- S&P 500 earnings have topped.

- The Federal Reserve talks tough.

- Rising energy prices threaten a European depression.

- Supply-side not monetary solutions are needed.

Following the equity and bond markets’ brutal first half, the S&P 500 index snapped back this summer. With Biden’s releases from the strategic petroleum reserve (SPR), markets experienced declining oil and gasoline prices and steady consumer spending, resulting in flattish S&P earnings. Consequently, the S&P 500 enjoyed a 17% rebound from June’s S&P 500 3674 low to its mid-August S&P 4280 peak. Are happy days here again?

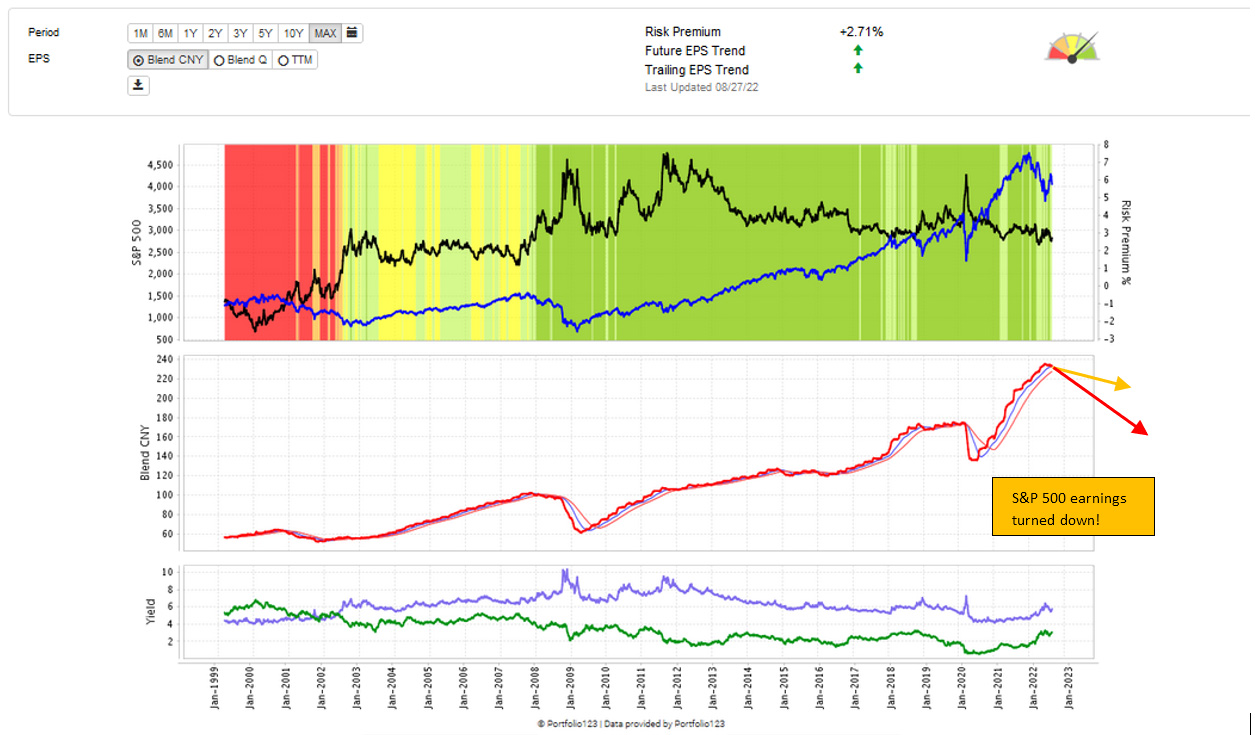

The Fed Model below shows some concerning developments. Most importantly, S&P 500 earnings (shown by the red line in the second panel of the chart below) have stopped rising. Every major decline since 1999 — specifically 2000, 2008, and 2020 — began with a decline in S&P 500 earnings. How earnings prove out in the coming weeks, months and quarters will decide market direction from here.

