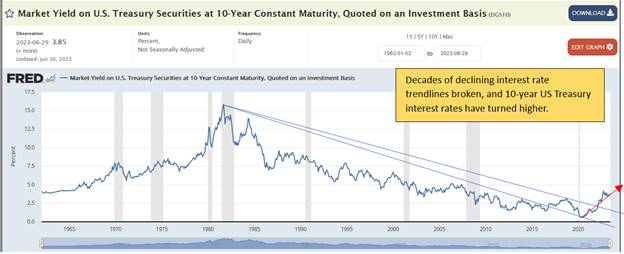

The Great Financial Crisis of 2008-2009 initiated a period of artificially low interest rates created by an overly accommodative Federal Reserve. This post-GFC period of abnormally low interest rates created historically rich valuations for stocks, bonds, and real estate and overextended four-decade-long bull markets fueled by declining interest rates. This prolonged period of declining interest rates is now reversing. Since August 2020, the Federal Funds Rate and 10-year US Treasury yields have risen 5% and 3.5%, respectively. Furthermore, the 2020 COVID-19 market collapse, the decade long bubble in low interest rates, and the resulting Federal Reserve accommodations and policy reversals have created many market extremes and investment opportunities for analytical and perspicacious investors. Today’s normalized interest rate environment has created compelling income investment opportunities and strategies that have not been attainable for decades. Today’s normalization of interest rates offers a great opportunity for retirement minded investors to build meaningful income producing portfolios that is a welcome relief for retirement aged investors.

Our relative value analysis of stocks and bonds has led to well-timed market calls chronicled in our monthly newsletter. In March 2020, we wrote Irrational Pessimism, at the bottom of the COVID-19 crash, stating equities were the cheapest they had been since the 2008-2009 financial crisis. In September 2020, we warned readers of the risks posed by the Federal Reserve’s policy shift away from its four decade anti-inflation posture. That letter warned of the potential consequences of the Federal Reserve’s policy reversal and marked the end of a 39 year bond bull market. We sold long duration bonds for our clients and added MLPs, energy, natural resource, and closed end fund investments which significantly increased portfolio income and reduced duration risk. (Reducing duration risk is precisely the risk management strategy that Silicon Valley Bank and other financial institutions shockingly failed to employ.) Another two letters emphatically cautioned readers of the equity markets’ massive top — The Final Stages of a Historic Bull Market in January 2021 and again in The Crack Heard Around the World in January 2022.

Based on the same perspicacious relative analysis, we strongly believe today’s wide range of attractive and high yielding investment opportunities represents a rare opportunity to sell overvalued positions in stocks and real estate and reallocate those proceeds into income investments. Today’s investment environment presents a welcome opportunity for income investors and for those looking to retire, in particular.

The Revenge of Retirement Aged Individuals:

Ron Welburn, CFA, a former CIO for Merrill Asset Management, often remarked that during the last decade of near zero interest rates, it was unfair to retirement aged individuals that they could no longer get a safe livable income from bank savings accounts and money markets. Today’s investment environment is a vast improvement from the last decade due to the wide range of attractive income vehicles available now that the Federal Reserve has raised the Federal Funds Rate 500 basis points to levels that are consistent with historic Federal Funds Rates.

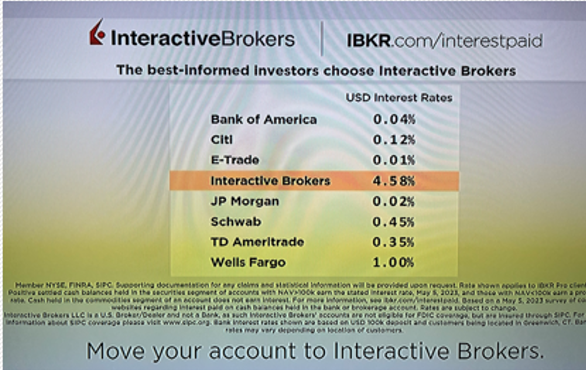

The advertisement below by Interactive Brokers shows today its money market yields are 4.58%, well above the near zero levels a few years ago and above their competitors’. We keep our client accounts at Interactive Brokers.

