Since 1982, 10-year US Treasury yields have declined from 15.8% to 0.55% in 2020. During this four decade period of declining rates, the three major asset classes of stocks, bonds, and real estate enjoyed unusually high returns that benefitted from the secular decline in interest rates. These three asset classes all share the common characteristic of recurring cash flow which benefits from declining interest rates. Now that the trend in declining inflation and interest rates has reversed, these historic asset class bubbles are now unwinding, and investors are largely oblivious to this investment sea change due to recency bias.

Today’s investment environment has further changed due to the COVID collapse of 2020 and the ensuing fiscal and monetary excesses that exacerbated bubbles in stocks, bonds, and real estate which will likely unwind over the coming decade. We have entered an inflationary commodity cycle and we believe that widely accepted investment strategies and investments, which have outperformed for the last four decades with declining interest rates, will now be replaced by new investment leadership and strategies.

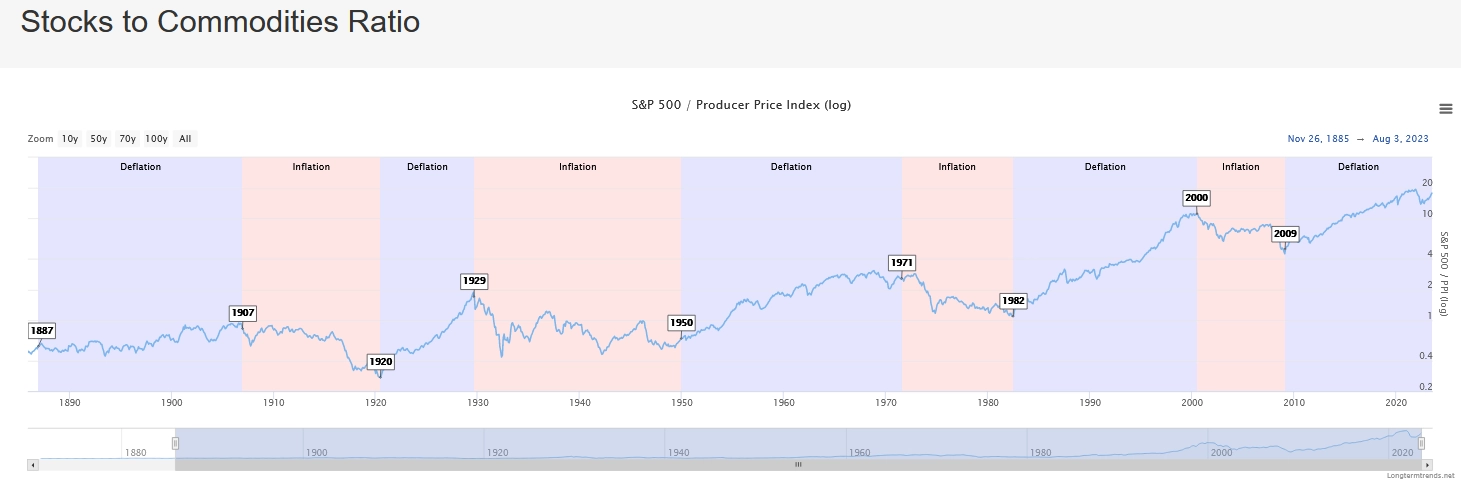

The chart below shows the ratio of the S&P 500 to the Producer Price Index. Over the last 140 years, the stock market has repeatedly experienced inflationary or deflationary cycles lasting 10 to 20 years based upon inflation as measured by the PPI index. Since 2009, the price of commodities like gold and oil have underperformed or declined while the S&P 500 has appreciated strongly. We now believe we have entered a period of higher inflation, like the 1999-2009 period, where commodities like gold and oil will appreciate relative to the S&P 500.

In short, we believe the 1970s and the 1999 to 2011 period market environments are historic analogues that provide clues into the investment leadership in the decade of the 2020s. Consequently, we believe the popular 60% equity 40% bond asset allocation strategy should now be replaced with a 25% cash 25% commodities 25% stock and 25% bond allocation for retirement plans, non-profits, and income focused retirement facing investors.

The Deflationary 60/40 Strategy Replaced By Inflationary 25/25/25/25 Strategy:

60% stocks 40% bonds: Both stocks and bonds are overpriced on a long-term historic basis. More importantly, if inflation and higher interest rates persist, both stock and bonds will underperform.

25% cash and cash equivalents. E.g. IBKR money market 4.83%1, 2 year US Treasury notes.

