The S&P 500 and Magnificent 7 stocks are expensive and at their all-time highs. We believe inflation will remain stubbornly persistent and not return to a 2% inflation rate this year, resulting in both stocks and bonds losing their appeal due to their duration and interest rate risk. Consequently, we are reallocating from the popular 60% equity/40% bond asset allocation mix to a 25% cash/25% commodity/25% stock/25% bond asset allocation mix designed to provide higher income, better inflation protection, and lower capital risk. This asset reallocation should be particularly attractive for retirement plans and those seeking retirement income.

This letter will highlight equity alternatives to the parabolic market cap weighted S&P 500 and NASDAQ 100 indexes and their mega cap constituents. For better income and lower duration risk, we advocate a barbell strategy of short-term treasury bills and money markets combined with high yielding equity and bond investments with yields around 10%. This barbell combination provides attractive income without the duration risk found in popular bond ETFs like the TLT iShares 20 year Bond Index which yields 3.38%.

The S&P 500 is Expensive:

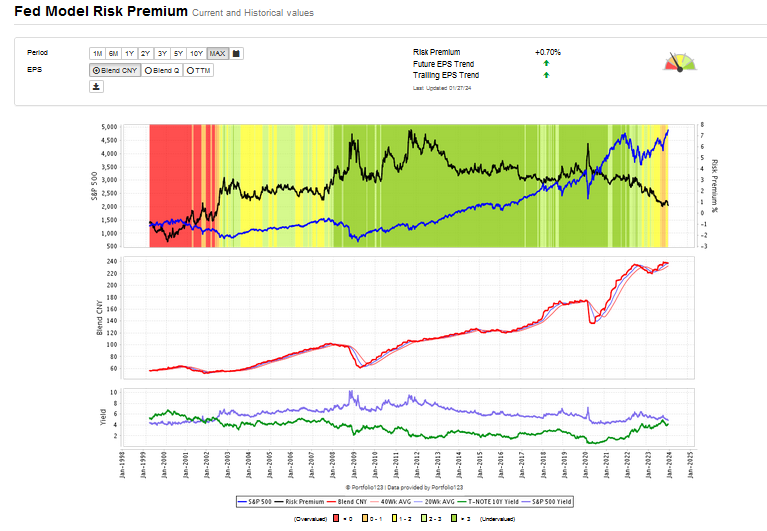

The risk premium provides an objective valuation of the S&P 500 by comparing the earnings yield of the S&P 500 to the 10-year US Treasury Note. Today’s paltry 0.7% risk premium is well below 6% levels recorded during major market bottoms of the Great Financial Crisis 2008-9, the European Debt Crisis 2011-12, and the Covid-19 Collapse (when we wrote Irrational Pessimism: The Market is Bottoming, on March 31, 2020). The risk premium is not as extreme as the -2.54% recorded in January 2000, but it is near the top 25% of risk premium scores. The chart below shows the risk premium model since 1999. If interest rates move higher or earnings turn down, the stock market will enter perilous territory.

The Magnificent 7:

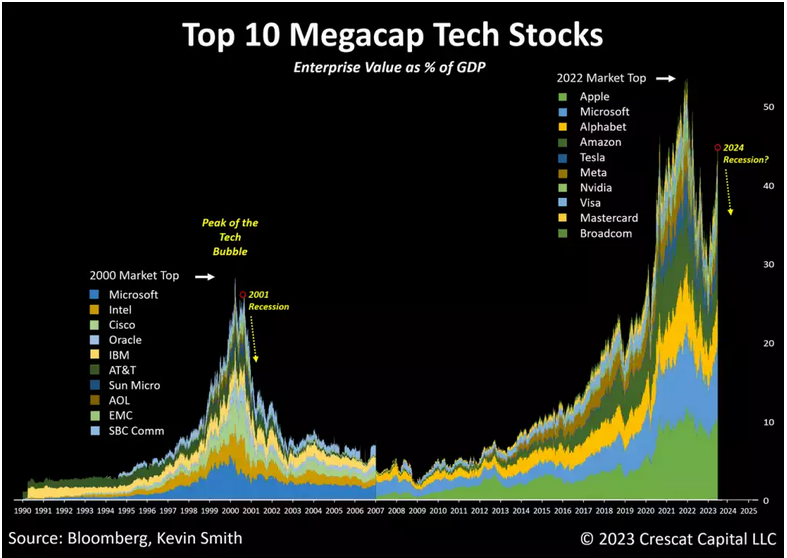

The Magnificent 7 stocks have reached parabolic peaks which should fade as they did following the historic market peaks reached in 2000, 2022, 1966, and 1929 when a small group of popular stocks spiked higher following multiyear parabolic share price moves and then reverted for the following several years.

