US markets are digesting the unwinding of three massive bubbles in stocks, bonds, and real estate. These asset classes have enjoyed consistently high returns due to four decades of declining interest rates, shrinking inflation, a technology revolution, and relative world peace. Today, those tailwinds are disappearing. Artificially low interest rates are being unwound and will reduce growth and profitability. Transitory inflation has been disproven and hurt the Fed’s reputation. The technology revolution is maturing and will lead to decellerating productivity. World peace is ebbing with nuclear proliferation and imperialistic risks rising out of China and Russia.

The mass psychology of today’s stock market is largely speculative. Benjamin Graham defined a speculation as any investment that does not promise a return of principal. Today, stocks, mutual funds, and cryptocurrencies “digital gold”, are all examples of speculations. Consequently, American households own a large portion of their retirement assets in investments which are more speculative than they realize. Furthermore, the trading volumes today reflect a speculative mindset profoundly different than the investment mindset advocated by Buffett and Graham: That is buying a piece of a business and holding it forever. For this reason, the duration of this consolidation cycle could easily last a decade until asset valuations become inexpensive and investor mindsets become more conservative.

Inflationary Commodity Market Cycles:

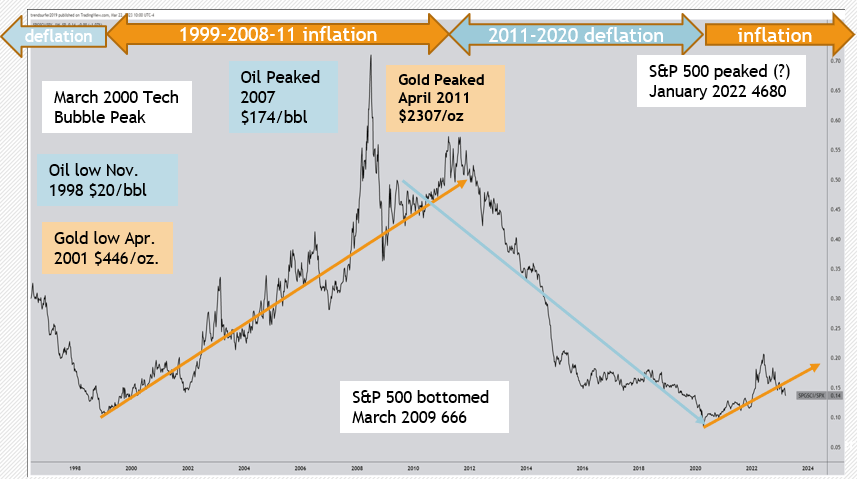

Our market cycle research points to the 1970s and the 1999-2011 period as economic and market analogues to today’s inflationary commodity cycle. The end of low inflation and historic monetary accommodation, and supply chain problems have created today’s inflationary commodity cycle where commodity businesses and short duration assets should outperform.

The cyclical pattern we have identified is shown in the chart below of the ratio of the Commodity Research Bureau Index versus S&P 500 Index. The chart captures the 1999-2011 inflationary commodity cycle when gold rose five-fold and oil rallied eight-fold. Furthermore, during the same period, the S&P 500 experienced two 50% declines, first following the 2000 Technology Bubble and then during the 2008-2009 Great Financial Crisis. In the subsequent deflationary period, following the Great Financial Crisis, the chart shows the S&P rallied seven-fold. With oil’s bottom below $20/bbl in early 2020, this current commodity cycle commenced when the CRBI/S&P 500 ratio turned up. Consequently, we expect the S&P 500 to potentially underperform commodities and that commodity related outperformance could be on the order of 700-900% over this decade.

Commodity and Equity Prospects:

We share Goldman analysts’ market expectation that commodities could rally 30% by year end. “The absence of a recession would likely lead to higher oil and commodity prices as well as higher rates, to which equities would likely react poorly.” Furthermore, “bulls, like ourselves, find comfort in the fact that end-use demand across the commodity complex has not shown recessionary signs and investment in supply remains elusive,” Goldman analysts including Jeffrey Currie wrote in May.