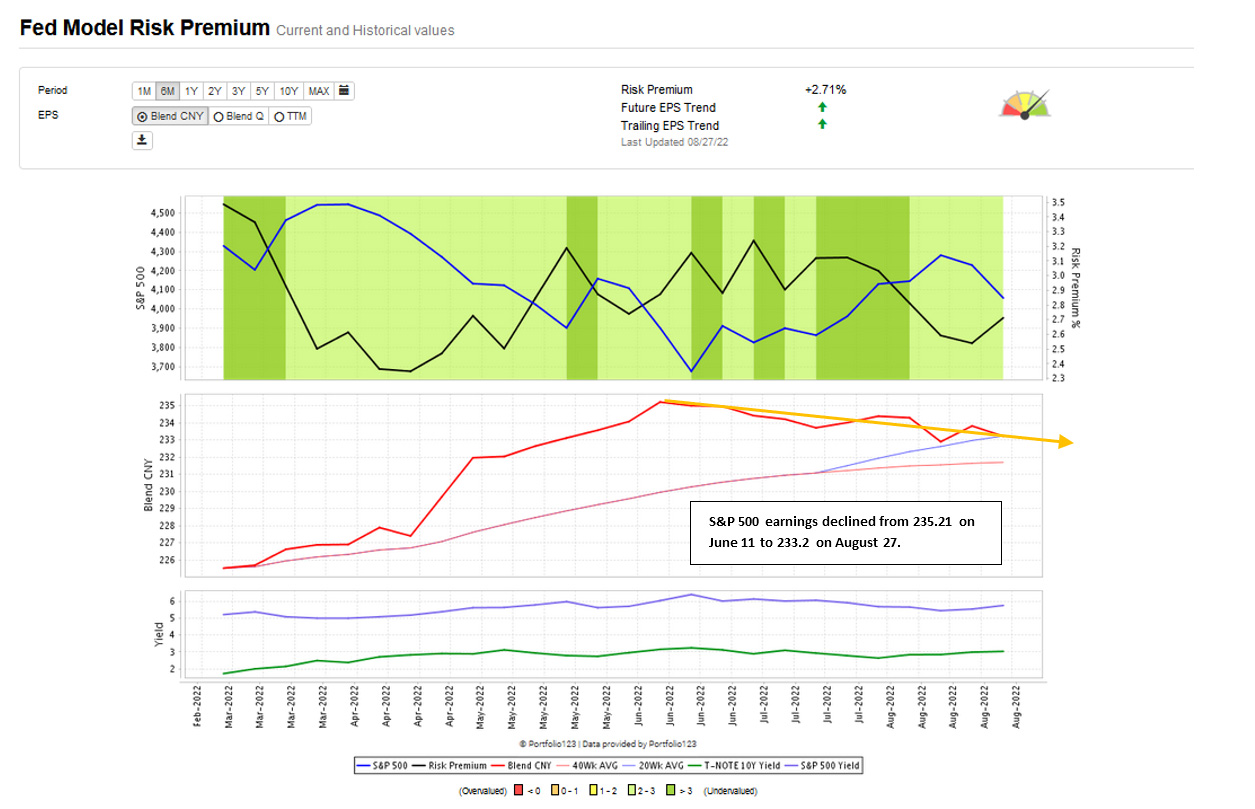

The last six months of S&P 500 earnings, shown in the chart below, declined modestly starting on June 11 at 235.21 to 233.2 in the week of August 27th. While the decline is not meaningful, the change in direction is. Further, this occurred during a period of improving sentiment and easing gasoline prices. The chart below shows that the “Risk Premium” increased from 2.74 to 3.03, meaning that investors were being paid a 2.7-3% premium to invest in the earnings yield of the S&P 500 versus the yield offered by the 10-year US Treasury note.

Sentiment also improved during this summer’s counter trend rally. The VIX index on S&P 500 declined from 35 in June to 19 in mid-August, before heading higher as the market’s summer rally faded.