The Magnificent 7 stocks: Apple Inc. (AAPL), Microsoft Corporation (MSFT), Alphabet Inc. (GOOGL), Amazon.com, Inc. AMZN, Nvidia Corporation (NVDA), Meta Platforms, Inc. (META) and Tesla, Inc. (TSLA) should fizzle, especially if inflation does not decline, because they are long duration assets which no longer enjoy the support of declining interest rates and cap weighted index buying.

Bonds Stink:

The chart below of the iShare 20+ Year Treasury Bond ETF (TLT) shows two decades of robust appreciation for the TLT from $84/share in August 2002 to $179/share in March of 2020. During this same period the TLT shares’ yield declined from approximately 5.28% to 1.35% when its shares peaked at over $170/share. Since 2020, with the rise of inflation and interest rates, TLT’s shares have declined from 179 to 82, a 58% decline for an investment that yielded less than 2% at its peak and now yields only 3.38%. This 58% decline in this long-term US Treasury ETF graphically shows the potential capital risk of a bond ETF in an asset class known for safety because bonds are designed to mature at par or 100. Many investors, planners, and advisors do not appreciate the capital risk of bond investing due to recency bias. That is, during the last four decades of declining interest rates, examples of sharp rises in interest rates causing bond prices to collapse were rare. With an actual bond, holding to maturity will guarantee you your return of principle; however, ETFs do not have actual maturities, and pose a risk many advisors or models don’t understand. Our concern is simply that we have no guarantee that our ballooning deficit, historic government spending, and persistent inflation will not result in 10-year US Treasury interest rates rising to 7% or higher in the years ahead. Consequently, portfolios overweighted with long duration ETF like the TLT could experience 50% declines in the future, and the TLT current yield of 3.38% is not attractive enough to justify its duration or interest rate risk. The same interest rate risk argument can be made against similar bond ETFs like the (BND) Vanguard Total Bond Index fund which yields 3.08% and the (AGG) iShares Core US Aggregate Bond Index which yields 3.13%.

Alternatively, (TEI) the Templeton Emerging Markets Income Fund yields 11.88% by investing in emerging market sovereign debt. With the emerging markets looking to grow relative to the US market, we believe TEI could provide an attractive source of income in the years ahead.

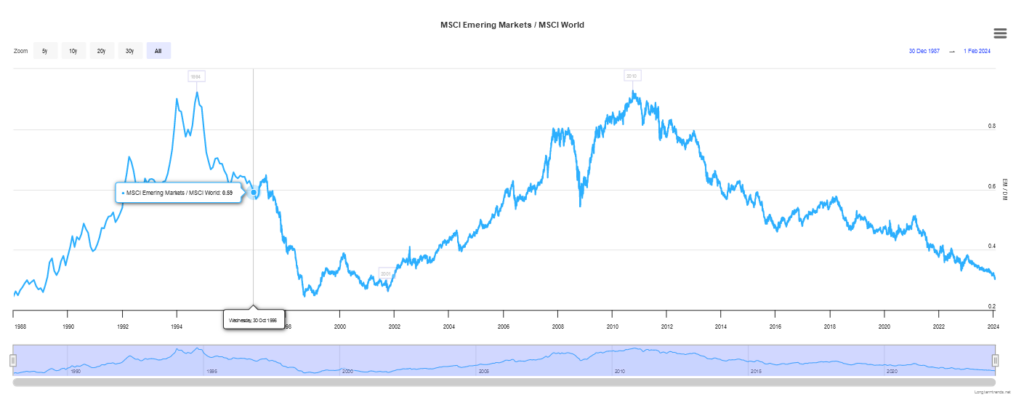

The chart below compares the performance of emerging markets versus developed markets by showing the ratio of the MSCI Emerging Market Index divided by the MSCI World index. The performance of emerging markets outpaced the returns of the S&P 500 and the MSCI World index following the 2000 Technology bubble, until 2011, when a period of low rates drove US markets to today’s bubble levels. We anticipate a period of strong growth in emerging markets and emerging market debt in the years ahead. Through TEI, investors can capture an attractive yield and capital appreciation potential, making TEI a sensible bond fund allocation.