25% commodities. Energy (natural gas, LNG, oil, nuclear) precious metals, green metals (copper, lithium, cobalt), steel, and agriculture.

25% bonds. Emerging market, high yield, and discounted corporates.

25% stocks- Value, small capitalization, emerging market, international, high yielding stocks in value sectors, CEFs and MLPs.

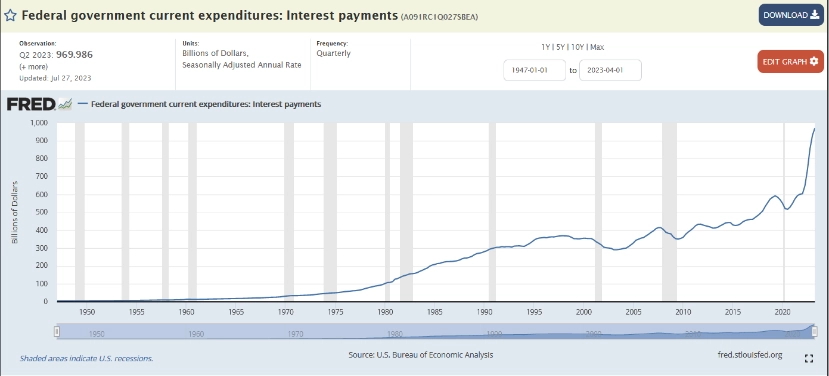

Interest Coverage on US Federal Debt is Accelerating and Unsustainable:

On August 1, 2023, credit rating agency Fitch downgraded US Treasuries “due to a steady decline in standards of governance.” The following day, US Treasury Secretary Janet Yellen said, “Fitch’s decision is puzzling in light of the economic strength we see in the United States…” and “I strongly disagree with Fitch’s decision, and I believe it is entirely unwarranted.” We disagree with the Treasury Secretary because the policies of the US government including the Federal Reserve and the Department of US Treasury have led to both a ballooning $33 trillion debt and inflation.

With the US Federal debt coverage rising from $516 billion q3 2020 to $969 billion q2 2023, a near doubling in three years, this accelerating expense growth is unsustainable. History should judge that from 2008 to 2023 government and monetary authorities, through excessive financial engineering, have created inflation and destabilized capital markets that hurt the US citizenry in the aggregate including the working poor.

Market Prospects and Risks:

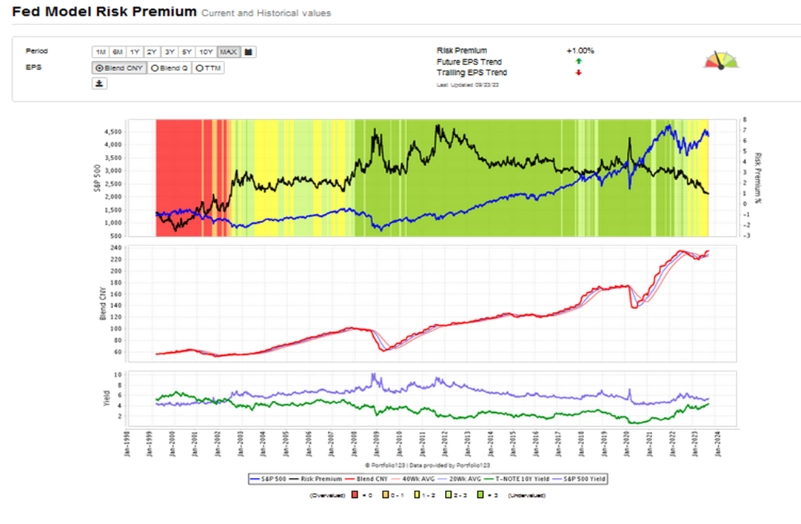

Below is a chart of the Risk Premium or Fed Model. The Fed Model or Risk Premium model compares the earnings yield of the S&P 500 to the yield of the 10-year US Treasury Note. The risk premium has declined to 1%, a level not seen since 2002. The low risk premium suggests the stock market does not offer a compelling risk premium or inducement for investors to invest in stocks over bonds. With interest rates rising due to inflation, continued economic strength and Federal Reserve’s limited capacity to create product supply, we expect that equities may experience a prolonged bear market or consolidation for the next decade and new asset classes, investments, and strategies should lead the market.

In 2020, during the COVID-19 collapse, the risk premium rose to over 6%. This 6% risk premium signaled that the equity market was offering a compelling inducement to investors to buy stocks. This was a critical indicator we used in writing “Irrational Pessimism” on March 22, 2020. We view today’s 1% as a cautionary level on this quantitative indicator that compares stocks against bonds.