Today, energy and commodity sectors are extraordinarily cheap. “Indeed, the energy sector is the cheapest of all 11 U.S. market sectors, with a current PE ratio of 5.7. In comparison, the next cheapest sector is basic materials with a PE valuation of 11.3 while financials is third cheapest at a PE value of 12.4. For some perspective, the S&P 500 average PE ratio currently sits at 22.2. So, we can see that oil and gas stocks remain dirt cheap even after last year’s massive runup, thanks in large part to years of underperformance.”

Energy Outperforming Growth:

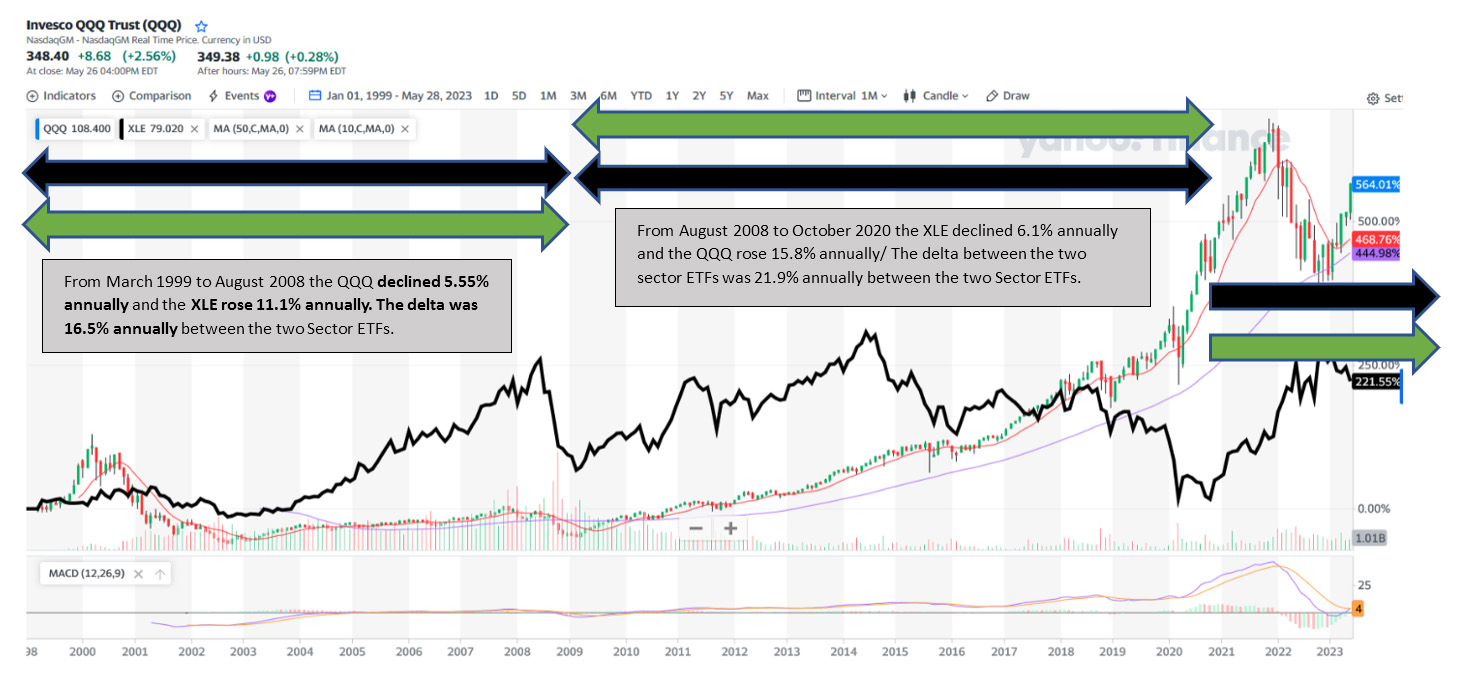

To illustrate the return impact of an inflationary commodity cycle we chose the Energy Select Sector SPDR Fund (XLE) ETF as a benchmark. Furthermore, to illustrate the impact of deflation and declining interest rates we chose the Invesco QQQ Trust (QQQ) which is based on the NASDAQ 100 index of large capitalization stocks to reflect deflation. We then compared performance differentials of both ETFs during the inflationary period of March 1999 to August 2008 and the deflationary Aug 2008 to October 2020 period. The outperformance during the two periods was noteworthy. The XLE outperformed the QQQ by 16.4% annually in the first period and the QQQ outperformed the XLE by 21.9% annually during the later period. This outperformance makes a compelling argument for sector rebalancing during inflationary and commodity cycles.

With the Russian invasion of Ukraine, energy surged dramatically in 2022 and the XLE outperformed the QQQ by 471% from October 2020 to May 2022. However, over the last 12 months the QQQ recovered, spurred most recently by the AI inspired tech rally, and energy and commodity prices pulled back sharply. Our technical, sector, and fundamental research points to a rally in commodities and believe the QQQs are vulnerable following its recent parabolic runup.

The Surprisingly Strong US Consumer:

The US economy has powered through the Federal Reserve’s 10 rate hikes without sliding into a recession due in large part to the strength of the US consumer. In fact, this past week’s purchasing managers index report was the highest in 13 months and shows the US consumers’ unwavering demand for travel, dining out, and other leisure activities is persisting despite recessionary expectations.

With odds of avoiding a recession rising, investing in deep value commodity opportunities offer potentially meaningful outperformance in the years ahead, while long duration assets like growth stocks, bonds, and real estate suffer from underperformance.

Natural Gas Opportunities:

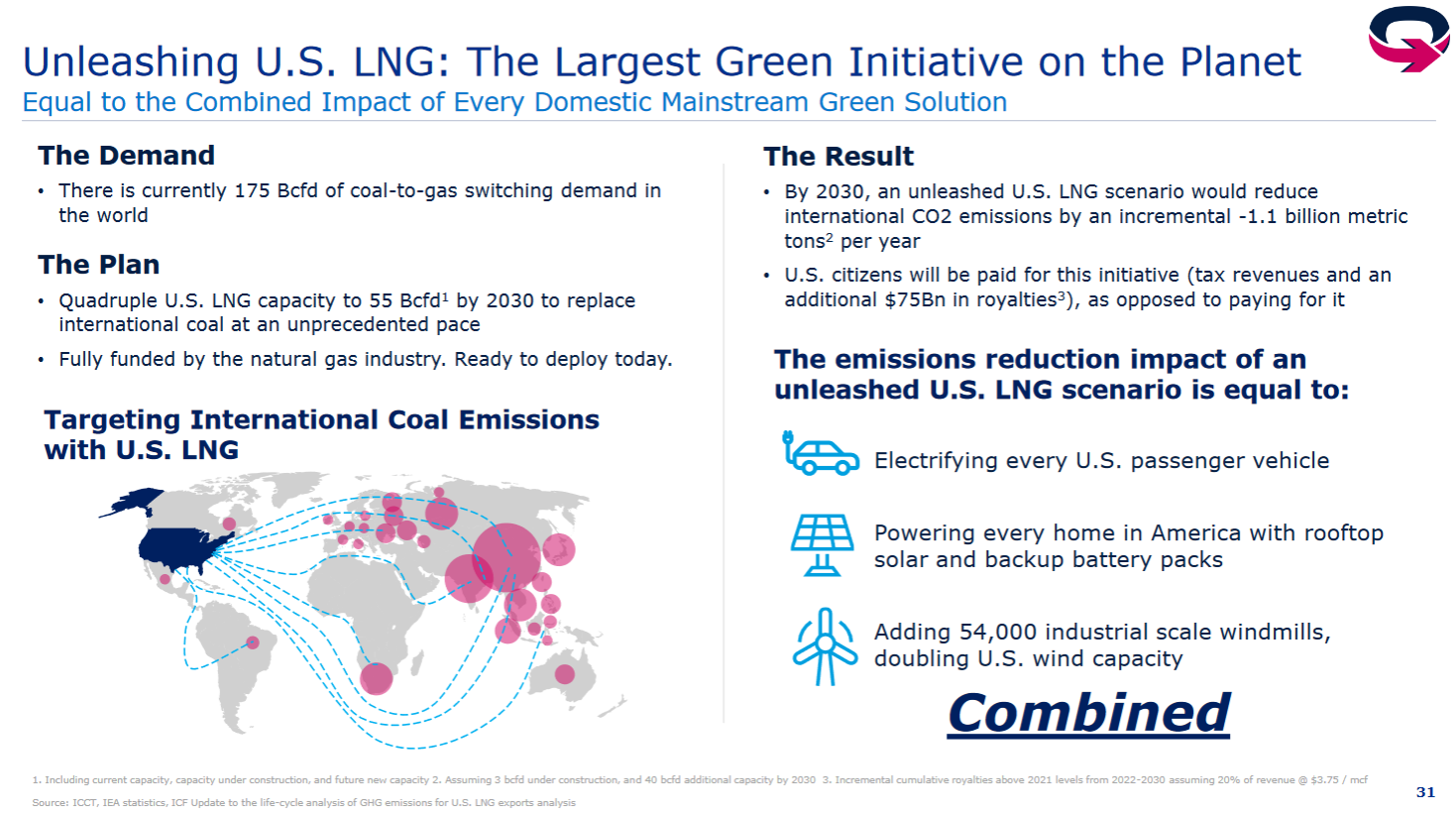

We have been keen on natural gas as a transition fuel because natural gas is the cleanest of the fossil fuels. Recent years’ push for renewables have dissappointed expectations. Natural gas offers high calorific values and a carbon footprint substantially below coal. Since UN Sustainability Goals #1 and #2 are ending poverty and ending hunger, the wholesale elimination of fossil fuels is proving counterproductive in ending poverty and hunger. Today compelling arguments are being made by EQT Corporation and others that the simple replacement of international coal fired electric plants with natural gas fired powerplants would dramatically accelerate decarbonization efforts to stop global warming.

The Most Powerful Weapon Against Climate Change?

EQT Corporation asserts: “Stopping CO2 emissions is a monumental global problem. Right now, we’re moving too slowly and missing the big picture. Unleashing U.S. LNG and replacing international coal with American natural gas is the largest green initiative on the planet and the world’s best weapon to address climate change.

“Replacing foreign coal with U.S. natural gas should be our #1 focus for reducing global emissions.”

Source: EQT March 2023 Investor Presentation. https://www.eqt.com/wp-content/uploads/2022/03/LNG_Final.pdf

With Russia’s use of energy as a weapon of war, natural gas and LNG offer energy security to countries around the world and the United States is emerging as a world leader in natural gas production.