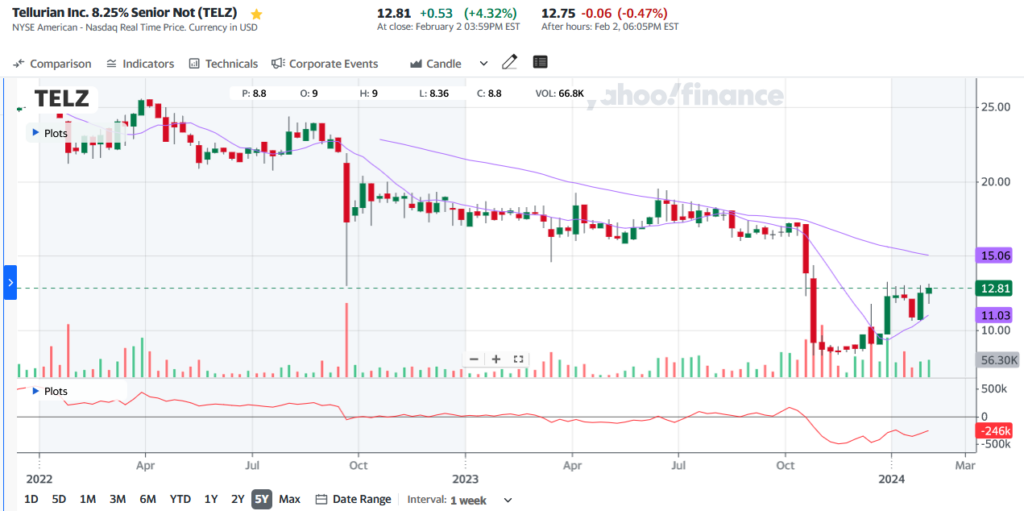

A unique and compelling bond investment is (TELZ), Tellurian Inc.’s 8.25% “baby” bond 50 million dollar Sr. note maturing at $25/share on November 31, 2028. Tellurian Inc. is a natural gas E&P and LNG liquefaction plant developer seeking to complete its funding of its Driftwood LNG terminal near Lake Charles, Louisiana. Its notes’ coupon is 8.25%, trades at $12.81/note, and matures to $25 per note. The bonds’ current yield is 16.1% and its bond price should double between now and November 2028. Tellurian is a distressed special situation which we have researched and written on extensively. TELZ notes are trading 49% below their maturity value, due to worries triggered by a “going concern” disclosure in its third quarter filing in October, 2023.

Tellurian has invested approximately $1 billion in the Driftwood liquefaction facility and Tellurian Production’s upstream assets are worth approximately $4-500 million according to Tellurian IR Matthew Phillips. Tellurian Production’s liabilities, associated with its 31,000 acre E&P project in the Haynesville shale formation, are approximately $300 million. We believe Tellurian’s assets are worth more than its liabilities, which makes TELZ an attractive risk.

With the removal of Charif Souki in December, and Tellurian co-founder Martin Houston now as acting Chairman, we believe Tellurian will fund its Driftwood facility, restructure its upstream debt, eliminate its going concern possibility and the company will succeed with the help of Lazard as its investment consultant, its valuable assets, and the considerable LNG experience of Tellurian’s management.

With the Department of Energy pausing its LNG licensing policy and Tellurian’s retention of Lazard as an advisor, Tellurian is well positioned to capitalize on the LNG “pause”. Tellurian Inc. benefits from this pause as the Driftwood LNG facility is one of the few fully licensed facilities with FERC and DOE licenses and is poised to produce LNG in 2027. Toby Rice the CEO of EQT Inc. a leading US natural gas producer wrote this thoughtful letter to secretary of Energy Jennifer Granholm this week. He explains that during the pause to review the tremendous growth of US LNG in recent years, the pause will hurt our international partners, strengthen our international adversaries, and hurt the United States’ effort to reduce carbon emissions as well as the US commitment to COP 28 and the Paris Accord.