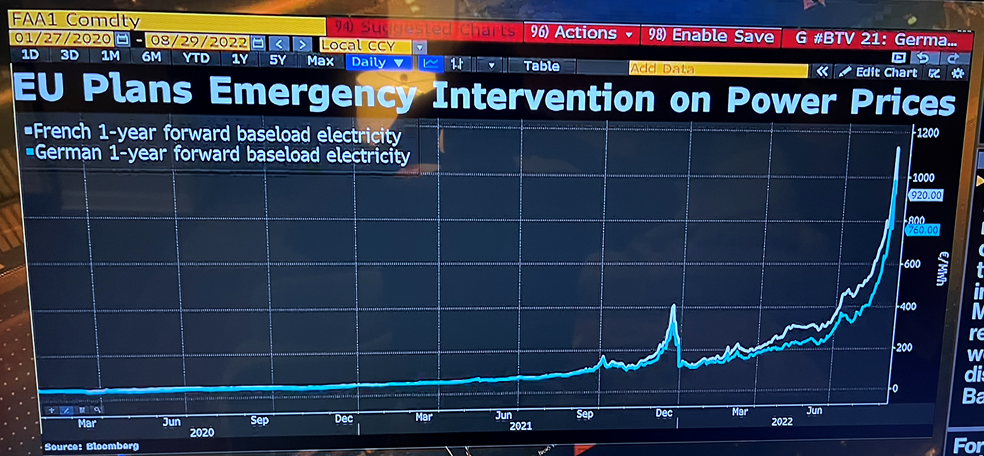

We have been weighing the competing concerns of rising inflation and a tightening Federal Reserve and believe the pivotal new risk factor is rising energy prices. Since June gasoline prices have declined nicely, aided by the SPR release, even though that benefit will likely reverse after the election. More troubling is the massive spike in natural gas and utility prices in Europe. Natural gas/electric prices in Europe have risen parabolically ten-fold in the last two years. This spike in natural gas prices threatens a depression in Europe and geopolitical divisions globally for the next several years.

The shocking rise in electricity prices in France and Germany over the last 18 month is displayed in the chart below. Europe’s green energy policy, which embraced solar and wind power while eliminating nuclear and fossil fuel was proving a policy disaster, before February 24th, when Vladimir Putin invaded the Ukraine and shut off natural gas to punish European countries’ supporting Ukraine.

The chart of the European benchmark Dutch Natural gas contract below shows natural gas prices increasing over 10-fold in the last 12 months and seven-fold since the Russian invasion. Our persistent optimism regarding natural gas and LNG prices has led IGA to invest in natural gas investments as a major client theme. Building new natural gas and LNG capacity is a multiyear project. Natural gas and LNG development help accelerate carbon dioxide reduction and provide energy security, by helping the United States and its allies, while stifling expansionist aggression. US natural gas leader EQT Corporation argues persuasively that by replacing all international coal burning power plants with natural gas would achieve its zero greenhouse emissions goal well in advance of 2050 and stop climate change.

The Federal Reserve’s Problem:

The Federal Reserve is tasked with full employment and price stability. By changing interest rates, the Federal Reserve can strengthen or weaken the economy which, by extension, increases or decreases inflation indirectly. Investors generally look to the Federal Reserve to help them time stock market investments, because an accommodating Federal Reserve can help lift markets. The Fed provided significant liquidity during financial crises or economic downturns over the last 35 years including the 1987 crash, the Tech Bubble, the Great Financial Crisis, and the COVID-19 market decline. These repeated liquidity events led to a period of unprecedented accommodation over the last few decades which has fostered excessive valuation levels in stocks, bonds, and real estate. Today’s inflation has grown out of COVID-19 supply chain problems, supply chain issues exacerbated by worsening international relations with both China and Russia, underinvestment in fossil fuels, excessive government spending, and unprecedented monetary stimulus. Unfortunately, the Federal Reserve today is confronted with 40 year high levels of inflation created from supply chain and supply problems which cannot be directly reversed by raising interest rates.

Better energy policies, limited government spending, improved international relations, and policies designed to increase supplies, will reduce costs. Historically governments have unfortunately been poor in these areas and the current administration does not appear focused on supply side solutions.