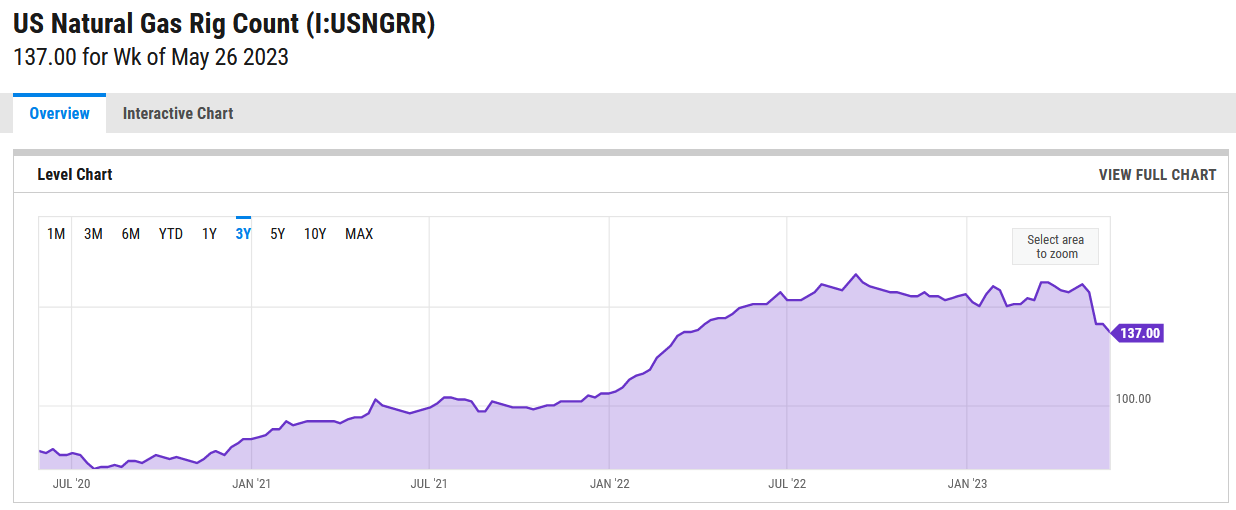

Beyond the environmental argument for natural gas and LNG investment, the supply demand economics of natural gas are also compelling. The chart below shows that since April, natural gas supply is shrinking with US natural gas rigs declining from 161 to 137, since low natural gas prices have disincentivized new production.

Source: YCharts.com

The chart below shows the huge run-up in natural gas prices from $2 in 2020 to $10/mmBTU 2022, when it peaked following the Russian invasion of Ukraine. Since May 2022, the price of natural gas has collapsed back to the $2/mmBTU range.

Source: Macrotrends.net

With the increasing number of US liquefaction facilities converting cheap US natural gas into LNG, the demand for natural gas should increase in the years ahead. This was detailed in a YouTube video by Charif Souki the Executive Chair of Tellurian on May 16th.

