Tellurian Inc.’s investment potential has always been contingent on the successful financing of its Driftwood LNG facility which we estimate could generate $2 billion to $4 billion in cash flow a year in the 2030 timeframe. Tellurian’s announcements that it is selling its Haynesville natural gas assets, evaluating alternative sources of cheap natural gas, and actively negotiating with partners to finance its Driftwood LNG plant were pivotal in changing market perceptions of the company this past week. Additionally, the Biden Administration’s LNG “pause” appears to be a blessing in disguise for Tellurian, because Tellurian is fully licensed with FERC and the DOE, four major less-licensed projects have now been sidelined. Consequently, Tellurian’s stock reversed and rose 84% from its 35 cent per share low on Monday when fears coalesced around the company’s ATM (At The Money share offering), liquidity concerns, and governmental regulations.

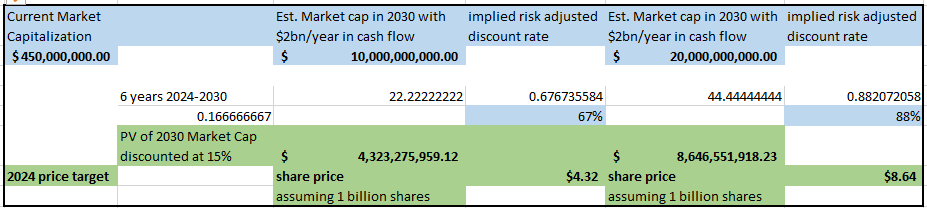

We estimate that Tellurian’s market capitalization could be 5 times $2 billion in annual cash flow in 2030. If the company secures favorable natural gas prices with E&Ps who have access to low-cost natural gas, Tellurian’s market capitalization could be 5 times $4 billion in annual cash flow. Tellurian’s market capitalizations could be $10 billion and $20 billion respectively in 2030. Given today’s market capitalization of $450 million, the market capitalization is discounting future growth at 67% or 88% annualized rates, respectively, for the next six years. Once the project is fully financed with “FID” Final Investment Decision and “FNTP” Full Notice to Proceed, we expect a 15% risk adjusted discount rate will be applied to the company shares (TELL) and its shares should trade toward $4.32/share or $8.64/share during 2024 depending on the natural gas cost basis and sourcing secured by Tellurian in lieu of its own Haynesville production. See table below for valuation methodology described above.

What Simoes said this Week:

“We have a project that has all the permits and is in construction. So we progress on securing offtake contracts and on securing partners,” Simoes told reporters on the sidelines of industry event India Energy Week in Goa. He also said that he expects its first LNG cargo delivery from the Driftwood LNG plant by 2028.

“We have made a lot of progress with the banks to understand the conditions. So once we finalize the offtake and the equity then the equity financing process can go but it should go very rapidly,” he added.

With the ouster of Charif Souki in December, we see Octavio Simoes and Martin Houston moving expeditiously to build Driftwood LNG. Simoes and Houston appear to provide a more grounded manner of disclosure than Souki, who is credited with creating the US LNG export business.

Tellurian Announced this Past Week:

“As we commercialize Driftwood LNG, Tellurian has been reviewing its strategy, including the dynamics of the U.S. natural gas market in the context of global LNG demand. We have concluded that there are alternative gas supply strategies available to us from various basins and our ownership of upstream assets is not necessary at this stage of Tellurian’s development. We have a substantial number of drilling locations that we believe will be highly attractive to oil and gas producers that can develop them more quickly than we would.”

We believe that Tellurian may look to swap liquefaction for natural gas feedstock. If the company can secure attractive terms which capitalize on the lower operating costs of larger E&Ps, the decision to sell the Haynesville assets may prove to be shrewd. But we don’t know whether Tellurian will be successful in its quest to maintain its vertically integrated business model.

“By unlocking the full value of these high-quality assets, we aim to substantially reduce our debt, further reduce our general and administrative expenses, and provide additional cash, enabling us to develop Driftwood LNG. Currently, this approach is more attractive than issuing equity to fund our 2024 development activities and working capital needs,” Simões added.

Our 11th Article on Tellurian:

Due to Cheniere Energy, Inc.’s enormous — Magnificent 7 sized — $1 to $183/share rise since 2010, we have repeatedly chronicled Tellurian’s efforts to fund Driftwood LNG since 2022. Our last blog was A Generational Opportunity for Tellurian. (November 1, 2023). There is a mathematical certitude to the potential rapid appreciation of Tellurian’s shares if it successfully can finance the Driftwood project. Raising 14.5 billion dollars is very difficult, especially with Tellurian’s novel “integrated model”, so Tellurian’s financing saga has led to many large stock moves. Today, Tellurian is well prepared to fund the Driftwood project, and now is poised to assemble its team of partners to finance Driftwood LNG and “it should go very rapidly”.