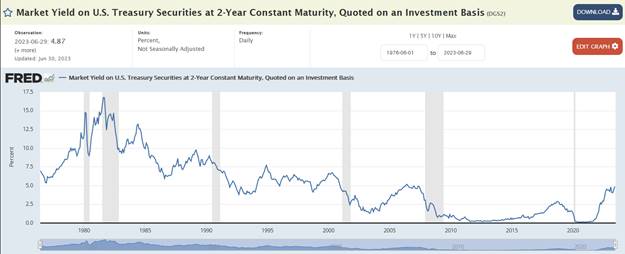

Additionally, two-year US Treasuries are yielding near 5% for the first time since 2007. While not sexy, a two year US Treasury offers a safe haven with nearly a 5% yield and is a compelling alternative to equities or long duration bonds.

Today’s attractive money markets and short term treasury yields offer a compelling safe-haven and alternative to stocks and treasury bonds.

The Case Against Long Duration Bonds:

Since 1982, 10-year US Treasury rates have dropped from 15% to 0.5% in August of 2020. We believe this trend of declining rates is over. Furthermore, the end of a four decade decline in rates has removed a key driver of returns for stocks, bonds, and real estate. Recency bias will lead investors to continue to believe the best returns and performance will be in stocks, bonds, and real estate. However, the current term structure of interest rates offers compelling risk adjusted income producing investments without having to extend maturities with the corresponding duration risk some regional banks famously miscalculated. Retired investors by definition lack the earnings capacity they had when they were employed, consequently, it is imprudent for them and their advisors to chase higher yields by extending duration risk.

Simply put, what compelling reason is there to invest in a 10-year US Treasury yielding 3.85% when a two year US Treasury Note can yield nearly 5%?

The 40% bond allocation prescribed by the 60/40 portfolio strategy is overly aggressive given today’s persistent inflation risk.

The Case Against the S&P 500:

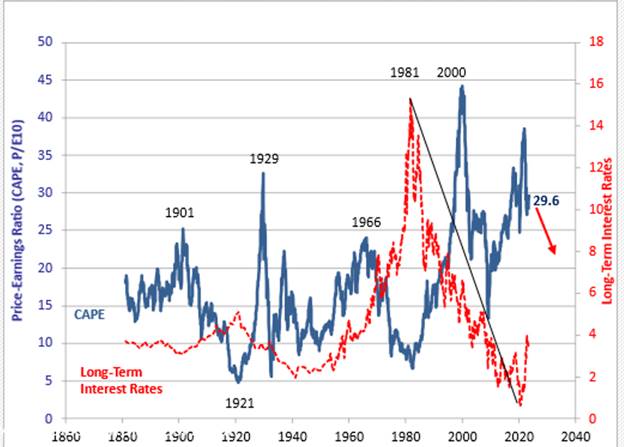

While we are not wildly bearish, the sober reality is that equities as measured by the S&P 500 are expensive. Nobel Laureat Robert Shiller’s CAPE or Cyclically Adjusted Price Earnings ratio is 29.6. That level has only been exceeded a few times in history, and those times were at or near major market peaks – specifically 1929, 2000, and 2022. Furthermore, there is a chance that interest rates could rise either because the economy does not fall into a recession or that inflation remains intransigent causing the Federal Reserve to tighten further or liquidate its massive holdings of US Treasuries to slow the economy. The rich valuation level of equities today combined with interest rate and geopolitical risks argue powerfully against a 60% equity allocation in retirement portfolios, prescribed by the popular 60/40 allocation strategy.

The chart below of the Shiller CAPE ratio over the last 145 years shows how expensive equities are at 29.6 on a historic basis. Furthermore, the chart simultaneously shows the post-1970’s inflationary period of declining 10-year US Treasury yields and its trend reversal.

We conclude that a 60% equity allocation to be too risky for prudent retirement plan investing, especially if that equity allocation is overweighted toward high multiple, non-dividend paying, high growth, large capitalization domestic stocks. Equity risk is reduced by investing in less popular market segments including value, small capitalization, high yielding, energy, commodity, and international stocks. The reinforcing feedback loop of capital weighted indexation and declining interest rates has made large capitalization weighted indices vulnerable to a protracted consolidation or correction.