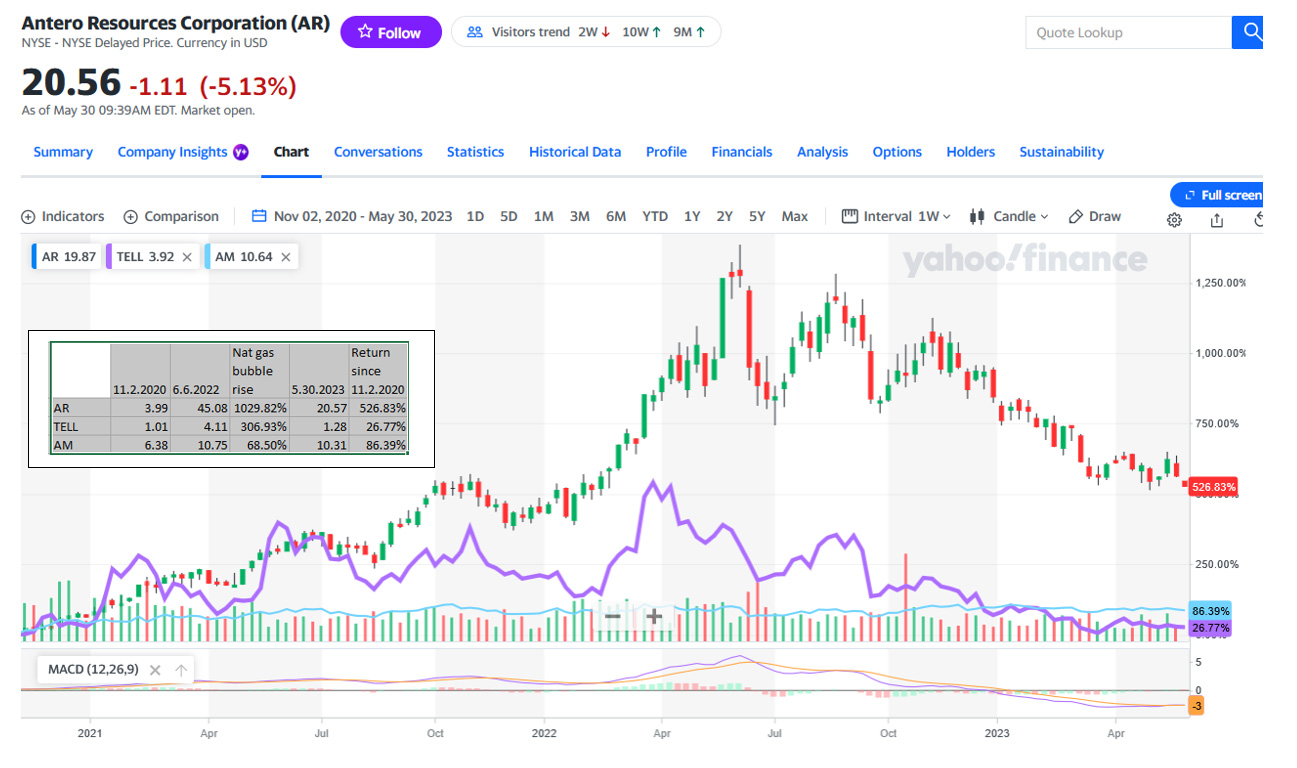

We own three smaller natural gas stocks which rose sharply during the natural gas bubble – Antero Resources Corporation (AR), Antero Midstream Corporation (AM), and Tellurian Inc. (TELL). Due to the sharp decline in natural gas prices over the last year, these stocks have pulled back and we are adding to these positions.

Source: Yahoo.finance, IGA Research

The following are the unique characteristics that make these natural gas investments particulary attractive: Antero Resources Corporation’s principals are former investment bankers who are large shareholders. The company is a low cost producer and has a long history of buying back its own shares and retiring debt. Antero Midstream Corporation (AM) has the same management team as Antero Resource Corporation (AR) and AR owns 29% of AM. AM has an attractive 8.62% dividend yield and is focused on paying down its debt and ultimately raising the corporation’s dividend. Tellurian Inc. (TELL) is a vertically integrated natural gas company with upstream assets and is building a liquefaction facility – Driftwood LNG. TELL seeks to capture the spread between high international LNG prices and low US natural gas prices. This spread capturing strategy is a new business model offering a potentially higher return than traditional toll road LNG facilities. If Tellurian succeeds in building Driftwood LNG, it could earn $10 billion in cash flow per year from 2029 onward. Tellurian’s management team has built 79% of US liquefaction capacity.

Conclusion:

The investment environment has evolved from four decades of declining interest rates, declining inflation, a technology revolution, and relative world peace. Regrettably those powerful drivers, which led to consistently attractive returns for investors in stocks, bonds and real estate, have dissipated. We believe markets during the 2020 decade now unfolding before us will likely mirror markets during the 1970s and from the 1999 to 2011 period.

Decades of declining interest rates and declining inflation have helped drive high returns in stocks and bonds. This consistently solid return profile has led investor expectations to drift to a more speculative mindset consistent with recency bias. Without adjustment, investors will likely be disappointed by the investments and strategies which have served them well in the past. However, the 1970s and the 1999-2011 period show that oil, gold, mining, value investments, and other commodities can produce outsized returns in an inflationary commodity cycle we see unfolding before us.

Investors are frequently warned that “Past performance is no guarantee of future returns.” This warning is especially true when the fundamental factors which drove the great bull markets of the last four decades have faded away.