Tellurian’s Tumble:

In 2022, following Russia’s invasion of Ukraine, Tellurian’s shares traded over $6/share. With 545,890,311 shares outstanding, Tellurian’s market capitalization peaked around $3.27 billion. In 2022, it was hoped that with the spiking demand for natural gas resulting from Russia using its gas as a weapon of war, causing natural gas prices to spike globally, Tellurian should have been able to finance Driftwood. It did not. With the cancellation of its September 2022 $1 billion note offering, Executive Chair Charif Souki said that Driftwood LNG funding would likely be delayed. This funding cancellation led to the cancellation of SPAs with Shell and Vitol on September 23, 2022. The company then changed its financing strategy to fund Driftwood using strategic equity investors or Equity Partners.

Charif Souki Removed:

On December 7th Charif Souki, the creator of the US LNG industry was removed by Tellurian’s board. Fortunately, Martin Houston who helped provide the natural gas offtake agreements through BG Group Plc., when Cheniere Energy was constructing its Sabine Pass facility, became the new Chairman of the Board of Tellurian Inc.. Tellurian CEO Octavio Simoes, the prior president and CEO of Sempra LNG, explained the management change – “We are focused on unlocking shareholder value via execution of potential development and commercial partners at Driftwood LNG, while also evaluating options to refinance our existing debt, streamline costs and improve our balance sheet. These management changes ensure alignment and continuity….” Both Houston and Simoes, who are now running Tellurian, are engineers and seasoned LNG executives by training; they are more like engineers than entrepreneurs. Working with their new advisor Lazard, their deliberate sober communication style and demeanor we believe may soon deliver Driftwood’s financing and a new natural gas sourcing approach.

Souki left in an amicable deal which assures that he will be paid if Driftwood achieves FID.

The Biden LNG Pause:

On January 8th, Politico reported that over 200 environmentalists were suing Venture Global’s Calcasieu Pass 2 and seeking to stop US LNG development led by Bill McKibben who had lobbied to stop the Keystone XL pipeline.

The DOE is holding off on several LNG export licenses until after the elections. This is pausing four multibillion dollar projects, but not Tellurian which is fully licensed. This pause is holding up 32 MPTA of LNG production while Tellurian could move ahead rapidly. In fact, both customers and funders at the delayed projects may become Driftwood LNG partners and customers as a result of the pause.

“Two of the projects, an expansion of Port Arthur LNG under development by Sempra Infrastructure, California-based Sempra’s Houston subsidiary, and Houston-based Commonwealth LNG’s marquee project in Louisiana, were near the regulatory finish line before the pause.

“The U.S. Department of Energy was reviewing fresh permit applications for two others, Energy Transfer’s Lake Charles LNG and Glenfarne’s Magnolia LNG, after the department declined to extend construction deadlines tied to their original export permits.”

New Strategies:

We don’t know how Tellurian will replace the Haynesville natural gas production which was to come from Tellurian Production Holdings, but the company stated “we have concluded that there are alternative gas supply strategies available to us from various basins.” Tellurian has a large fully licensed facility about to be financed, and many large players are entering the natural gas space.

Activity in the natural gas market has become heated and liquefaction will be essential for international distribution. ExxonMobil bid $59.5 billion for Pioneer Natural Resources in October. Chevron paid $53 billion in stock for its October mega gas acquisition. Closer to Driftwood, in the Haynesville, Tokyo Gas bought Rockcliff Energy for $2.7 billion in December and Chesapeake Energy merged with Southwest Energy in a $7.4 billion deal in January and Driftwood would be a logical partner and source of liquefaction.

We envision large producers working collaboratively with Tellurian for Driftwood Liquefaction that leverages the better operating economics of large-scale operators and the relative monopoly Driftwood now enjoys as it gears up its financing for first gas on the water in 2027.

The Capitalization Plan for Driftwood:

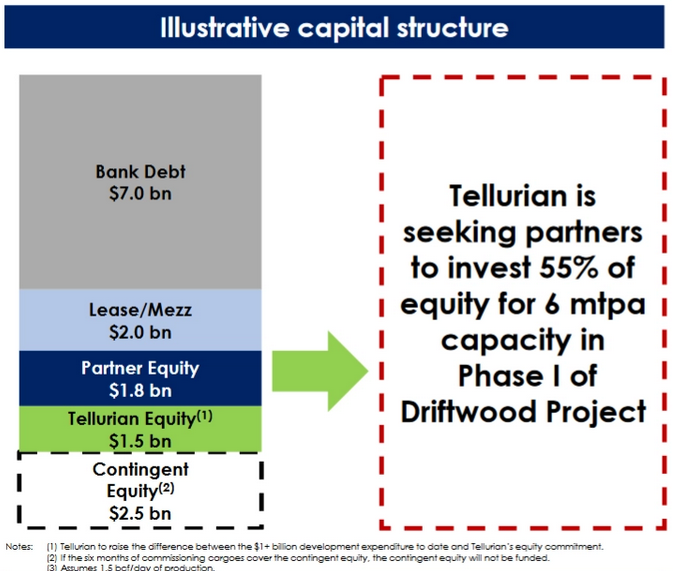

We believe that financing is doable along the structure laid out below. What we anticipate is that Partner Equity of about $2 billion will be secured in the coming seeks and an international oil company like Aramco or Shell will be the lead equity partner, though an India company like GAIL or Tokyo Gas Natural Resources would likely take a share of Driftwood LNG. With the $1-1.5 billion Tellurian has invested, the company can secure its $7 billion bank loan or construction loan when its equity investors are secured. At that point, $10 billion in capital will have been committed and the company can announce FID.

