most importantly, a restrictive monetary policy and high inflation environment requires that investors reduce duration risk.” May 2022, “Record soaring inflation is destroying bond markets.” The risks were in plain sight and still are.

The Inflationary Investment Cycle:

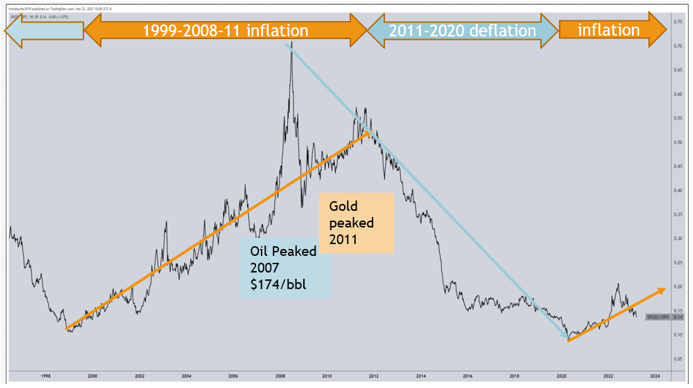

Income Growth Advisors, LLC continues to argue that a pragmatic inflation oriented investing strategy will outperform a conventional S&P 500 and large capitalization growth strategy in the years ahead. There are two good historical precedents to guide investors through today’s challenging economic and market environment. These periods, the 1970s and from 1999 to 2011, are historical analogues to today. Both periods followed major speculative stock market peaks, experienced significant bull markets in both gold and oil, and the returns for equities and bonds were poor. Both periods coincided with global warfare and domestic strife. While history does not repeat itself, we see many valuable lessons that investors, who are susceptible recency bias, would be well advised to consider.

Today’s overpriced stock and bond markets will lead to underperformance in the widely adopted 60% equity 40% bond asset allocation strategy in the years ahead. By contrast, we believe investing in new investment leaderships such as value stocks, emerging markets, commodities, precious metals, energy, money markets, two-year US Treasury bills and small capitalization stocks will lead to attractive risk adjusted returns.

Market Overvaluation and Risk:

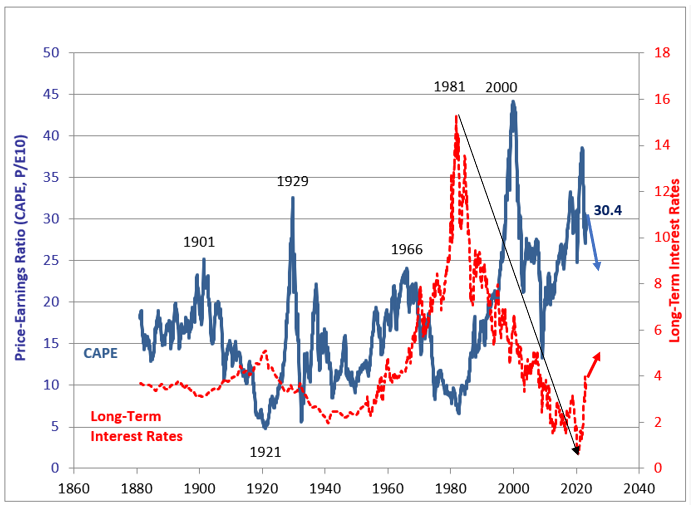

The Shiller CAPE Ratio chart below shows the sudden rise in 10-year US Treasury yields since 2020. Because of the SVB banking crisis, the Federal Reserve will not be able continue raising rates to reduce inflation. Sadly, a recession will wreak havoc on earnings and hurt the stock market which is already priced well above historical levels with a CAPE 10-year PE of 30.4. The historical perspective of the chart below, shows both stocks and bonds are overvalued. This banking crisis will hurt return prospects for both stocks and bonds in the years ahead.

History of Inflationary Cycles:

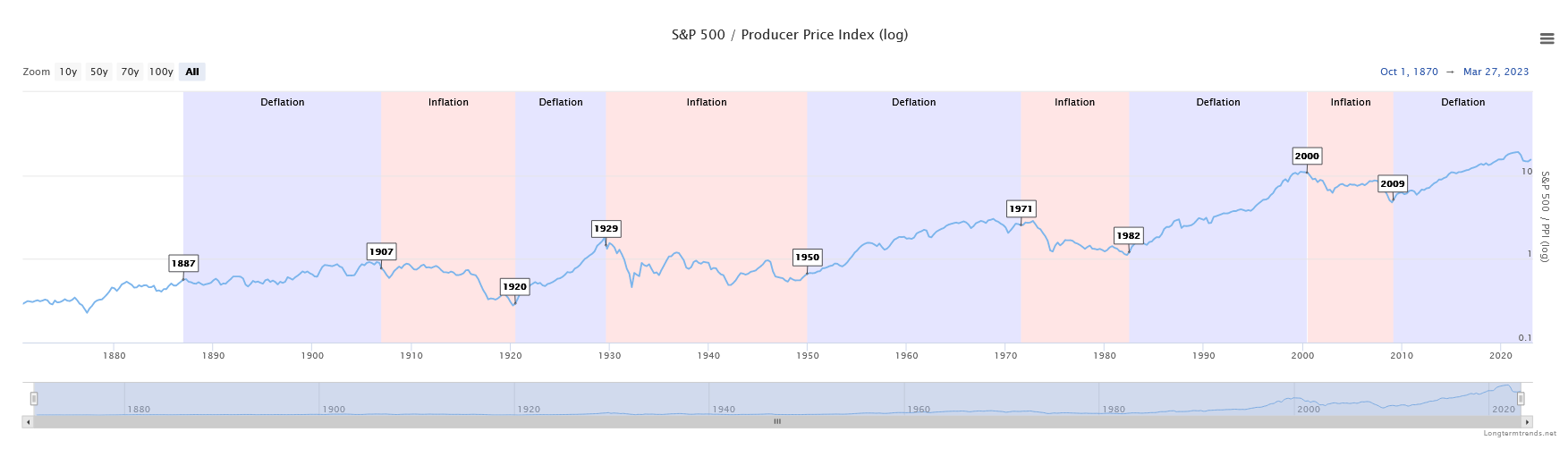

The chart below shows the 1971-1982 and the 2000-2009 period as inflationary cycles. We believe that we are in a new inflationary period that commenced with the bottom in crude oil in March 2020. We recommend buying companies which can push through price inflation like commodity producing companies.

The Case for Commodities:

We are in a commodity cycle, and this is reflected in the chart below which shows the ratio of the CRB index divided by the S&P 500 index. Jeffrey Gundlach observed that this chart shows that during a commodity cycle, outperformance can be on the order of 700-900%. That degree of outperformance profoundly challenges static asset allocation models like the 60% equities 40% bond strategy which became the keystone of financial planning and portfolio construction in recent decades.

Furthermore, “Goldman Sachs expects a commodities super cycle driven by China and the capital flight from energy markets and investment this month after concerns triggered by the banking sector, the U.S. bank’s head of commodities said.

‘As losses mounted, it spilled into commodities,’ Jeff Currie, global head of commodities for Goldman Sachs, told the Financial Times Commodities Global Summit on Tuesday, March 21” reported Reuters. Rising commodity prices is inflationary.

The Case for Gold:

Financial modelling teaches us to identify investments’ prospective returns and their cross correlations to build a sound risk adjusted portfolio. Since interest rates peaked in 1982, a persistent trend of declining interest rates created a beautiful marriage of stocks and bonds culminating in the broad use of the 60% equity 40% bond asset allocation strategy. Today, the prospects for both stocks and bonds are limited by the backdrop of higher inflation, flawed monetary policy, and economic uncertainty.

Consider the investment prospects for equities and bonds versus the prospects for gold. According to Crescat Capital gold:

- Companies generating near-historic levels of cash flow

- Miners buying back stocks near-record levels at historically cheap valuations

- Highest dividend yields in history

- Major balance sheet improvements after a long deleveraging period

- Highest cash levels in decades

- CAPEX cycle at depressed levels after a long downtrend signaling a market bottom

- An early-stage M&A cycle developing

- Lowest P/E ratio for the metals and mining industry since 2008

- Gold supply is likely to remain suppressed as we enter a secular declining trend for production

- Lack of new high-grade precious metals discoveries

- No new gold or silver projects are expected to become large producing assets for years

- The mining industry as a percentage weight in the S&P 500 Index near all-time lows

- Overly bearish sentiment for precious metals while the crypto industry implodes

- Gold-to-silver ratio starting to decline from extreme historic levels

- The growth-to-value transition likely to favor highly profitable, low valuation, and counter-cyclical growth businesses such as gold and silver miners

- Over 70% of the US Treasury curve inverted, giving a strong signal to buy gold and sell S&P 500 indexing strategies

- Rising labor costs, natural resource shortages, reckless deficit spending, de-globalization, and ultimately further debt monetization will likely fuel an inflationary decade that favors investments in tangible assets

- Investors increasingly considering gold as the quintessential offensive asset to counterbalance their falling traditional 60/40 stock and bond portfolio

- Most portfolios remain severely under allocated toward metals, especially gold

- Central banks being forced to buy gold to improve the quality of their international reserves

- Precious metals’ prices relative to money supply is near all-time lows.