Martin Houston has written two letters defining his plan to maximize shareholder value and pursue several new business partners. His second letter specifically explains the importance of hiring Lazard to evaluate business options for Tellurian, Inc. We believe that under Houston’s leadership, the companies’ assets will far exceed the company’s liabilities and TELZ will be an excellent high yield or “junk bond” investment now benefitting from government regulation, Lazard, and the realigned of management. Chairman Martin Houston owns 20,000,000 shares of TELL and is highly incentivized to make both TELZ whole and TELL profitable.

The Inflationary Cycle:

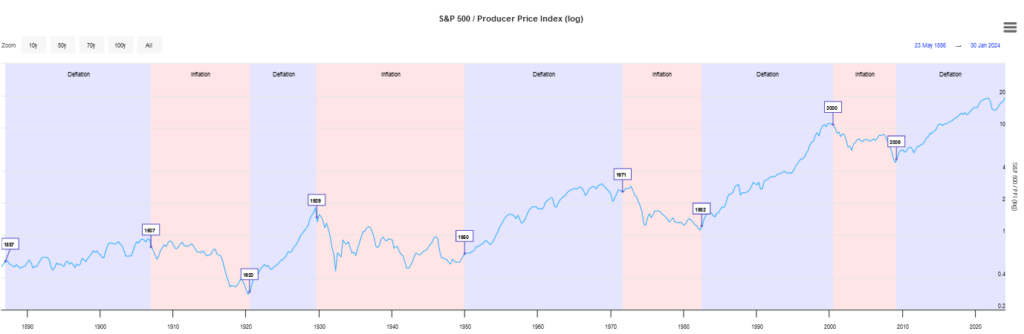

We believe markets are cyclical and that stocks, bonds, and real estate have been disproportionate beneficiaries of declining interest rates since 1982, when the 10-yr US Treasury yielded 15.2%. Federal Funds similarly declined from 22% in December 1980. Both rates declined to nearly 0% in 2020 and today, 10-yr US Treasury yields are 4.15% and the Federal Funds rate is 5.33%. That era of declining rates and artificially low rates is over. The next decade will be led by assets which are not primary beneficiaries of low and declining interest rates. Commodities, gold, energy, and money markets should out-perform stocks and bonds in the current period of rising rates and a long inflation tail.

The chart below highlights inflationary periods such as the ones experienced in the 1970s, the 1999 to 2007-11 period. During those inflationary periods, both gold and oil had massive moves while the S&P 500 performed poorly. We expect these historic analogues will be prologue in the years ahead. The S&P 500 will underperform while commodities and inflation beneficiaries will provide attractive returns.

Four High Yielding Investments:

The following four investments are hybrid investments in that they could be defined as equity or commodity proxies for our 25%/25%/25%/25% allocation framework. The inflationary cycle model suggests that investments in gold or energy should benefit from commodity sector outperformance. Due to their high yield, these investments can be held for their income alone, especially when compared to the S&P 500 which yields 1.4%.

GAMCO Global Gold, Natural Resources & Income Trust (GGN) is a closed end fund that generates a high yield by employing a covered writing strategy that yields 9.6% and trades at a 1.4% discount to NAV.

MPLX LP (MPLX) is a 37 billion dollar market capitalization Master Limited Partnership run by Marathon Oil. Its distribution yield is 9.0%.

Energy Transfer LP (ET) is a 48.2 billion dollar market capitalization Master Limited Partnership with a 8.8% distribution yield and distribution growth potential.

Kayne Anderson (KYN) is a closed end MLP fund that yields 9.6% and has a 14.8% discount to its net asset value “NAV”.