Once the project has secured Final Investment Decision, the risk premium or risk-adjusted discount rate will drop considerably from its current high 67% level towards 15%. Usually after FID, FNTP should follow and additional funding from mezzanine and Blue Owl should add another $2 billion in equity and the final contingent equity will add another 2.5 billion if the first six months of commissioning cargoes don’t provide sufficient capital. All included there will be $14.5 billion in capital available to build Driftwood LNG. We believe FNTP should occur by July 2024 when Blue Owl’s sale leaseback offer expires.

FERC Construction Permit Extension:

This Tuesday, February 13th, Tellurian’s construction permit extension is on FERC’s docket. An extension is usually an administrative action, but since the company asked for an accelerated approval in November because it said certain partners sought regulatory certainty before investing, this extension is important. Requirements for an extension are good faith and good cause, both of which Tellurian can easily demonstrate. What is particularly critical was the suggestion that funding decisions require this extension. Consequently, when FERC grants its extension, we believe several off take or equity partner announcements will follow, leading Driftwood to FID in the coming weeks and months.

Tellurian’s “Junk” Bond Opportunity TELZ:

A unique and compelling bond investment is (TELZ), Tellurian Inc.’s 8.25% “baby” bond 50 million dollar Sr. note maturing at $25/share on November 30, 2028. The notes’ coupon is 8.25%, trades at $12.81/note, and matures to $25 per note. The bonds’ current yield is 16.1% and its bond price should double between now and November 2028. Tellurian is a distressed special situation which we have researched and written on extensively. TELZ notes are trading 49% below their maturity value, due to worries triggered by a “going concern” disclosure in its third quarter filing in October, 2023.

With this week’s announcement of Tellurian’s decision to sell its Haynesville assets and use the proceeds to substantially reduce its Haynesville debt, we expect this debt security should start trading toward par in the weeks and months ahead.

The chart below of TELZ shows the notes declining in October with the going concern language in its third quarter earnings release. The notes have been moving up in price are another compelling play to capitalize on Tellurian’s debt restructuring and Driftwood financing. The chart below shows the bond’s prices declining with the cancelled offering in September 2022 and the “going concern note” in October 2023.

Conclusion:

Tellurian Inc. has struggled to finance its Driftwood LNG liquefaction plant, but now appears poised to succeed.

Debt worries surrounding a convertible bond on Tellurian Holdings, have led to a partial repayment of the convert in early January. With this week’s announcement of its intention to sell its Haynesville properties to substantially pay down its liabilities, these actions should debunk any concerns about the company’s solvency.

Most importantly, CEO Octavio Simoes stated that the company is uniquely positioned and licensed to move ahead in the near term with equity partners and off takers to finance Driftwood LNG. And that “the equity financing process can go but it should go very rapidly,” according to Simoes.

This week we anticipate that Driftwood will get its FERC construction permit extension, and this will greenlight off take agreements and Equity Partner announcements in the coming days and weeks. Once about $2 billion in Equity Partner capital is committed to Driftwood, we anticipate that $7 billion in bank construction loans will be secured and Tellurian can announce Final Investment Decision “FID”. With FID, the project will be viewed as commercially viable and significantly derisked. We estimate TELL shares could rise toward $3.00/share by quarter end and $4.36/share with Full Notice To Proceed being secured by July 2024.

The mathematics of the valuation leap associated with FID and FNTP is not uncertain. There is a risk, however, with the plan being rolled out by Martin Houston and Octavio Simoes and hope that plan will be executed. We believe that Houston and Simoes have the experience, contacts, and skill to deliver Driftwood’s funding. Ironically, Biden’s LNG pause makes Driftwood LNG the last major facility fully licensed in the US, while several competitors have been sidelined while the DOE reviews its LNG policy over the next year.

We believe Tellurian is a unique asymmetric opportunity whose time has come with a management restructuring and government regulation. The Tellurian opportunity should derisk with a FERC construction permit extension, ensuing SPAs, Equity Partner agreements, and announcements of FID and FNTP in the coming months. Due to the return potential of a derisked and funded Driftwood liquefaction project, Tellurian’s potential success could prove tremendous.

The author and Income Growth Advisors, LLC’s clients are long shares and options on Tellurian Inc.