Gold’s Technical Prospects:

From a technical perspective gold is poised to break out of a 12 year consolidation and above $2000/ounce.

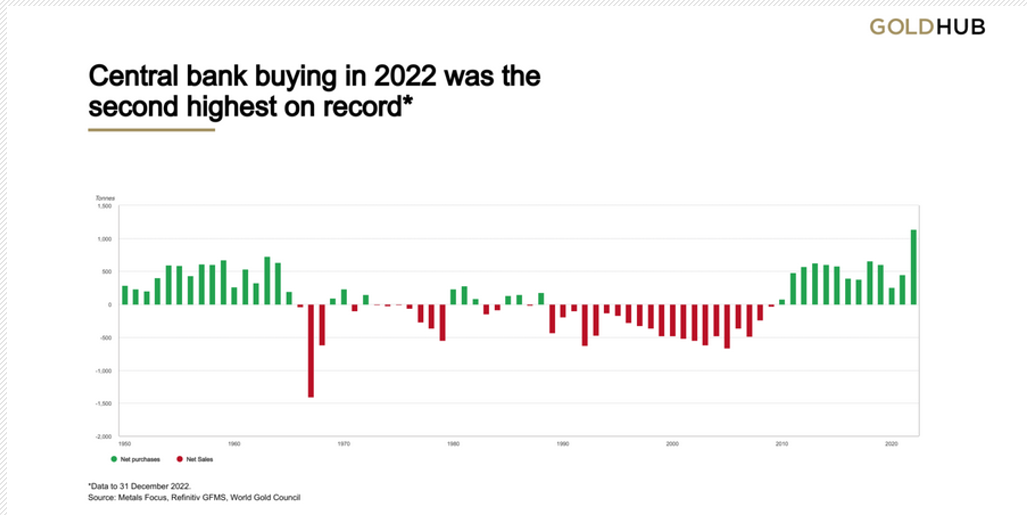

Central Bank Purchases:

For thousands of years, gold has been recognized as both a store of wealth and a currency. Unlike other commodities, which can also store wealth, gold can be held on the balance sheets of central banks, along with other currencies, as part of their reserve holdings. Gold is now being purchased by central banks and we believe that central banks will accelerate their purchases in the future, particularly as increasingly hostile nations like Russia and China seek to dethrone the US dollar. The emergence of central banks’ gold purchases should turn the supply demand balance into a sustained bull market, especially given the dearth of new gold production.

The chart below shows the accelerating purchases of gold by central banks globally.

Source: https://www.mining.com/2022-was-record-year-for-central-bank-gold-buying-wgc-confirms/

According to Rudi Fronk, CEO of Seabridge Gold, Inc. (SA), the World Gold Council just released that “global central banks purchased more gold than they have in 55 years. They bought 800 tons of gold – 400 tons in q3 and 417 tons in q4 of 2022”. Fronk also commented that gold equities prices relative to the gold price are at their cheapest that he has seen in his career.

Shrinking Gold Production:

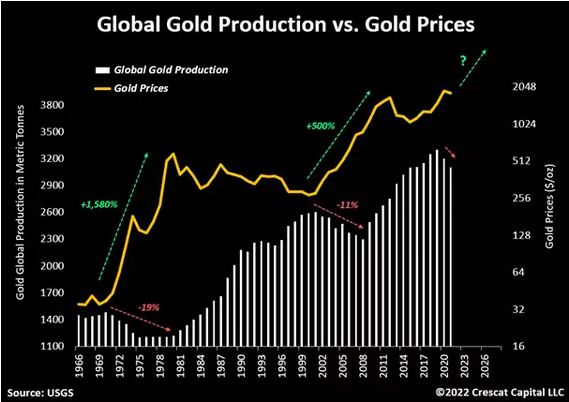

The chart below shows that gold production has been in decline for the last few years. The chart also shows that gold has enjoyed major moves concurrent with declining production, e.g. 1970s up 1580% and 1999-2011 up 500%.

The combination of central bank purchases plus shrinking gold production is a compelling economic argument that gold prices will rise. Combine these supply and demand factors with declining confidence in bitcoin and other crypto currencies and a banking system being bailed out for the third time since the 1980s, we should see new and larger buyers of gold in the years ahead.

Increasing price momentum in gold and flagging returns in stocks and bonds will inspire asset allocators and momentum investors to create further buying. This prospective feedback loop for gold could last a decade. How far gold could rally remains an open question; however, Gundlach’s commodity versus S&P 500 delta of 700-900% is a plausible scenario. Furthermore, the return history of gold during the last two gold bull markets of 1580% and 500% is a second striking precedent if your investment time horizon is long term.