Cash and Short-Term Treasuries:

Since the Global Financial Crisis, accommodative monetary policies have helped corporations but hurt retired or income investors seeking an income from their retirement assets. With the rise of inflation and the Federal Funds rate since 2020, investors can now find attractive money markets, bank savings rates, and short-term US Treasury investments that provide an attractive yield. Fixed income investments with maturities greater than a year are increasingly subject to duration risk. Consequently, we advocate short-term Treasuries yielding over 5%, a yield which exceeds the inflation rate, and preserves purchasing power parity. That is your investment return is not eroded by inflation. This is known as a positive real yield, a yield which exceeds the rate of inflation. With real rates of return available in short-term Treasuries we advocate having 25% of a portfolio in short-term Treasuries yielding over 5% or money markets approaching a 5% yield.

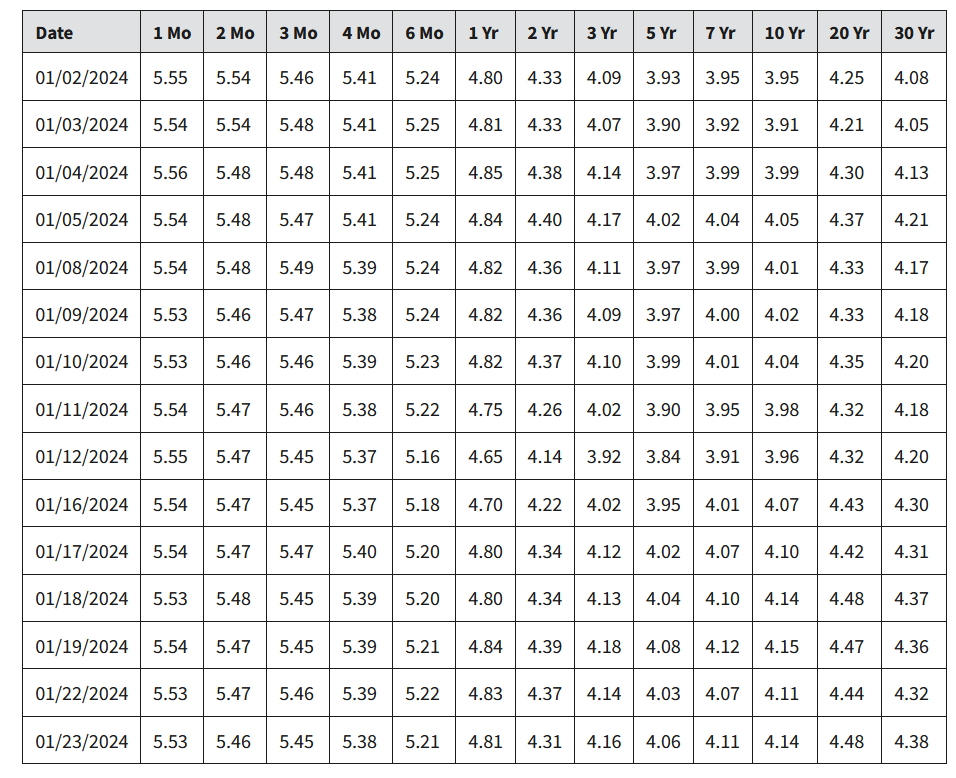

Below is a chart of US Treasury yields at differing maturities. We favor those Treasuries yielding 5% up to a maturity of two years. As treasury maturities extend, duration risk rises and is not sufficiently offset by their yield to compensate for that interest rate risk. (This duration risk is the problem we have identified with the TLT bond ETF). The chart below shows Treasury bill rates over 5% up to a maturity of 6 months. Last year, two year Treasuries were available with a yield over 5% which we also advocate compelling as investments with real returns and limited duration risk.