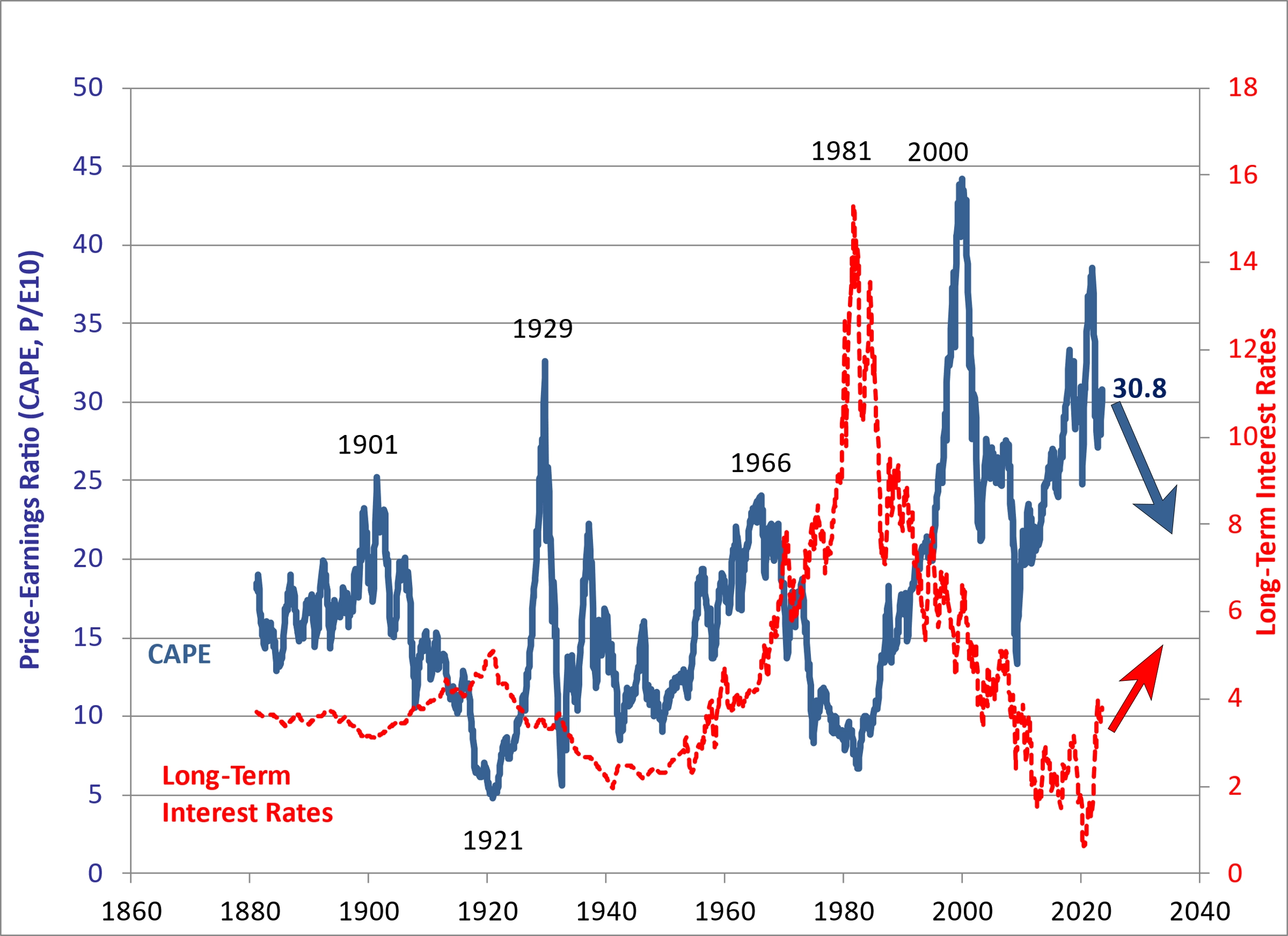

The chart below shows the Shiller CAPE ratio and the 10-year US Treasury yield. In 1982, when the 10-year US Treasury yield was 15%, the CAPE was below 10. Since 1982, interest rates have declined, and the CAPE ratio has tripled. We believe with the reversal of interest rates in 2020, the CAPE has lost an important market driver and the CAPE ratio should revert toward 20 over the next decade. Furthermore, we fear that inflation may prove persistent and that rising commodity prices could lead to higher interest rates which will hurt the performance of both stocks and bonds.