Global Uncertainty and War:

The prospect of World War Three grows by the day. The Russian invasion of Ukraine has united Europe and the world against Russia. The United States has become an active supporter of Ukraine and recent engagements of Russian and the US forces have made direct conflict a reality. News of the downing of a US drone by Russia and the killing of a US soldier in Syria by Iran, a Russian proxy, Russia’s holding of a Wall Street Journal reporter, and Russia’s withdrawal from a nuclear treaty with the US, all suggest that the world is a dangerous place and military conflict is no longer a remote thought.

China’s overt territorial aggression toward Taiwan is another real risk which will worry investors and inspire investing in gold as a safe haven. The world appears to be dividing between China, Russia, Iran, and North Korea against the United States, Ukraine, and Europe. This new normal may be another cold war and not a hot war, but it resembles both the 1970s and the 1999 – 2011 historic analogues which favored gold and commodities over the S&P 500.

Two Gold Investment Recommendations:

There are good reasons to go to your local gold coin shop and buy gold coins or gold bars. However, for ease of use and rapid portfolio integration we recommend two gold ETFs.

- The SPDR Gold Trust (GLD) is the largest gold ETF. This ETF invests directly in gold, consequently, GLD will closely track the price of gold. GLD has had $489 million in inflows this year.

- VanEck Gold Miners ETF (GDX) is a gold miners ETF. This ETF invests in the global gold-mining companies and other precious metals miners in addition to gold miners. This ETF offers higher beta as miners have operating leverage and can grow their earnings in a gold bull market faster than the price appreciation of the gold as GLD is.

The five year chart below compares the GLD and GDX ETFs. GDX, in yellow, is the gold miners ETF and shows a higher beta than GLD — which mirrors the price behavior of the gold physical market.

We would buy both today but recommend GLD over the GDX for less sophisticated investors. Depending on one’s investment objectives and risk tolerances, adding a few percent over a period of months or years could be a thoughtful and pragmatic step toward transitioning away from interest rate sensitive strategies like the 60% stock 40% bond allocation and ownership of the S&P 500 – SPDR S&P 500 ETF (SPY) and NASDAQ 100 large cap growth ETF – Invesco QQQ Trust (QQQ), which have become widely popular since the Great Financial Crisis.

Although we are investment generalists, we have recommended on gold and precious metals successfully in the past applying this relative value methodology. In September of 2019, we recommended precious metals in our monthly letter Gold and Silver Return as Investment Leaders. We exited the position in August 2020 with “Sell gold and precious metals like GLD, GDX and SLV” in our COVID-19 Vaccine Prospects and Curve Flattening Compel Cyclical Rotation letter. In the eleven months between the two letters, GLD – the SPDR Gold Trust – rose 35%, GDX – the Van Eck Gold Miners ETF – rose 55%, and SLV – the iShares Silver Trust – rose 55%. (Period from Sept 9th, 2019, to August 7th, 2020.)

Conclusion:

We have entered an inflationary market cycle where interest rate sensitive investment leadership will no longer benefit from persistently lower interest rates and low inflation. Investors should transition from the 60% equity and 40% bond allocation strategy which dominated investing in recent decades and consider shorter duration investment strategies. A 25% equity, 25% commodities, 25% money market and short term debt, and 25% bond allocation strategy should provide a better portfolio return given the less promising and predictable market outlook for the 2020s. We believe there is potential for significant outperformance by investing in commodities based on the historical analogues of the 1970s and the 1999 to 2011 period. Recent investment leaders like the S&P 500, the NASDAQ 100 large cap growth ETF, and longer duration fixed income investment will be challenged by higher interest rates and inflation.

Conversely, the economic cycle is turning favorable for commodities. Oil capital expenditures and infrastructure development has been in decline since 2015. Limited new capital investment and government environmental restrictions continue to keep oil supply constrained resulting in higher costs for the average American. Furthermore, ESG funding through government targeted Green New Deal spending will drive mining for minerals critical to producing a low carbon infrastructure. Energy, mining, gold, precious metals, and commodities are likely this inflationary cycles’ new leadership.

Gold, silver, and precious metals should see significant appreciation in the years ahead. Investing into precious metals investments whether directly into the metal or through miners or related investments should see solid growth this decade. Today’s grim geopolitical environment and fragile global banking system will be new challenges in the 2020s contributing to economic malaise and uncertainty. We are in the midst of an investment paradigm shift where results can be realized by shedding the psychological shackles of recency bias and looking to the new market opportunities unfolding before us.