The Case for Commodities:

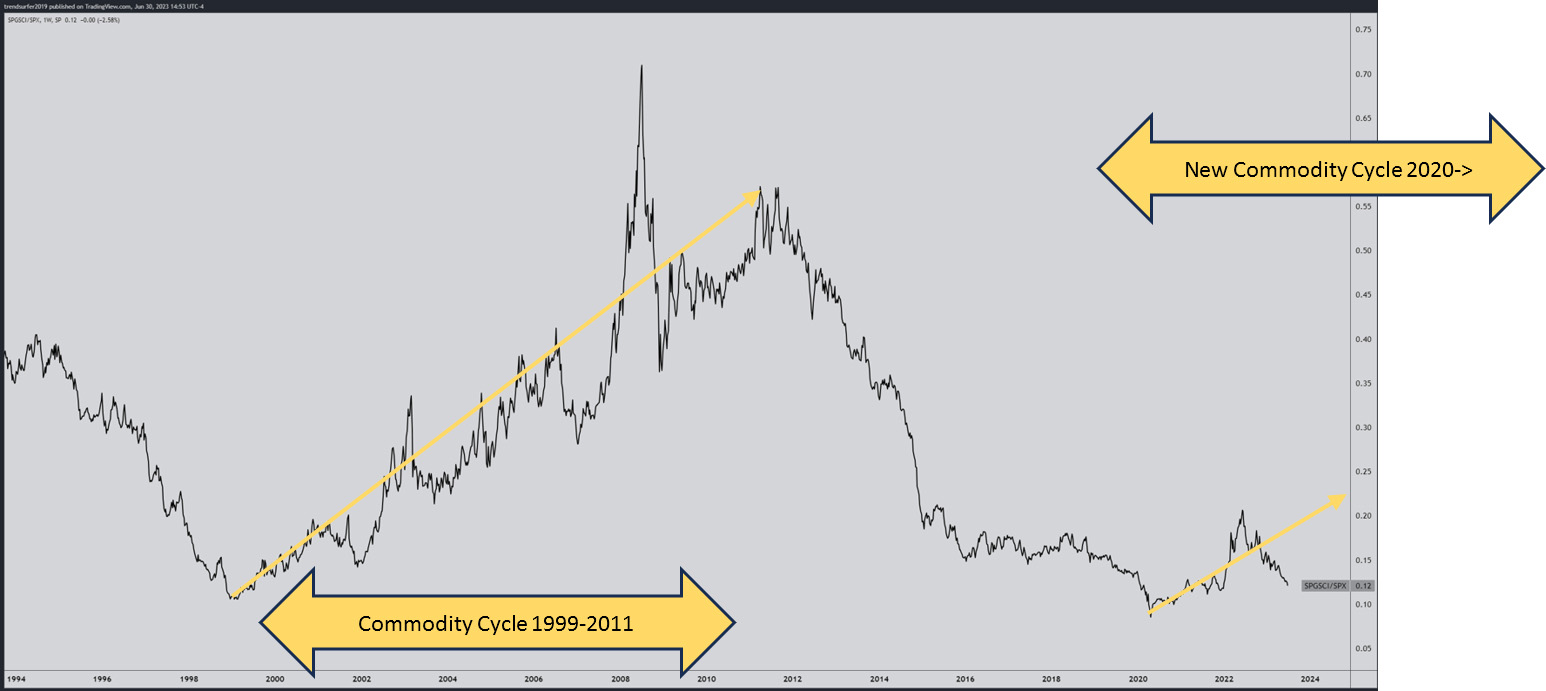

The energy and climate transition will require massive capital investment in order to power the world and simultaneously to reduce carbon emissions to fight global warming. Historically, commodities out perform the S&P 500 when interest rates are rising and massive physical infrastructure cycles engage. The transition to a global low-carbon industrial base, the re-shoring and near-shoring of manufacturing capacities, and the modernization of the massive populous emerging economies of China and India are driving a new commodity cycle.

The chart below of the ratio of the S&P 500 to the Commodity Research Bureau Index is now rising and suggests a ten year cycle of commodity outperformance.