The current 30.8 CAPE ratio is indicative of historic market peaks like 1926, 1966, and 2000. Higher interest rates should hurt future investment return prospects for stocks and bonds, but, unfortunately, recency bias will lead many investors to overweight stocks and bonds in their portfolios.

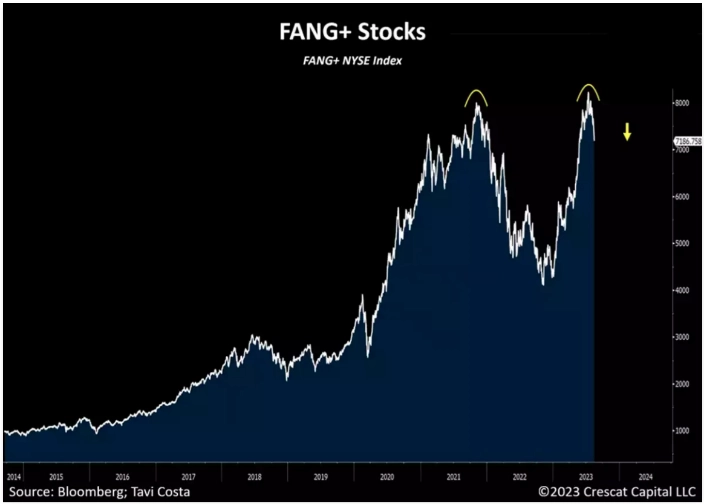

The chart below of the FANG+ stocks show overvaluation that resembles past peaks like 1929, Nifty Fifty stocks, and 2000 Tech Bubble. We expect a long-term consolidation in the FANG+ stocks which are both technology stocks and large cap growth stocks. Since large cap growth stocks are long duration assets, the aggregate performance in these stocks will be lower due to the higher inflation and higher interest rate environment in the years ahead. More importantly, FANG+ stocks have become capitalization beneficiaries of m indexes like the S&P 500 and NASDAQ 100, which have disproportionately large allocations creating a positive feedback loop of share purchases.

The chart below by Crescat Capital suggests a parabolic double top, that we see breaking down due to overvaluation, artificial intelligence exuberance, and higher interest rates.

The chart below of the Ark Innovation ETF (ARKK) and the Invesco QQQ Trust (QQQ) shows bubble like behavior in ARKK and a double top in the QQQ. ARKK was the Cathie Wood ETF that owned many of the most promising but overvalued technology names which peaked in 2021 during the MEME stock bubble. The QQQ, which tracks the NASDAQ 100 index, is a broader large cap ETF, it looks like an attractive short opportunity while interest rates continue to push higher with persistent inflation data. SQQQ is an inverse ETF for the QQQ which appreciates when the QQQ declines.

Five Attractive High Yield Investments:

Below are four high yielding commodity focused investments that we own for our clients and reflect today’s attractive retirement income investment environment. They are:

Energy Transfer LP (ET) is a Master Limited Partnership with top tier management that seeks to grow 8.8% distribution.

MPLX LP (MPLX) is a Master Limited Partnership run by Marathon Oil. Its distribution yield is 8.7%.

Kayne Anderson (KYN) is a closed end MLP fund that yields 9.6% and 15.5% discount to NAV.

GAMCO Global Gold, Natural Resources & Income Trust (GGN) is a closed end fund that generates a high yield by employing a covered writing strategy that yields 9.8% and trades at a 3.4% discount to NAV.

We like to use high yielding commodity focused investment in the equity portion of a 25/25/25/25 asset allocation strategy as opposed to popular growth indexes like the S&P 500 index (SPY) or Nasdaq 100 (QQQ).

Conclusion:

Large capitalization growth and technology should underperform in the years ahead due to the difficult inflation and interest rate environment; however, commodity oriented equities should outperform.

Higher interest rates are now offering attractive yields to investors. For income or retirement minded investors this is a refreshing change from the artificially low interest rate environment which was created to combat the Great Financial Crisis.

Money markets and cash equivalents offer yields in the 5% range. Investments in closed end funds and MLPs can offer yields in the 7-10% range. Following a decade of near zero interest rates, investors now have an opportunity to build portfolios with lower market risk and income to cover living expenses.

It is human nature to make investment decisions based on recent investment performance; however, a longer term investment perspective based on value and historic analogues should lead to better risk adjusted returns and a more stable income and return profile for those abandoning the 60% stock 40% bond asset allocation fad of the last four decades.