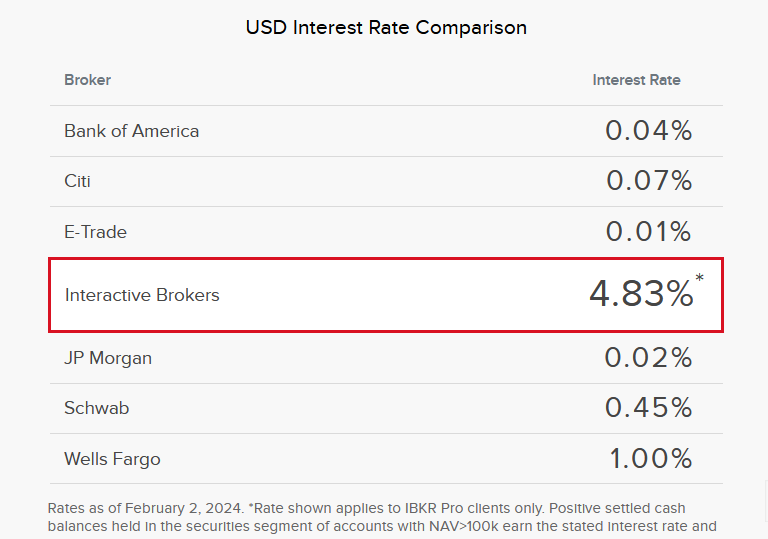

The Chart below from Interactive Brokers shows their money markets yield 4.83%, a yield which we find very attractive. A money market invests in short term securities and its yield will rise and decline with short term rates. In the early 1980s money markets yielded in the high teens. Not surprisingly, equity market valuations were much lower as fixed income investments offered yields in the teens with little principal risk.

Source: https://www.interactivebrokers.com/en/accounts/fees/pricing-interest-rates.php

Conclusion:

Historically, markets trade in cycles and different assets become popular depending on the economic conditions of those periods. During periods when inflation and interest rates are decreasing, financial assets that offer recurring income or cash flows attract investment flows. These periods are deflationary cycles when equities, bonds, and real estate are generally top-performing asset classes. Conversely, when inflation and interest rates are rising, commodities, commodity linked investments, and money market investments are top-performing asset classes. Since we have entered an inflationary cycle in 2020, we believe lower allocations to the S&P 500 and long-term bonds reduce capital risk. Likewise, adding to commodities or commodity-linked securities and short-term Treasury notes and money markets provide better income, lower duration risk, and inflation protection. Consequently, we favor a 25%/25%/25%/25% asset allocation framework over the 60% equity/40% bond allocation framework for retirement plans and income seeking investors.

Based on the market capitalization methodologies of indexes like the S&P 500 and the NASDAQ 100 (QQQ), we believe when the current equity upcycle ends, these funds will experience outflows and it will hurt the largest capitalization shares the most. Specifically, the Magnificent 7 shares will experience persistent downside pressure in a downcycle as they are the largest constituents in those indices. Since the S&P 500, NASDAQ 100, and Magnificent 7 offer little dividend income and are long duration assets, they will be at risk of persistent underperformance if interest rates and inflation rise in the future. With a burgeoning deficit and Federal Debt, increasing international military engagements, and a global transition to lower greenhouse emissions, we fear that higher inflation and interest rates are possible in the years ahead.

Money markets and cash equivalents offering yields in the 5% range are attractive. Investments in closed end funds “CEFs” like the GGN and TEI offer attractive yields near 10%. MLPs like ET and MPLX CEFs like KYN can offer yields in the 7-10% range with the potential for commodity price improvement. Conversely, bond ETFs like the TLT, BND, and AGG offer yields near 3% which offer no real income after accounting for inflation. Furthermore, the duration risk with long-term bonds, bond funds, and bond ETFs have capital risks investors may not appreciate as we showed in our chart of the TLT. Following a decade of near zero interest rates, investors now have an opportunity to build portfolios with lower market risk and income to cover living expenses.

It is human nature to make investment decisions based on recent investment performance. Man’s mind is susceptible to recency bias, meaning that we tend to remember more clearly the recent past and project that into the future. Consequently, we believe generations of investors have grown complacent owning capitalization indexes like the S&P 500 index and long-term bonds, when they both could be vulnerable to capital risk that nearly 40 years of declining rates have made the investment public oblivious to. Consequently, a longer term investment perspective based on asset value and historic analogues should lead to better risk adjusted returns with greater income than found in the popular 60% equity 40% bond allocation popularized over the last 40 years.

As philosopher George Santayana famously said, “Those who do not learn history are doomed to repeat it.” We believe we are entering an inflationary cycle where the 60% equity/40% bond allocation is vulnerable to capital risk and provides limited income. A reallocation of assets to 25% cash/25% commodities/25% equities/25% bonds is prudent for retirement plans, endowments, and individuals living on fixed budgets for the balance of this decade.