Following the Jackson Hole meeting, Federal Reserve Chairman Jerome Powell said “restoring price stability will require a “sustained” period of below-trend growth and a weaker labor market. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses.” His comments tell us that the Federal Reserve will allow interest rates to remain elevated for years and not months. Further Powell’s comments reflect that the Federal Reserve is aware of the 1970s Federal Reserve’s missteps that led to a decade of inflation. Specifically, unlike Arthur Burn’s sad legacy of easing monetary policy after some success in reducing inflation, Powell asserted that the Fed not be quick to ease monetary policy. After four decades of “the Greenspan put”, Powell’s tough words will be tested next year when inflation continues to persist, and the economy is, again, in recession.

Because interest rates will remain elevated higher for longer, we continue to advocate an investment approach which is has little duration risk, owns inflation-beneficiaries, and avoids long-duration stocks and bonds.

The Great Rotation:

Today’s conventional investment advice is flawed because it is backward looking. For four decades, stock, bonds and the 60% stock 40% bond allocation strategy benefitted from decades of declining interest rates. Consequently, the 60% equity and 40% balanced portfolio allocation strategy, the keystone of financial planners’ investment strategy, should underperform its historic record and may produce negative performance as it did with its record poor performance in the second quarter this year. Blackrock’s 60/40 Target allocation fund through September 1, 2022 is down 14.72% year to date. Equities and growth stocks, in particular, will lag their four decade bull market performance as interest rates are now a headwind. Bonds too will suffer as their performance will be stifled by a tightening Federal Reserve.