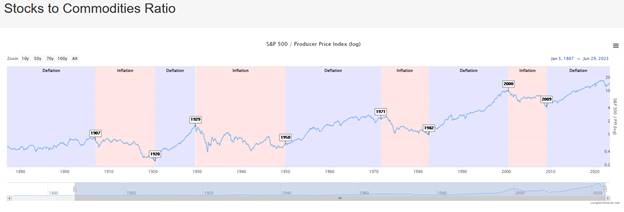

We believe the dramatic rise in inflation since 2021 has turned lower rates and deflationary trends to higher rates and inflationary trends. The chart below shows the cyclical trends associated with inflationary and deflationary trends. We have now entered an inflationary market cycle which favors commodity assets over financial asset such as the S&P 500.

AI Irrational Exuberance and Large Capitalization Growth Bubble:

This year’s parabolic price action in Nvdia (NVDA) suggests a specualtive frenzy often seen at major market peaks characterized by irrational exuberance and new era thinking. The ten year chart below of Nvidia’s 100 fold rise and four-fold nine-month rise suggests that the exciting artificial intelligence craze has now largely been discounted in NVDA’s stock price.

The chart below of the NASDAQ 100 Large Capitalization Growth Stock ETF (QQQ) and the S&P 500 capitalization weighted ETF (SPY), show ten-fold and four-fold parabolic rises, respectively, that benefited from abnormally low interest rates and capitalization weighted index construction methodologies that overweighted large-capitalization outperformance. These factors make both of these indices vulnerable to consolidation and correction following their fourteen year bull markets.

Five Attractive High Yield Investments:

The following are five high yielding investments that we own for our clients and are reflective of today’s attractive retirement income investment environment. They are:

Antero Midstream Corporation (AM) is a Utica Marcellus based natural gas company with a large and sophisticated insider shareholding that yields 8.1% and seeks to grow its dividend.

Energy Transfer LP (ET) is a Master Limited Partnership with top tier management that seeks to grow 9% distribution.

Kayne Anderson (KYN) is a closed end MLP fund that yields 10.3% and 16% discount to NAV.

GAMCO Global Gold, Natural Resources & Income Trust (GGN) is a closed end fund that generates a high yield by employing a covered writing strategy that yields 9.7% and trades at a 3.4% discount to NAV.

Templeton Emerging Markets Income Fund (TEI) is a closed end fund that invests primarily in the sovereign debt in the emerging markets that yields 10.8% and trades at a 10.1% discount to NAV.

High yields such as these don’t come without attached risks. AM, ET and KYN all cut their dividends or distributions in the COVID market and commodity crash in 2020 but have subsequently outperformed.

The Case Against the 60/40 Portfolio Strategy:

Since 1982, the popularity of the 60% equity 40% bond asset allocation strategy has been widely adopted as a prudent risk adjusted investment strategy and one widely embraced by consultants and financial planners. However, today, the over-valuation of the S&P 500 and the inverted yield curve make both the 60% stock allocation and 40% bond allocation appear overly aggressive. With today’s parabolic 14-year bull markets in the QQQ and the S&P, we advocate reducing exposure to equities and indices that are expensive and interest rate sensitive. Furthermore, we don’t see the appeal of long term bonds in an inverted yield curve environment when the inflation question remains unresolved. Alternatively, we suggest an asset allocation rebalancing toward a 25% money market/cash, 25% commodities, 25% equities and 25% bonds.

Conclusion:

In the last 14 years, the Federal Funds rate collapsed to near zero. This led to a large shift of safe money and savings into stocks, bonds, and real estate since money market/savings accounts no longer offered a livable safe return. While today’s Federal Funds Rate may no longer drive investment into stocks, bonds, and real estate, the elevated Fed Funds rate now supports attractive short duration investment options not seen in nearly two decades. Additionally, there is a wide range of income investments which make building a retirement income strategy more attainable today than in decades. Finally, we believe reallocating from a 60/40 stock bond allocation strategy to shorter duration more inflation tolerant portfolio allocation of 25% money market/cash, 25% commodity, 25% stock, and 25% bond will reduce portfolio risk and better position investors for an inflationary commodity cycle in the decade ahead.