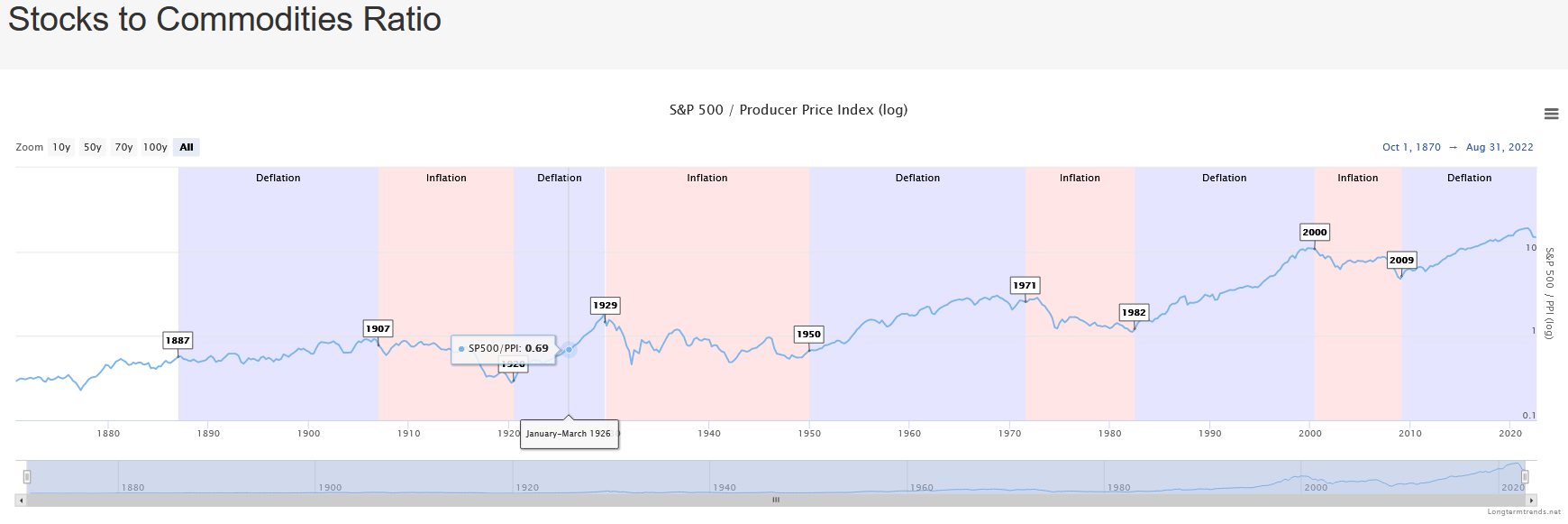

We have entered an inflationary environment where the benefits of declining interest rates no longer will aid trusted investment themes and strategies which have led to decades of appreciation in stocks, bonds, and real estate. The chart below delineates inflationary and deflationary environments by tracking the S&P 500 divided by the inflation. To adapt to a cycle of higher interest rates, we are focusing on new growth themes, inflationary beneficiaries, and income securities which benefit from a inflation. The great rotation is the market phenomenon associated with leadership shifting from growth stock leadership to value stock leadership due to rising interest rates.

One major growth theme for at least the next decade will be the energy and sustainability transition. This transition will be positive for energy, metals, and mining. Metals and mining are essential products needed to build the new sustainable infrastructure targeting electric vehicles and renewables. Specifically, metals like copper, cobalt, lithium, zinc, and rare earths will be critical for the transition to a low carbon economy.

Energy is the lifeblood of economic growth. Due to policy missteps, energy investments are experiencing intense demand. We favor the cleanest and most efficient energy investments. Natural gas and Liquid Natural Gas (LNG) look to play a key role as a transition fuel as the world moves to lower carbon emissions over the coming decades. On an intermediate and emergency basis we see good value in oil and coal. Tellurian Inc. TELL is making material progress funding its Driftwood LNG project and is poised to emerge as a new energy growth leader. Tellurian’s management owns 20% of the company stock and its Executive Chairman Charif Souki Co-Founded LNG leader Cheniere Energy, Inc. (LNG) and financed both of Cheniere’s facilities.

Another investment theme which could provide real (net of inflation) growth is precious metals like gold, silver, and platinum. Precious metals are a safe haven investment which historically has proven a fungible store of wealth and hedge against inflation.

We are buying portfolio income securities where the cash flows are beneficiaries of inflation and offer attractive yields. Icahn Enterprises L.P. (IEP) and Antero Midstream Corporation (AM) yield 15.4% and 8.8% respectively are two investments we own and are inflation beneficiaries. Billionaire Carl Icahn owns 86% of IEP and IEP invests in energy, fertilizer and real estate. Antero Midstream Corporation is natural gas midstream operator in the Utica and Marcellus basins and enjoys 38% insider ownership and the shrewd management of former energy investment bankers Paul Rady and Michael Kennedy.

Conclusion:

The rules of the investment game have changed. Inflation statistics are recording their highest reading in 40 years. Today’s inflationary environment is a scary policy consequence of the Federal Reserve’s Jackson Hole August 2020 meeting when it abandoned its strict anti-inflation posture. We cautioned that the Fed’s generational policy change could be problematic in Two Generational Trends Reverse: Fed Inflation Policy….

Income Growth Advisors, LLC is constructing investment portfolios that assume this inflationary cycle will last for 10 years. Our inflation strategy is to hedge against the dark inflationary backdrop Professor Nouriel Roubini recently described “During the Great Stagflation, both components of any traditional asset portfolio — long-term bonds and US and global equities — will suffer, potentially incurring massive losses.”

We have identified three compelling investment themes. Owning equities which will benefit from the global transition to sustainability by investing green infrastructure and owning mining companies that produce copper, cobalt, lithium, zinc and rare earths is essential to this new infrastructure. Precious metals and their producers should enjoy years of appreciation even as traditional investment benchmarks wilt under inflations costly consequences. Lastly, income investments whose cashflows benefit from inflation are a key component for our clients who are looking for attractive income which should prosper in an inflationary environment.

We hope Jerome Powell’s stated conviction to quash inflation by raising interest rates will not be swayed by likely recessionary pressures. Fed history is not encouraging on this matter. Until durable supply chain problems are resolved in the years ahead, we caution against any investment strategy based on the hope that we will soon be singing “Happy Days Are Here Again”. Great investment opportunities abound, but they largely will not be found in “the old leaders” library.